Click to enlarge.

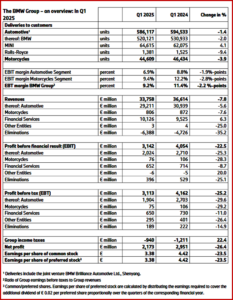

The BMW Group* (Bayerische Motoren Werke AG ADR BMWYY) said today that Earnings (EBIT) for Q1 2025 totaled €2,024 million, down from 2024 at € 2,710 million for a -25.3% decline). The EBIT margin came in at 6.9% (2024: 8.8%) and was at the high end of the revised BMW target range of 5-7% for the year. Excluding depreciation and amortization from the BBA purchase price allocation, the EBIT margin for the first quarter was 8.1%.** First-quarter Group revenues totaled €33,758 million (2024: € 36,614 million -7.8%; currency-adjusted: -8,7%) Based on the strength of its current operating performance, the BMW Group allocated €1,984 million (2024: €1,974 million/+0.5%) to research and development in the first quarter which was concentrated on electrification and digitalization of the vehicle fleet across all model series. The company also incurred R&D expenditure primarily for the future models of the NEUE KLASSE, such as the BMW iX3, and the successor models to the BMW X5 and BMW X7.

“The more challenging the environment, the more crucial it is to have compelling products, a consistent strategy and a high degree of flexibility. Our technology-open approach remains a key success factor: with our young, highly attractive models and our broad range of drives, we are able to meet the various needs of customers worldwide. This enables us to achieve robust results and stay on course to meet our ambitious full-year targets,” said Oliver Zipse, Chairman of the Board of Management of BMW AG.

“With the NEUE KLASSE, we are putting our biggest future project on the road: we are expanding our fully-electric offering, and rolling out future technology clusters and the new design language across our entire model portfolio. This will raise the level of innovation in our vehicles across all drive types to a whole new level – while also setting the course for profitable growth and sustainable success,” said Zipse.

Increase in Fully-Electric Vehicle Deliveries

- Despite persistently strong competition in China, the company’s global deliveries remained largely in line with the previous year (-1.4%). In the first three months, the BMW Group achieved growth in key markets Europe (+6.2%) and the US (+4.0%).

- In the first quarter of 2025, the BMW brand delivered a total of 520,121 vehicles to customers worldwide, surpassing the previous year’s volume in all regions except China. The strongest growth was recorded by the new BMW 5 Series models (+35.8%), as well as the BMW X1 and X2 variants (+31.8%).

- The BMW M brand achieved solid sales growth of +5.0% in the first quarter, delivering a total of 50,500 vehicles to customers. The main growth drivers were the high-performance models BMW M3* and M3 Touring* as well as BMW M5* and BMW M5 touring*, which were in high demand across all regions.

- The MINI brand, which updated its entire product range over the course of last year, sold 64,615 units worldwide – an increase of 4.1%. The Rolls-Royce brand delivered 1,381 units to customers between January and March (-9.4%).

- Fully-electric vehicles from the BMW, MINI and Rolls-Royce brands reported significant growth, with 109,513 deliveries worldwide (+32.4%). The BMW iX1* was the brand’s most successful BEV model, while the BMW i4* accounted for half of all BMW 4 Series delivered.

- Sales of fully-electric vehicles saw the strongest growth in Europe (+64.2%). New models from the MINI brand were major contributors to this: The urban premium brand delivered a total of 22,794 fully-electric vehicles, achieving a BEV share of 35.3%.

- The BMW Group currently offers at least one model with an electrified drive train in every vehicle class. Total deliveries of electrified vehicles (BEVs and PHEVs) also rose significantly in the first three months of the year, reaching 157,487 vehicles (2024: 122,582 vehicles/+28.5%).

The BMW Group said it is successfully implementing its strategic plan to further expand e-mobility. Additionally, it will reach two significant sales milestones: first, the delivery of 1.5 million fully-electric premium vehicles since the market launch of the BMW i3 in 2013; and second, a total of three million electrified cars since then.

BMW Group Confirms Full-Year Guidance

The International Monetary Fund (IMF) has revised its forecasts for global economic growth downwards to 2.8% in April 2025: Current trade conflicts and the associated potential rise in inflation, as well as uncertainty among businesses and consumers, could weigh on global growth. According to sector forecasts, the global automotive markets are likely to see slight growth.

- The BMW Group expects demand to rise in many markets in 2025, driven by a stabilizing inflation and further moderate interest rate cuts. In the USA, permanent tariffs could be reflected in rising inflation.

- The guidance published in the BMW Group Report 2024 in March 2025 includes all tariff increases that had taken effect by 12 March 2025. Due to the volatile developments and ongoing negotiations, the potential impact of tariffs in the current financial year can only be estimated, based on assumptions. The BMW Group expects some of the tariff increases to be temporary, with reductions from July 2025. The forecast also includes mitigating measures to offset the impact of higher tariffs.

- BMW anticipates slight sales growth, with fully-electric vehicles contributing to a slightly higher share of deliveries. Due to the factors mentioned above, Group earnings before tax are expected to be on a par with the previous year. The EBIT margin for the Automotive Segment is forecast to be within the range of 5.0-7.0%, with an RoCE of between 9-13%.

- In the Financial Services Segment, RoE is projected to be between 13-16%.

- In the Motorcycles Segment, a slight increase in sales and an EBIT margin within the range of 5.5-7.5%are forecast, with an RoCE of 13-17%

- The above targets will be achieved with the current number of employees.

*Bayerische Motoren Werke AG, trading as BMW Group sells automobiles under the BMW, Minicooper and Rolls-Royce brands, motorcycles are marketed as BMW Motorrad

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

BMW Group Q1 2025 Earnings Drop 25%

Click to enlarge.

The BMW Group* (Bayerische Motoren Werke AG ADR BMWYY) said today that Earnings (EBIT) for Q1 2025 totaled €2,024 million, down from 2024 at € 2,710 million for a -25.3% decline). The EBIT margin came in at 6.9% (2024: 8.8%) and was at the high end of the revised BMW target range of 5-7% for the year. Excluding depreciation and amortization from the BBA purchase price allocation, the EBIT margin for the first quarter was 8.1%.** First-quarter Group revenues totaled €33,758 million (2024: € 36,614 million -7.8%; currency-adjusted: -8,7%) Based on the strength of its current operating performance, the BMW Group allocated €1,984 million (2024: €1,974 million/+0.5%) to research and development in the first quarter which was concentrated on electrification and digitalization of the vehicle fleet across all model series. The company also incurred R&D expenditure primarily for the future models of the NEUE KLASSE, such as the BMW iX3, and the successor models to the BMW X5 and BMW X7.

“The more challenging the environment, the more crucial it is to have compelling products, a consistent strategy and a high degree of flexibility. Our technology-open approach remains a key success factor: with our young, highly attractive models and our broad range of drives, we are able to meet the various needs of customers worldwide. This enables us to achieve robust results and stay on course to meet our ambitious full-year targets,” said Oliver Zipse, Chairman of the Board of Management of BMW AG.

“With the NEUE KLASSE, we are putting our biggest future project on the road: we are expanding our fully-electric offering, and rolling out future technology clusters and the new design language across our entire model portfolio. This will raise the level of innovation in our vehicles across all drive types to a whole new level – while also setting the course for profitable growth and sustainable success,” said Zipse.

Increase in Fully-Electric Vehicle Deliveries

The BMW Group said it is successfully implementing its strategic plan to further expand e-mobility. Additionally, it will reach two significant sales milestones: first, the delivery of 1.5 million fully-electric premium vehicles since the market launch of the BMW i3 in 2013; and second, a total of three million electrified cars since then.

BMW Group Confirms Full-Year Guidance

The International Monetary Fund (IMF) has revised its forecasts for global economic growth downwards to 2.8% in April 2025: Current trade conflicts and the associated potential rise in inflation, as well as uncertainty among businesses and consumers, could weigh on global growth. According to sector forecasts, the global automotive markets are likely to see slight growth.

*Bayerische Motoren Werke AG, trading as BMW Group sells automobiles under the BMW, Minicooper and Rolls-Royce brands, motorcycles are marketed as BMW Motorrad

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.