Without subsidies, which may or may not be economically possible, depending on your political bias and social class, electric vehicles are clearly not cost competitive now and for years to come.

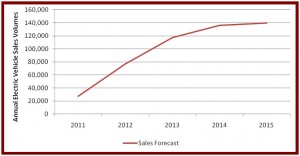

In its latest study, the Center for Automotive Research (CAR) estimates the national distribution of electric vehicles across the United States over the next four years – the same period that President Obama wants 1 million electric vehicles on U.S. streets.

The assumptions of the study – always key – use hybrid vehicle sales in the 50 states as a proxy for electric vehicle sales, and derives a national estimate of electric vehicle market share annually.

CAR, an Ann Arbor-based nonprofit research organization with close ties to the auto industry, is quick to point out that it’s not wading into what I call the political swamp of actually forecasting electric vehicle sales, but just looking at how various incentive programs could affect electric vehicle proliferation.

Executive summary – taxpayer money on the hood moves the sheet metal, but auto company press release predictions about EV sales are dubious.

The electric vehicle incentives are an increasingly contentious budget item. And at some point electric vehicle incentives will be subject to scrutiny as the political maneuvering around the gigantic budget deficits of federal, state and local governments continue to make headlines.

To paraphrase a perhaps wishful thinking economist not conversant in the ways of politicians doling out pork – if something is economically impossible, then it won’t happen. Well without subsidies, which may or may not be economically possible, depending on your political bias and social class, electric vehicles are clearly not cost competitive now and for years to come.

“The study finds that many factors could affect deployment and annual market share,” said Kim Hill, lead researcher on the study, and director of the Sustainability and Economic Development Strategies group at CAR.

The study – since it extrapolates from hybrid sales – not surprisingly suggests that California, New York, Texas, and Florida (the largest hybrid markets in the nation, each with more than 15,000 retail hybrid registrations in 2009) will be the states with the most electric vehicles.

Automakers have indeed selected these areas as initial rollout markets for electric vehicles.

In what I take to be a welcome sign of academic integrity, CAR said it originally planned to use two different national estimates for calculating state allocations. These were, first, the sum of company announcements from press releases and news articles; and, second, a sales forecast estimate that integrated numbers from the IHS Global Insight forecast, a J.D. Power forecast, and CAR research.

Ah, the perils of relying on press releases are myriad since they often have little basis in reality, as any working journalist knows.

CAR puts this truism dryly, but with rapier wit that separates the “head” lines from the body so quickly that the body appears to be still standing at first glance:

“The available company announcement values, however, were often vague and not scientifically based, and despite having very few models represented, resulted in an unreasonably high national sales estimate. For those reasons, and so as to not confuse the consumers of this study, the company announcement estimate of national sales was not used to determine state allocations.”

“The estimated number of vehicles on the road in this time period could be pushed higher through an increased level of consumer acceptance, fleet purchases, new entrants into the market, and most importantly, through incentive programs at the federal, state and local levels, such as an expansion of EV-ready cities and regions, and consumer incentives,” Hill said.

The study, funded through a research grant from General Motors to CAR’s Automotive Communities Partnership (ACP) is available on CAR’s website at www.cargroup.org

The ACP has a stated goal of helping people understand “the impact of changes in the automotive industry and how it affects their communities.”