“Retail sales in April are off to another strong start, as the month may be benefiting from consumers purchasing vehicles earlier, while there is still ample inventory,” said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates, which monitors real time transactions at new car dealers.

“However, the pace isn’t expected to be sustainable as inventory dries up, especially among small cars, and becomes a more widespread problem toward the end of April and into May.”

Total light-vehicle sales for April – propped by the use of incentives by the Detroit Three – are expected to come in at 1,147,300 units, which is 13% higher than in April 2010. Fleet sales in April are expected to decrease to 199,100 units, as volume is likely to shift to the retail market to support the current pace of demand. Fleet volume is projected to be less than 18% of total sales in April.

| U.S. Sales and SAAR Comparisons – April 2011 | |||

| April 2011 | March 2011 | April 2010 | |

| New vehicle retail sales | 948,100 units +16% April 2010 | 978,471 units | 790,469 units |

| Total vehicle sales | 1,147,300 units +13% April 2010 | 1,244,009 units | 980,107 units |

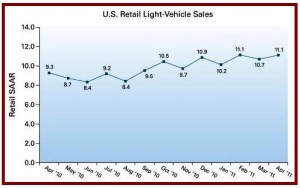

| Retail SAAR | 11.1 million units | 10.7 million units | 9.3 million units |

| Total SAAR | 13.1 million units | 13.1 million units | 11.2 million units |

| J.D. Power and Associates | |||

Sales Outlook

The pace of sales through April would typically lead to an upward revision in the forecast for 2011, according to Power. However, due to the high level of uncertainly related to the inventory situation and full impact of parts shortages for non-Japanese OEMs, Power is holding its 2011 forecast at 10.7 million units for retail sales and 13 million units for total sales.

“The industry is now facing its first real challenge since the recession, as potential widespread parts shortages could have a profound impact on the pace of the recovery,” said John Humphrey, senior vice president of automotive operations at J.D. Power and Associates. “However, with a lower and more variable cost structure, the industry is better prepared to weather the uncertainty.”

North American Production

North American production in the first quarter of 2011 increased 17% from the same period in 2010. Nearly 3.4 million units have been built in 2011, compared with 2.9 million units built in the first quarter of 2010. However, for some manufacturers, near-term production has been impacted by parts shortages caused by the earthquake and tsunami in Japan, which is likely to worsen in the coming weeks.

The overall inventory level heading into April was slightly better than expected at 54 days’ supply at the end of March 2011, down only slightly from the 60-day supply level at the end of February 2011. However, several small cars and many models imported from Japan are in a much shorter supply situation. With the strength of April sales combined with supply constraints from Japanese imports, inventory is expected to continue to be challenged for the next few months and will likely fall below 45 days’ supply.

“The supply side of the industry is just now starting to see the effects of the parts shortage and is bracing for additional production losses during the next quarter, with volume through June expected to be down nearly 200,000 units from the previous forecast of 3.3 million units for the second quarter,” said Schuster.

J.D. Power and Associates’ forecast for North American production in 2011 remains at 12.9 million units, as lost volume in the near-term is expected to be made up by the end of the year. However, there remains a relatively low level of risk of a downward revision.