Passenger Vehicle wholesales increased by 36% year-on-year to 2.17 million units in August 2022 with growth remaining strong, according to data just published by respected consultancy LMC Automotive*. The Light Commercial Vehicle (LCV) segment was almost unchanged in the month, with sales of 0.22 million units. The overall Light Vehicle (LV) market ended August with an increase of 32% YoY, and a total of 2.39 million units sold. Year-to-date LV sales totaled 16.73 million this year, up by 5.6%. Total light vehicle production in August was up by 40.6% YoY to 2.33 million units, with a categorization of 2.12 million PVs (+45% YoY) and 0.21 million LCVs (+6% YoY).

“PV wholesales and production numbers for August were in line with our expectation for the month. After the reopening of Shanghai, sales rebounded strongly for the second consecutive month in July, continuing to be boosted by pent-up demand and the temporary purchase tax cut on PVs (from 1 June to 31 December 2022). The local governments’ and automakers’ sales promotions also played a role in the brisk demand. In the recently three months, some of the premium brands have been promoted by the purchase tax preferential policy, and the recovery of the market is obvious,” said LMC.

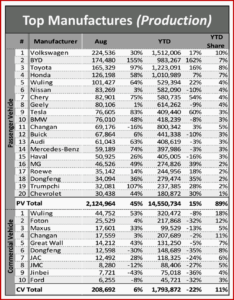

Click to Enlarge.

LMC has the August seasonally adjusted annual rate (SAAR) at an all-time high of 34 million units/year, down -7.7% from a record high of 36.8 million units/year in July.

“Although the ninth version of the COVID-19 prevention and control plan in China was released, it was believed that there wouldn’t be a widespread and long shutdown. For example, Shanghai reduced its quarantine time from 14 days to just 7 days for travelers from “high-risk” places.

China has also reopened to foreign students after two years of COVID-19 lockdowns. “Now that the COVID-19 outbreak has gradually been brought under control, the purchase tax cut incentive and the sales promotion of automakers will continue to boost sales through this year,” LMC said.

Semiconductor shortages continued to go away. However, production in August was disrupted by other factors. LMC said severe heatwaves in Sichuan province caused power shortages and led to temporary suspension in production, including Toyota and a number of auto suppliers. COVID-19 lockdowns in Chongqing and Chengdu impacted production at VW, Bosch and many others.

“At present, no manufacturer has announced any production losses due to the persistent high temperatures and lack of electricity. The high temperature-related power shortages began earlier in August, but the large- scale impact of high temperatures across the country started to recede from the 26th of the month. In addition, the arrival of rainy weather in southwest China has now begun to alleviate the power shortages. Hence it is expected that the impact of the heatwave on full-year sales and production will be limited,” LMC said.

Click to Enlarge.

In August, the Wuling Hongguang Mini BEV continue to be the best-selling model, followed by Tesla Model Y and BYD’s Song. NEVs (new electric vehicles) remained the market leaders, with sales of BEVs and PHEVs increasing by 92.9% and 160% YoY respectively in August. “The momentum of the NEV market remains strong, with sales of 626k units in August, up by 106% YoY. Their low use cost encouraged more people to buy NEV models, and incentive policies from local governments remain skewed towards NEVs. In addition, the central government declared that they would extend the NEV purchase tax cut policy until the end of 2023 and would also establish a coordination mechanism for the development of the NEV industry,” said LMC.

LMC has raised its full-year 2022 forecast by 710,000 vehicles. Sales are now projected to expand by 7.5% to 27.4 million units this year. This is still lower than the record high of 28.6 million units in 2017. The forecast sees a passenger vehicle market growing 11.1% in 2022, up by 3.2% compared with the last forecast.

LMC Automotive

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, the distinguished Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

China Light Vehicle Sales Highest Ever in August

Passenger Vehicle wholesales increased by 36% year-on-year to 2.17 million units in August 2022 with growth remaining strong, according to data just published by respected consultancy LMC Automotive*. The Light Commercial Vehicle (LCV) segment was almost unchanged in the month, with sales of 0.22 million units. The overall Light Vehicle (LV) market ended August with an increase of 32% YoY, and a total of 2.39 million units sold. Year-to-date LV sales totaled 16.73 million this year, up by 5.6%. Total light vehicle production in August was up by 40.6% YoY to 2.33 million units, with a categorization of 2.12 million PVs (+45% YoY) and 0.21 million LCVs (+6% YoY).

“PV wholesales and production numbers for August were in line with our expectation for the month. After the reopening of Shanghai, sales rebounded strongly for the second consecutive month in July, continuing to be boosted by pent-up demand and the temporary purchase tax cut on PVs (from 1 June to 31 December 2022). The local governments’ and automakers’ sales promotions also played a role in the brisk demand. In the recently three months, some of the premium brands have been promoted by the purchase tax preferential policy, and the recovery of the market is obvious,” said LMC.

Click to Enlarge.

LMC has the August seasonally adjusted annual rate (SAAR) at an all-time high of 34 million units/year, down -7.7% from a record high of 36.8 million units/year in July.

“Although the ninth version of the COVID-19 prevention and control plan in China was released, it was believed that there wouldn’t be a widespread and long shutdown. For example, Shanghai reduced its quarantine time from 14 days to just 7 days for travelers from “high-risk” places.

China has also reopened to foreign students after two years of COVID-19 lockdowns. “Now that the COVID-19 outbreak has gradually been brought under control, the purchase tax cut incentive and the sales promotion of automakers will continue to boost sales through this year,” LMC said.

Semiconductor shortages continued to go away. However, production in August was disrupted by other factors. LMC said severe heatwaves in Sichuan province caused power shortages and led to temporary suspension in production, including Toyota and a number of auto suppliers. COVID-19 lockdowns in Chongqing and Chengdu impacted production at VW, Bosch and many others.

“At present, no manufacturer has announced any production losses due to the persistent high temperatures and lack of electricity. The high temperature-related power shortages began earlier in August, but the large- scale impact of high temperatures across the country started to recede from the 26th of the month. In addition, the arrival of rainy weather in southwest China has now begun to alleviate the power shortages. Hence it is expected that the impact of the heatwave on full-year sales and production will be limited,” LMC said.

Click to Enlarge.

In August, the Wuling Hongguang Mini BEV continue to be the best-selling model, followed by Tesla Model Y and BYD’s Song. NEVs (new electric vehicles) remained the market leaders, with sales of BEVs and PHEVs increasing by 92.9% and 160% YoY respectively in August. “The momentum of the NEV market remains strong, with sales of 626k units in August, up by 106% YoY. Their low use cost encouraged more people to buy NEV models, and incentive policies from local governments remain skewed towards NEVs. In addition, the central government declared that they would extend the NEV purchase tax cut policy until the end of 2023 and would also establish a coordination mechanism for the development of the NEV industry,” said LMC.

LMC has raised its full-year 2022 forecast by 710,000 vehicles. Sales are now projected to expand by 7.5% to 27.4 million units this year. This is still lower than the record high of 28.6 million units in 2017. The forecast sees a passenger vehicle market growing 11.1% in 2022, up by 3.2% compared with the last forecast.

LMC Automotive

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, the distinguished Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.