Click to enlarge.

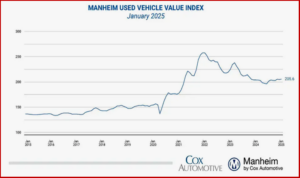

Wholesale used-vehicle prices (mix, mileage, seasonally adjusted basis) moved 0.4% higher in January compared to December, causing the Manheim Used Vehicle Value Index (MUVVI) to increase to 205.6, a gain of 0.8% from a year ago. The seasonal adjustment to the index muted the movement for the month, as non-seasonally adjusted values rose faster than seasonally adjusted values. The non-adjusted price in January increased by 0.6% compared to December, moving the un-adjusted average price up 1.1% year over year, Cox Automotive said today.* Notably absent was any mention of the Trump tariff chaos, which likely will significantly increase new vehicle prices and thereby increasing demand and prices for used vehicles.

“While it’s not yet spring, wholesale values increased more than we usually see in the month of January, with particular strength at the end of the month,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “The Manheim index is at the highest point since October 2023, after we experienced stronger-than-usual gains in non-seasonally adjusted values. Currently, retail days’ supply at used dealerships sits nine days lower than last year, and we are just now on the cusp of starting the spring wholesale market.”

New-vehicle sales in January were up 3.8% from last year, yet volume declined 25.7% from December. The January sales pace, or seasonally adjusted annual rate (SAAR), came in at 15.6 million, up 0.6 million from last year’s but lower than the strong 16.9 million level in December. In January, Manheim Market Report (MMR) values saw mixed moves over the course of the month but ended with the last week of January seeing strong price appreciation, with values rising 0.4% in the last week alone. Over the last four weeks, the Three-Year-Old Index increased an aggregate of 0.2%, including a decline of 0.5% in the third week of the month. Those same four weeks delivered an average decrease of 0.1% between 2014 and 2019, indicating depreciation trends were less than Cox usually sees at this time of the year.

Over the month, daily MMR Retention, the average difference in price relative to the current MMR, averaged 98.8%, meaning market prices moved away from MMR values this month and were lower against December levels. Compared to last year, valuation models were lower by 0.5 percentage points for MMR retention, and they are eight-tenths of a point lower than 2019 levels for the same period. The average daily sales conversion rate rose to 58.8%, an increase of 5.7 percentage points compared to last month. For comparison, the daily sales conversion rate averaged 54.4% in January over the last three years.

Major market segments saw mixed trends for seasonally adjusted prices year over year in January. Compared to January 2023, luxury was up the most, rising by 2.0%, with SUVs also up 1.2%. Performing worse than the industry, mid-size sedans were down 1.6%, trucks down 2.1%, and compact cars declined the most, falling by 3.4% compared to last year. Compared to the previous month, the luxury segment rose the most, moving higher by 2.7%, while SUVs were up 1.2% in the period. Faring worse than the industry overall, mid-size sedans were down 0.9%, trucks declined 1.8%, and compact cars showed the largest decline, falling 2.1% over the last month.

Looking at the market by powertrain, electric vehicles (EVs) were higher against December, showing their third consecutive month-over-month rise, which was also stronger than the industry average overall. EV values were up 2.1%, while non-EVs rose 0.4% over the same period. Seasonally adjusted EV values in January continue to show declines versus the prior year, which are smaller than in previous months. For January 2025, EV values are down 5.1% compared to January 2024, while non-EVs were up 0.3% year over year, a bit lower than the overall industry average.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook, or Cox-Automotive-Inc on LinkedIn.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Used Vehicle Prices Poised to Soar?

Click to enlarge.

Wholesale used-vehicle prices (mix, mileage, seasonally adjusted basis) moved 0.4% higher in January compared to December, causing the Manheim Used Vehicle Value Index (MUVVI) to increase to 205.6, a gain of 0.8% from a year ago. The seasonal adjustment to the index muted the movement for the month, as non-seasonally adjusted values rose faster than seasonally adjusted values. The non-adjusted price in January increased by 0.6% compared to December, moving the un-adjusted average price up 1.1% year over year, Cox Automotive said today.* Notably absent was any mention of the Trump tariff chaos, which likely will significantly increase new vehicle prices and thereby increasing demand and prices for used vehicles.

“While it’s not yet spring, wholesale values increased more than we usually see in the month of January, with particular strength at the end of the month,” said Jeremy Robb, senior director of Economic and Industry Insights at Cox Automotive. “The Manheim index is at the highest point since October 2023, after we experienced stronger-than-usual gains in non-seasonally adjusted values. Currently, retail days’ supply at used dealerships sits nine days lower than last year, and we are just now on the cusp of starting the spring wholesale market.”

New-vehicle sales in January were up 3.8% from last year, yet volume declined 25.7% from December. The January sales pace, or seasonally adjusted annual rate (SAAR), came in at 15.6 million, up 0.6 million from last year’s but lower than the strong 16.9 million level in December. In January, Manheim Market Report (MMR) values saw mixed moves over the course of the month but ended with the last week of January seeing strong price appreciation, with values rising 0.4% in the last week alone. Over the last four weeks, the Three-Year-Old Index increased an aggregate of 0.2%, including a decline of 0.5% in the third week of the month. Those same four weeks delivered an average decrease of 0.1% between 2014 and 2019, indicating depreciation trends were less than Cox usually sees at this time of the year.

Over the month, daily MMR Retention, the average difference in price relative to the current MMR, averaged 98.8%, meaning market prices moved away from MMR values this month and were lower against December levels. Compared to last year, valuation models were lower by 0.5 percentage points for MMR retention, and they are eight-tenths of a point lower than 2019 levels for the same period. The average daily sales conversion rate rose to 58.8%, an increase of 5.7 percentage points compared to last month. For comparison, the daily sales conversion rate averaged 54.4% in January over the last three years.

Major market segments saw mixed trends for seasonally adjusted prices year over year in January. Compared to January 2023, luxury was up the most, rising by 2.0%, with SUVs also up 1.2%. Performing worse than the industry, mid-size sedans were down 1.6%, trucks down 2.1%, and compact cars declined the most, falling by 3.4% compared to last year. Compared to the previous month, the luxury segment rose the most, moving higher by 2.7%, while SUVs were up 1.2% in the period. Faring worse than the industry overall, mid-size sedans were down 0.9%, trucks declined 1.8%, and compact cars showed the largest decline, falling 2.1% over the last month.

Looking at the market by powertrain, electric vehicles (EVs) were higher against December, showing their third consecutive month-over-month rise, which was also stronger than the industry average overall. EV values were up 2.1%, while non-EVs rose 0.4% over the same period. Seasonally adjusted EV values in January continue to show declines versus the prior year, which are smaller than in previous months. For January 2025, EV values are down 5.1% compared to January 2024, while non-EVs were up 0.3% year over year, a bit lower than the overall industry average.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. Fueled by the largest breadth of first-party data fed by 2.3 billion online interactions a year, Cox Automotive tailors leading solutions for car shoppers, automakers, dealers, retailers, lenders, and fleet owners. The company has 25,000-plus employees on five continents and a family of trusted brands that includes Autotrader®, Dealertrack®, Kelley Blue Book®, Manheim®, NextGear Capital™, and vAuto®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook, or Cox-Automotive-Inc on LinkedIn.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.