The second week of September looms large in the US and Canada this year because for the first time since 1999 the UAW and Unifor contract agreements with Stellantis, GM and Ford are set to expire. Bargaining with what used to be called the Detroit 3, aka Big Three, starts this month with job security, joint-venture plants with non-unionized offshore companies, and of course higher wages and pensions are the main priorities in limited public comments thus far.

However, the new reform UAW leader Shawn Fain* and International Executive Board members instead of kicking off Big Three negotiations last month with what was called “a dog and pony show shaking hands with CEOs,” went to shake hands with workers at what previously would have been called Detroit Three plants. “The only limits we face are our own limits that we put on ourselves. I don’t see any limits to what we can achieve when we unite in a common cause,” said Shawn Fain, UAW president. (AutoInformed: UAW Dumps Traditional Negotiation Opening Handshake; EV Politics – Biden versus the UAW).

“This year, negotiations are expected to be more contentious, and UAW President Shawn Fain has alluded that things may be done differently this time around which could mean that they negotiate with all three simultaneously – ultimately leading to a strike against all of the Detroit 3 if their demands are not met,” said Taylor Prodin, Analyst, Americas Vehicle Forecasts, GlobalData**.

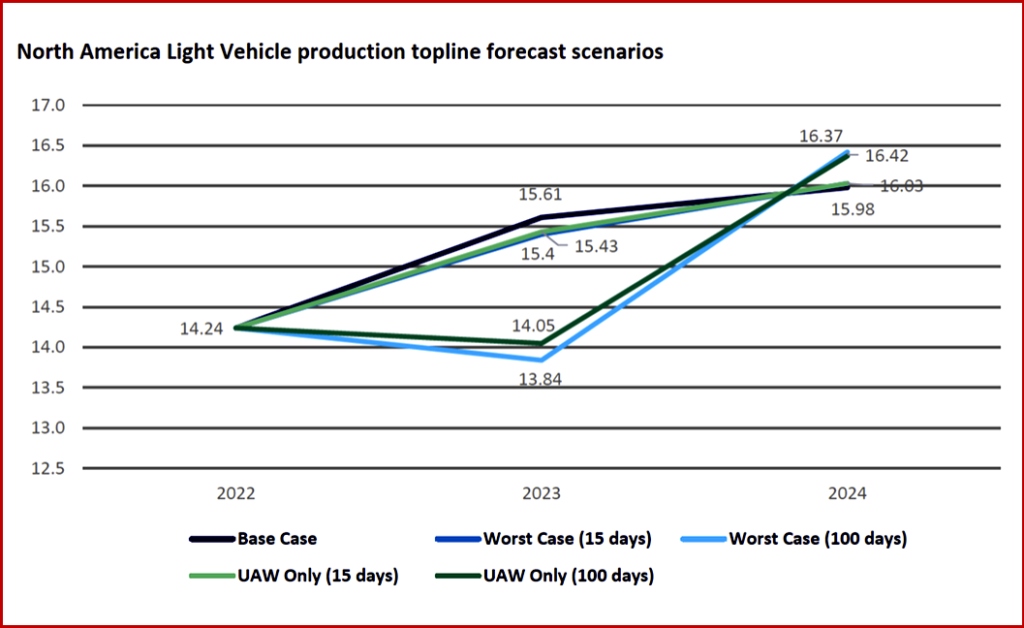

“Given this, there could be multiple scenarios at play, but looking at the most extreme example – a strike against all three automakers – we estimate that the impact on 2023 North American production could range from a minor 1% volume impact if the UAW strikes for only 15 days, to a more severe 11% if both the UAW and Unifor strike for 100 days. Looking at 2024, we could see slightly higher production in order to make up for lost volume, although it may be contingent on vehicle demand. As in the strike of 2019, there is a risk of Mexico’s output being affected due to a lack of engines and other parts that the plants there use from the US and Canada. Other OEMs may also be affected given that some of their suppliers are UAW, although it is likely that they are working on contingency plans in the event of a strike,” according to GlobalData.

Click for more GlobalData.

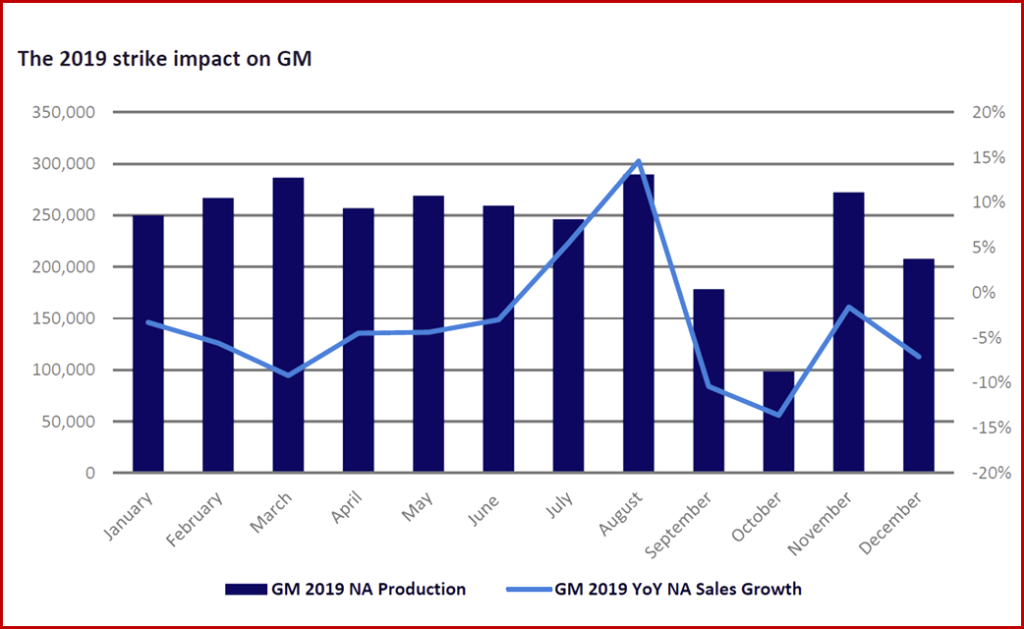

“Back in 2019, the UAW decided to strike against General Motors, the strike lasted 40 days, becoming the longest national walkout against the automaker since a 67-day strike in 1970. Nearly 50,000 workers became involved and shut down 33 manufacturing plants across the US, which GM reported cost them 300k units of production and US$4 billion. GM’s Silao and Ramos Arizpe plants in Mexico as well as its Oshawa plant in Canada were also impacted due to a parts shortage from the strike. As a result of the halted production, GM’s inventory fell from 795k units in August 2019 to 649k units in October 2019 and consequently, YoY sales dropped in September and October,” said Prodin of GlobalData.*

GlobalData Points

- A strike could potentially delay notable new product launches and buildouts such as the refreshes of the popular and profitable GM Large SUVs and Ford and Stellantis’ large pickup trucks.

- Unionized production of large pickup trucks in North America “faces a downward trend” as other non-union manufacturers such as Tesla and Toyota continue to increase sales. Large pickup truck production previously represented 40% of overall production in the region in 2019, but now only represents about 36% for 2023.

- GM, Ford, and Stellantis are continuing to look to reduce labor costs as they upgrade current or build new facilities to manufacture BEVs (battery electric vehicles) so that they can stay competitive with Tesla and other manufacturers. BEVs require fewer parts than traditional fossil-fueled vehicles, which means fewer union workers are needed to manufacture each vehicle.

- Earlier in 2023, Stellantis idled the Belvidere assembly plant in Illinois – in part due to the escalating costs in the shift to BEVs – which left 1300 employees out of work. The plant was once home to the Jeep Cherokee and has the capacity to produce 300,000 vehicles annually.

- The threat of more plant closures is one item on the agenda for contract negotiations and since the automakers have had recent years of healthy profits, the UAW believes the closures are unnecessary.

The Red Bottom Line?

Click for more GlobalData.

“We anticipate that US vehicle sales would also be impacted, as dealer inventories could be quickly depleted after just 30 days of a strike. Additionally, there is a likelihood that some buyers will delay their purchase or divert to other OEMs although this impact would be minimal. We foresee the 2023 US sales impact ranging from 1% based on a mild scenario to 9% based on a more severe scenario. A severe scenario is expected to take nearly two years for the lost volume to be recovered with about 60-70% being recovered in 2024,” said GlobalData.

*UAW President Shawn Fain is a 29-year member of the United Auto Workers. “Fain started with the union in 1994 as an electrician for Chrysler at the Kokomo Casting Plant in his hometown of Kokomo, Indiana. Fain comes from a family of UAW members. His grandfather started working at Chrysler in 1937, the same year GM workers first unionized with the UAW. Fain still carries his grandfather’s pay stubs with him to this day. Fain served five terms as Skilled Trades Committeeman and Plant Shop Chairman for Local 1166, and became an International Representative for the UAW in 2012. He also became a voice against concessionary bargaining and for more membership involvement at every level of the union,” according to his UAW bio.

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com. (The information provided is © GlobalData Plc 2023. Registered Office: John Carpenter House, John Carpenter Street, London, EC4Y 0AN, UK | Registered in England No. 03925319)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

New Pattern Bargaining – UAW and Unifor Strike All Makers?

The second week of September looms large in the US and Canada this year because for the first time since 1999 the UAW and Unifor contract agreements with Stellantis, GM and Ford are set to expire. Bargaining with what used to be called the Detroit 3, aka Big Three, starts this month with job security, joint-venture plants with non-unionized offshore companies, and of course higher wages and pensions are the main priorities in limited public comments thus far.

However, the new reform UAW leader Shawn Fain* and International Executive Board members instead of kicking off Big Three negotiations last month with what was called “a dog and pony show shaking hands with CEOs,” went to shake hands with workers at what previously would have been called Detroit Three plants. “The only limits we face are our own limits that we put on ourselves. I don’t see any limits to what we can achieve when we unite in a common cause,” said Shawn Fain, UAW president. (AutoInformed: UAW Dumps Traditional Negotiation Opening Handshake; EV Politics – Biden versus the UAW).

“This year, negotiations are expected to be more contentious, and UAW President Shawn Fain has alluded that things may be done differently this time around which could mean that they negotiate with all three simultaneously – ultimately leading to a strike against all of the Detroit 3 if their demands are not met,” said Taylor Prodin, Analyst, Americas Vehicle Forecasts, GlobalData**.

“Given this, there could be multiple scenarios at play, but looking at the most extreme example – a strike against all three automakers – we estimate that the impact on 2023 North American production could range from a minor 1% volume impact if the UAW strikes for only 15 days, to a more severe 11% if both the UAW and Unifor strike for 100 days. Looking at 2024, we could see slightly higher production in order to make up for lost volume, although it may be contingent on vehicle demand. As in the strike of 2019, there is a risk of Mexico’s output being affected due to a lack of engines and other parts that the plants there use from the US and Canada. Other OEMs may also be affected given that some of their suppliers are UAW, although it is likely that they are working on contingency plans in the event of a strike,” according to GlobalData.

Click for more GlobalData.

“Back in 2019, the UAW decided to strike against General Motors, the strike lasted 40 days, becoming the longest national walkout against the automaker since a 67-day strike in 1970. Nearly 50,000 workers became involved and shut down 33 manufacturing plants across the US, which GM reported cost them 300k units of production and US$4 billion. GM’s Silao and Ramos Arizpe plants in Mexico as well as its Oshawa plant in Canada were also impacted due to a parts shortage from the strike. As a result of the halted production, GM’s inventory fell from 795k units in August 2019 to 649k units in October 2019 and consequently, YoY sales dropped in September and October,” said Prodin of GlobalData.*

GlobalData Points

The Red Bottom Line?

Click for more GlobalData.

“We anticipate that US vehicle sales would also be impacted, as dealer inventories could be quickly depleted after just 30 days of a strike. Additionally, there is a likelihood that some buyers will delay their purchase or divert to other OEMs although this impact would be minimal. We foresee the 2023 US sales impact ranging from 1% based on a mild scenario to 9% based on a more severe scenario. A severe scenario is expected to take nearly two years for the lost volume to be recovered with about 60-70% being recovered in 2024,” said GlobalData.

*UAW President Shawn Fain is a 29-year member of the United Auto Workers. “Fain started with the union in 1994 as an electrician for Chrysler at the Kokomo Casting Plant in his hometown of Kokomo, Indiana. Fain comes from a family of UAW members. His grandfather started working at Chrysler in 1937, the same year GM workers first unionized with the UAW. Fain still carries his grandfather’s pay stubs with him to this day. Fain served five terms as Skilled Trades Committeeman and Plant Shop Chairman for Local 1166, and became an International Representative for the UAW in 2012. He also became a voice against concessionary bargaining and for more membership involvement at every level of the union,” according to his UAW bio.

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com. (The information provided is © GlobalData Plc 2023. Registered Office: John Carpenter House, John Carpenter Street, London, EC4Y 0AN, UK | Registered in England No. 03925319)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.