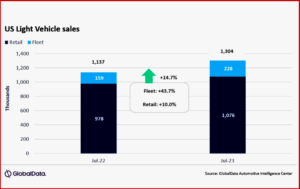

US Light Vehicle sales totaled 1.30 million units in July, according to GlobalData.* The annualized selling rate increased from 15.7 million vehicles a year in June, to 15.8 million in July. July’s daily selling rate was estimated at ~52,200 vehicles per day, compared to 53,000 in June. According to early estimates, retail sales totaled around 1,076,000 units, while fleet sales accounted for approximately 228,000 units, representing around 17.5% of total sales.

“At the risk of sounding like a broken record, July continued the trends that we have observed for several months now. As vehicle availability has improved, sales have grown, and the economy remains sufficiently strong to support the market’s activity, despite high transaction prices, rising interest rates and fears of a recession later in the year or in 2024,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

Click for more GlobalData.

“The share of the market represented by fleet sales took a step back from the preceding months, but this is a normal seasonal trend for July, and fleet is still a driving force behind the increase in total sales,” Oakley said.

General Motors led the market in July -making for a full year of being the number one manufacturer. However, the gap between GM and second-placed Toyota Group narrowed to around 23,000 units in July, the smallest difference since October 2022. The Ford F-150 retained its customary position as the bestselling model in the market, on ~43,000 units, with the Toyota RAV4 finishing ahead of the Tesla Model Y at 37,800, compared to an estimated ~34,600 units for the Model Y. The Compact Non-Premium SUV segment led the way in July, with a 20.1% share, ahead of Midsize Non-Premium SUVs at 15.0% and Large Pickup on 13.5%.

The outlook for US auto sales remains at 15.4 million units, an increase of 11% from 2022. While both retail and fleet volume continue to recover, the fleet share of total Light Vehicles is expected at 19%, the highest level since 2019. The forecast for 2024 remains at 16.0 million units with some upside if the economy avoids recession and begins to accelerate again, according to GlobalData.

US inventory levels year-to-date (YTD) are up 14% from 2022 and volume has climbed to 1.9 million units. Days’ supply remains curbed at 36 but has risen from 28 days a year ago.

“With the upcoming union contract negotiations on the horizon, there is some expected inventory build expected through August to mitigate any short-term volume risk,” GlobalData observed.

However, because of summer factory shutdowns, inventory levels are expected to have declined slightly in July, but this should not be interpreted as a sign of a genuine tightening in supply.

“Indeed, the outlook for inventory is generally improving, notwithstanding the potential risks stemming from the end of contract agreements between the UAW, Unifor, and the Detroit-based OEMs, in September,” GlobalData said.

Global Forecast

The global Light Vehicle selling rate was 94.3 million vehicles in June, the highest selling rate since August 2019 and nearly 10 million units higher than June 2022. Light Vehicle volume rose to 8.0 million units in the month, an increase of 11% from the same period last year. The outlook for 2023 is largely in line with last month, but volume is up 100,000 units to 86.4 million, or 7% higher than 2022, as concerns for a pronounced slowdown in the second half of 2023 are reduced, according to GlobalData.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com. (The information provided is © GlobalData Plc 2023. Registered Office: John Carpenter House, John Carpenter Street, London, EC4Y 0AN, UK | Registered in England No. 03925319)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Sales Lengthen Bidenomics Growth Streak in July

US Light Vehicle sales totaled 1.30 million units in July, according to GlobalData.* The annualized selling rate increased from 15.7 million vehicles a year in June, to 15.8 million in July. July’s daily selling rate was estimated at ~52,200 vehicles per day, compared to 53,000 in June. According to early estimates, retail sales totaled around 1,076,000 units, while fleet sales accounted for approximately 228,000 units, representing around 17.5% of total sales.

“At the risk of sounding like a broken record, July continued the trends that we have observed for several months now. As vehicle availability has improved, sales have grown, and the economy remains sufficiently strong to support the market’s activity, despite high transaction prices, rising interest rates and fears of a recession later in the year or in 2024,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

Click for more GlobalData.

“The share of the market represented by fleet sales took a step back from the preceding months, but this is a normal seasonal trend for July, and fleet is still a driving force behind the increase in total sales,” Oakley said.

General Motors led the market in July -making for a full year of being the number one manufacturer. However, the gap between GM and second-placed Toyota Group narrowed to around 23,000 units in July, the smallest difference since October 2022. The Ford F-150 retained its customary position as the bestselling model in the market, on ~43,000 units, with the Toyota RAV4 finishing ahead of the Tesla Model Y at 37,800, compared to an estimated ~34,600 units for the Model Y. The Compact Non-Premium SUV segment led the way in July, with a 20.1% share, ahead of Midsize Non-Premium SUVs at 15.0% and Large Pickup on 13.5%.

The outlook for US auto sales remains at 15.4 million units, an increase of 11% from 2022. While both retail and fleet volume continue to recover, the fleet share of total Light Vehicles is expected at 19%, the highest level since 2019. The forecast for 2024 remains at 16.0 million units with some upside if the economy avoids recession and begins to accelerate again, according to GlobalData.

US inventory levels year-to-date (YTD) are up 14% from 2022 and volume has climbed to 1.9 million units. Days’ supply remains curbed at 36 but has risen from 28 days a year ago.

“With the upcoming union contract negotiations on the horizon, there is some expected inventory build expected through August to mitigate any short-term volume risk,” GlobalData observed.

However, because of summer factory shutdowns, inventory levels are expected to have declined slightly in July, but this should not be interpreted as a sign of a genuine tightening in supply.

“Indeed, the outlook for inventory is generally improving, notwithstanding the potential risks stemming from the end of contract agreements between the UAW, Unifor, and the Detroit-based OEMs, in September,” GlobalData said.

Global Forecast

The global Light Vehicle selling rate was 94.3 million vehicles in June, the highest selling rate since August 2019 and nearly 10 million units higher than June 2022. Light Vehicle volume rose to 8.0 million units in the month, an increase of 11% from the same period last year. The outlook for 2023 is largely in line with last month, but volume is up 100,000 units to 86.4 million, or 7% higher than 2022, as concerns for a pronounced slowdown in the second half of 2023 are reduced, according to GlobalData.

AutoInformed on

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com. (The information provided is © GlobalData Plc 2023. Registered Office: John Carpenter House, John Carpenter Street, London, EC4Y 0AN, UK | Registered in England No. 03925319)

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.