Click to enlarge.

With new-vehicle inventory and sales rebounding to pre-pandemic levels in the United States during the Biden Administration’s economic recovery, more buyers are ignoring loyalty to a specific brand. This is according to the J.D. Power 2023 U.S. Automotive Brand Loyalty StudySM released today. The study, now in its fifth year, uses data from the Power Information Network to calculate whether an owner purchased the same brand after trading in an existing vehicle on a new vehicle.* AutoInformed notes that since ~20% of the new vehicle market consists of leased vehicles, it’s easier than ever to change brands.

“As vehicle availability increased and more choices hit the market for consumers, loyalty among brands as a whole saw a decline this year,” said Tyson Jominy, vice president of data & analytics at J.D. Power. “Additionally, owners were tied down to their vehicles for longer than normal due to ongoing supply chain disruptions, and as a result were more likely to experience problems with their vehicles.”

Highest-Ranking Brands

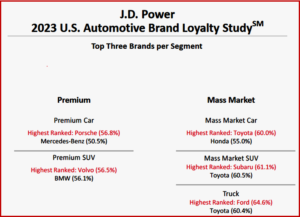

- Porsche ranks highest among premium brand car owners for a second consecutive year, with a 56.8% loyalty rate. Mercedes-Benz (50.5%) ranks second.

- Volvo ranks highest among premium brand SUV owners with a 56.5% loyalty rate. BMW (56.1%) ranks second.

- Toyota ranks highest among mass market brand car owners for a second consecutive year, with a 60.0% loyalty rate. Honda (55.0%) ranks second.

- Subaru ranks highest among mass market brand SUV owners with a 61.1% loyalty rate. Toyota (60.5%) ranks second.

- Ford ranks highest among truck owners for a second consecutive year, with a 64.6% loyalty rate, the highest loyalty rate in the study. Toyota (60.4%) ranks second.

“Now that some of those issues have eased, consumers are looking to get behind the wheel of something different and are no longer remaining as loyal to a brand. However, many of the highest-ranking brands perform similarly year after year. When vehicles deliver an experience that meets owner expectations, such as by offering superb build quality, owners are likely to reward brands with their loyalty,” concluded Jominy.

*Customer loyalty is based on the percentage of vehicle owners who choose the same brand when trading in or purchasing their next vehicle. Only sales at new-vehicle franchised dealers qualify. The study includes brand loyalty across five segments: premium car; premium SUV; mass market car; mass market SUV; and truck. The 2023 study calculations are based on transaction data from September 2022 through August 2023 and include all model years traded in.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Brand Loyalty Down Again for New Vehicles

Click to enlarge.

With new-vehicle inventory and sales rebounding to pre-pandemic levels in the United States during the Biden Administration’s economic recovery, more buyers are ignoring loyalty to a specific brand. This is according to the J.D. Power 2023 U.S. Automotive Brand Loyalty StudySM released today. The study, now in its fifth year, uses data from the Power Information Network to calculate whether an owner purchased the same brand after trading in an existing vehicle on a new vehicle.* AutoInformed notes that since ~20% of the new vehicle market consists of leased vehicles, it’s easier than ever to change brands.

“As vehicle availability increased and more choices hit the market for consumers, loyalty among brands as a whole saw a decline this year,” said Tyson Jominy, vice president of data & analytics at J.D. Power. “Additionally, owners were tied down to their vehicles for longer than normal due to ongoing supply chain disruptions, and as a result were more likely to experience problems with their vehicles.”

Highest-Ranking Brands

“Now that some of those issues have eased, consumers are looking to get behind the wheel of something different and are no longer remaining as loyal to a brand. However, many of the highest-ranking brands perform similarly year after year. When vehicles deliver an experience that meets owner expectations, such as by offering superb build quality, owners are likely to reward brands with their loyalty,” concluded Jominy.

*Customer loyalty is based on the percentage of vehicle owners who choose the same brand when trading in or purchasing their next vehicle. Only sales at new-vehicle franchised dealers qualify. The study includes brand loyalty across five segments: premium car; premium SUV; mass market car; mass market SUV; and truck. The 2023 study calculations are based on transaction data from September 2022 through August 2023 and include all model years traded in.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.