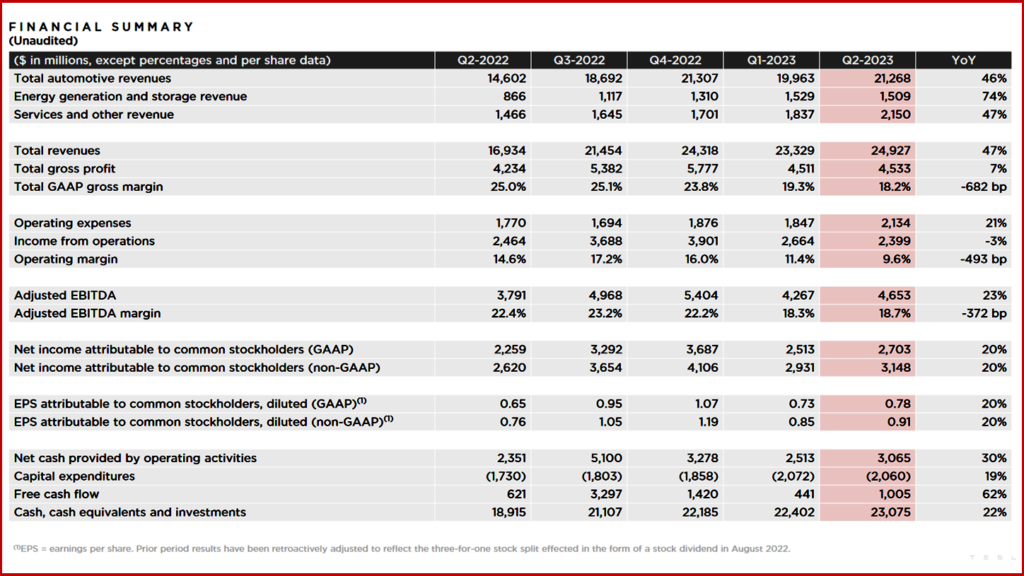

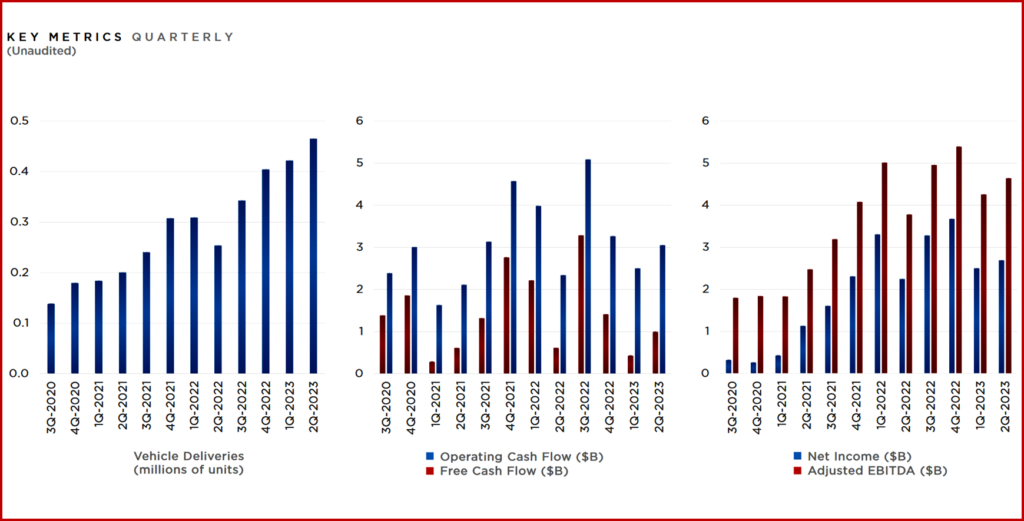

During Q2 2023 Tesla (NASDAQ: TSLA) made ~480,000 vehicles and delivered more than 466,000, the highest to date. As a result, Q2-2023 looked solid with Tesla setting its production and deliveries among its top five quarters. The result was revenue approaching $25B in a single quarter. Net revenue was $2.7 billion. However, analysts remain skeptical about what many of them say is a greatly overvalued stock that pays no dividends. During the past year a share of TSLA stock has ranged from ~$102 to $315. It’s currently trading ~$260. (AutoInformed: Ford Cuts F-150 Lightning Prices by $6000 to $10,000)

“Our operating margin remained healthy at approximately 10% [9.6%], even with price reductions in Q1 and early Q2. This reflects our ongoing cost reduction efforts, the continued production ramp success in Berlin and Texas and the strong performance of our Energy and Services & Other businesses,” Tesla said.

Click to enlarge.

Tesla also reiterated its desire to be “at the forefront of AI development,” as it started production of so-called Dojo training computers. “We are hopeful that our immense neural net training needs will be satisfied using our in-house designed Dojo hardware. The better the neural net training capacity, the greater the opportunity for our Autopilot team to iterate on new solutions,” Tesla said.

Click to enlarge.

“We are focusing on cost reduction, new product development that will enable future growth, investments in R&D, better vehicle financing options, continuous product improvement and generation of free cash flow. The challenges of these uncertain times are not over, but we believe we have the right ingredients for the long-term success of the business through a variety of high potential projects,” Tesla said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Tesla – Solid Q2 with Higher Production and Lower Prices but…

During Q2 2023 Tesla (NASDAQ: TSLA) made ~480,000 vehicles and delivered more than 466,000, the highest to date. As a result, Q2-2023 looked solid with Tesla setting its production and deliveries among its top five quarters. The result was revenue approaching $25B in a single quarter. Net revenue was $2.7 billion. However, analysts remain skeptical about what many of them say is a greatly overvalued stock that pays no dividends. During the past year a share of TSLA stock has ranged from ~$102 to $315. It’s currently trading ~$260. (AutoInformed: Ford Cuts F-150 Lightning Prices by $6000 to $10,000)

“Our operating margin remained healthy at approximately 10% [9.6%], even with price reductions in Q1 and early Q2. This reflects our ongoing cost reduction efforts, the continued production ramp success in Berlin and Texas and the strong performance of our Energy and Services & Other businesses,” Tesla said.

Click to enlarge.

Tesla also reiterated its desire to be “at the forefront of AI development,” as it started production of so-called Dojo training computers. “We are hopeful that our immense neural net training needs will be satisfied using our in-house designed Dojo hardware. The better the neural net training capacity, the greater the opportunity for our Autopilot team to iterate on new solutions,” Tesla said.

Click to enlarge.

“We are focusing on cost reduction, new product development that will enable future growth, investments in R&D, better vehicle financing options, continuous product improvement and generation of free cash flow. The challenges of these uncertain times are not over, but we believe we have the right ingredients for the long-term success of the business through a variety of high potential projects,” Tesla said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.