Click for more ACEA data.

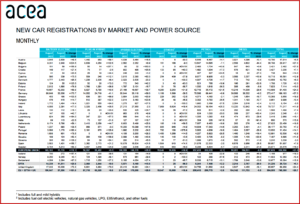

EU new car registrations increased ~21% in August with battery electric vehicles (BEVs) passing 20% share for the first time in history, according to the ACEA* trade group. During August 2023, there were 787,626 registered units, marking the thirteenth consecutive month of growth.

“Despite August typically being a slower month for car sales, double-digit gains indicate that the EU market is rebounding from last year’s component shortages. There were double-digit percentage gains in most markets, including the three largest: Germany (+37.3%), France (+24.3%), and Italy (+11.9%), ACEA said.

From January to August 2023, new EU car registrations grew substantially (+17.9%), totaling 7.1 million units. However, even with this year-to-date improvement, the market trails the pre-COVID pandemic level of 9 million units sold in 2019. Most markets experienced double-digit percentage gains in this eight-month period, including the four largest: Spain (+20.5%), Italy (+20.2%), France (+16.6%), and Germany (+16.5%).

Click for more ACEA data.

Registrations by Type

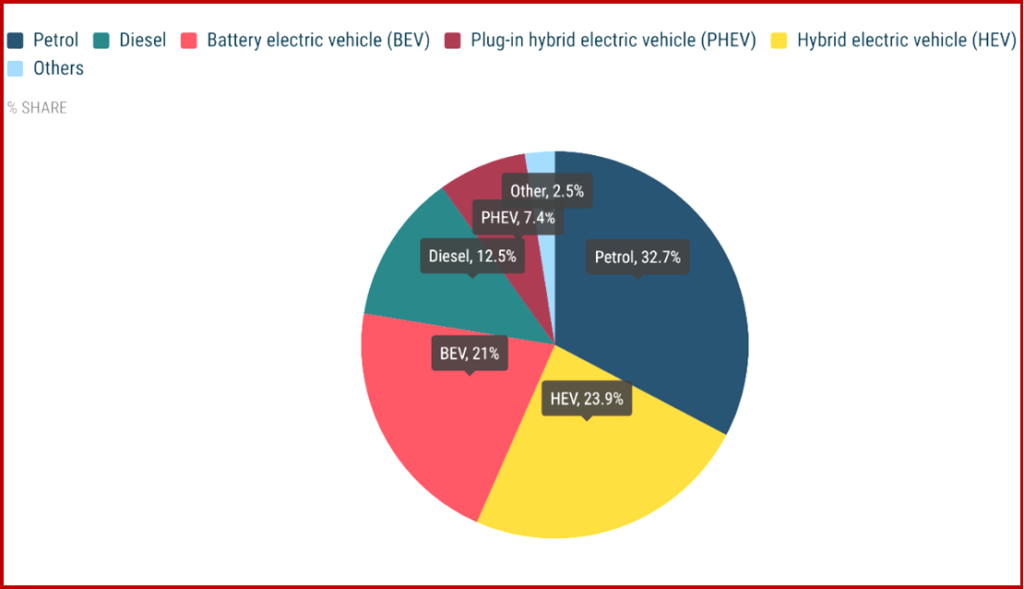

In August, the market share of battery-electric cars exceeded 20% for the first time (up from 11.6% in August last year), overtaking diesel for the second time this year and becoming the third-most-popular choice for new car buyers. Hybrid-electric cars held position as buyers’ second choice, with a 24% market share. While petrol cars are still the most popular choice, market share decreased from 38.7% in August 2022 to 32.7%.

Electric cars: In August 2023, EU battery-electric car registrations increase by 118.1%, reaching 165,165 units, accounting for 21% of the market. Except for Malta (-22.6%), all EU markets saw double- and triple-digit percentage growth, with Germany, the largest market by volume, growing by 170.7%. Belgium recorded the highest growth rate of 224.5%. Overall, battery-electric car sales increased by a significant 62.7%, with nearly 1 million units registered from January to August.

Hybrid-electric car: Registrations expanded by 29%, primarily driven by growth in three of its four largest markets: Germany (+59%), France (+38.7%), and Spain (+21.5%), while Italy recorded a slight decline (-2.3%). This resulted in a cumulative 28.6% increase, with nearly 1.8 million units sold between January and August, equivalent to a quarter of the market.

Plug-in hybrid car: Registrations grew by 5.5%, totaling 58,557 units. Major markets such as the Netherlands (+44.7%), France (+40.5%), and Sweden (+24.9%) helped offset a decline in Germany (-41.1%), the largest market for this power source. Despite this growth, the market share of plug-in hybrid cars decreased from 8.5% to 7.4% in August this year.

Petrol and diesel cars: During August, the EU petrol car market slightly increased by 2.1%, with its market share decreasing from 38.7% to 32.7% compared to August 2022. A strong performance in Italy (+25.3%) and France (+21.5%) primarily drove this growth, while most of the bloc’s markets declined.

Courtesy of and Copyright GlobalData consultancy.

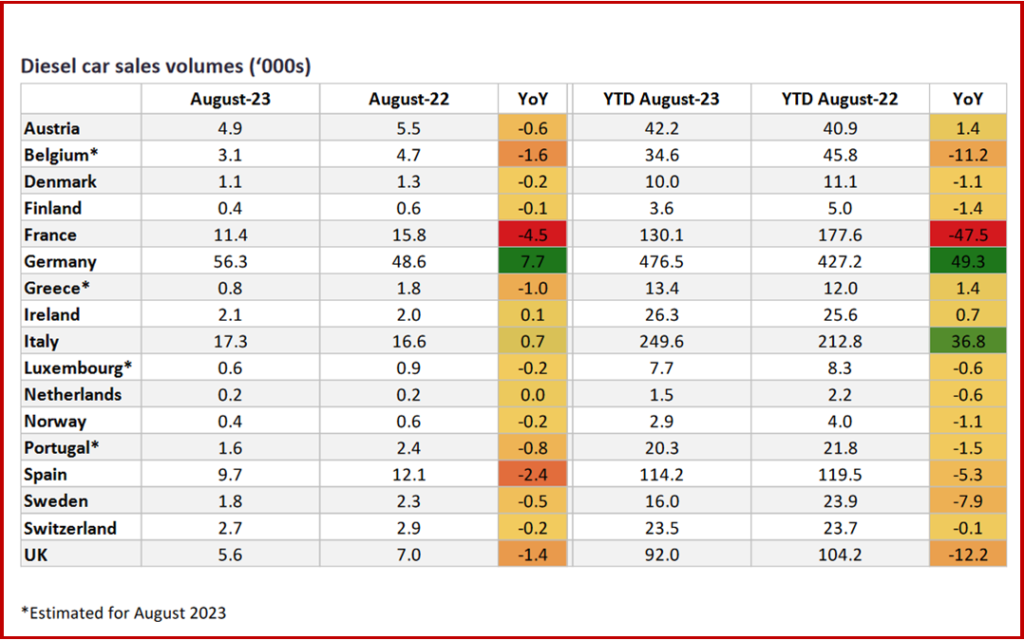

Conversely, the EU’s diesel car market continued its decline in August (-6%), despite growth in Germany (+9.2%) and Central and Eastern European markets, notably Slovakia (+22.6%) and Romania (+19.4%). Diesel cars now have a market share of 12.5%, down from 16.1% in August of the previous year.

AutoInformed on

*ACEA: The European Automobile Manufacturers’ Association (ACEA) represents the 14 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group.

About the EU automobile industry

- 13.0 million Europeans work in the automotive sector

- 11.5% of all manufacturing jobs in the EU

- €374.6 billion in tax revenue for European governments

- €101.9 billion trade surplus for the European Union

- Over 7% of EU GDP generated by the auto industry

- €59.1 billion in R&D spending annually, 31% of EU total

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

EU August Sales – BEVs Soar to 20% Market Share

Click for more ACEA data.

EU new car registrations increased ~21% in August with battery electric vehicles (BEVs) passing 20% share for the first time in history, according to the ACEA* trade group. During August 2023, there were 787,626 registered units, marking the thirteenth consecutive month of growth.

“Despite August typically being a slower month for car sales, double-digit gains indicate that the EU market is rebounding from last year’s component shortages. There were double-digit percentage gains in most markets, including the three largest: Germany (+37.3%), France (+24.3%), and Italy (+11.9%), ACEA said.

From January to August 2023, new EU car registrations grew substantially (+17.9%), totaling 7.1 million units. However, even with this year-to-date improvement, the market trails the pre-COVID pandemic level of 9 million units sold in 2019. Most markets experienced double-digit percentage gains in this eight-month period, including the four largest: Spain (+20.5%), Italy (+20.2%), France (+16.6%), and Germany (+16.5%).

Click for more ACEA data.

Registrations by Type

In August, the market share of battery-electric cars exceeded 20% for the first time (up from 11.6% in August last year), overtaking diesel for the second time this year and becoming the third-most-popular choice for new car buyers. Hybrid-electric cars held position as buyers’ second choice, with a 24% market share. While petrol cars are still the most popular choice, market share decreased from 38.7% in August 2022 to 32.7%.

Electric cars: In August 2023, EU battery-electric car registrations increase by 118.1%, reaching 165,165 units, accounting for 21% of the market. Except for Malta (-22.6%), all EU markets saw double- and triple-digit percentage growth, with Germany, the largest market by volume, growing by 170.7%. Belgium recorded the highest growth rate of 224.5%. Overall, battery-electric car sales increased by a significant 62.7%, with nearly 1 million units registered from January to August.

Hybrid-electric car: Registrations expanded by 29%, primarily driven by growth in three of its four largest markets: Germany (+59%), France (+38.7%), and Spain (+21.5%), while Italy recorded a slight decline (-2.3%). This resulted in a cumulative 28.6% increase, with nearly 1.8 million units sold between January and August, equivalent to a quarter of the market.

Plug-in hybrid car: Registrations grew by 5.5%, totaling 58,557 units. Major markets such as the Netherlands (+44.7%), France (+40.5%), and Sweden (+24.9%) helped offset a decline in Germany (-41.1%), the largest market for this power source. Despite this growth, the market share of plug-in hybrid cars decreased from 8.5% to 7.4% in August this year.

Petrol and diesel cars: During August, the EU petrol car market slightly increased by 2.1%, with its market share decreasing from 38.7% to 32.7% compared to August 2022. A strong performance in Italy (+25.3%) and France (+21.5%) primarily drove this growth, while most of the bloc’s markets declined.

Courtesy of and Copyright GlobalData consultancy.

Conversely, the EU’s diesel car market continued its decline in August (-6%), despite growth in Germany (+9.2%) and Central and Eastern European markets, notably Slovakia (+22.6%) and Romania (+19.4%). Diesel cars now have a market share of 12.5%, down from 16.1% in August of the previous year.

AutoInformed on

*ACEA: The European Automobile Manufacturers’ Association (ACEA) represents the 14 major Europe-based car, van, truck and bus makers: BMW Group, DAF Trucks, Daimler Truck, Ferrari, Ford of Europe, Honda Motor Europe, Hyundai Motor Europe, Iveco Group, JLR, Mercedes-Benz, Renault Group, Toyota Motor Europe, Volkswagen Group, and Volvo Group.

About the EU automobile industry

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.