The China Light Vehicle market slowed down in January. Passenger Vehicle (PV) sales increasing by only 0.4% year-on-year (YoY) to 2.28 million units. Full-year growth for 2016 was +17%. The Light Commercial Vehicle (LCV) sector remained on the downward trend seen last year, with sales declining by 9.6% to 0.25 million units in the month. The Light Vehicle (LV) market closed January with a total of 2.53 million units sold, -0.7% down YoY.

Nevertheless, the seasonally adjusted annualized rate (SAAR) of LV sales reached 25.67 million units in January, -13.7% down from last December because of special circumstances. During Q4 of 2016, there was a buying scurry that preceded the expected termination of the purchase tax cut on small-engine vehicles. This caused the SAAR remained high at 30 million units. However, when the process of phasing out the tax incentive was implemented, the rate of sales began to normalize, per consultancy LMC.

The CADA dealer‐level inventory index stood at 1.60 months at the end of January 2017, a +95% increase on last December and +62% higher in YoY terms. Having spent six consecutive months below the “warning line” of 1.5 months, the inventory level rose above the warning line in January. Market surveys show that the number of consumers visiting dealerships fell to one-third of the total seen in December 2016.

This year, the Chinese New Year holiday began earlier than usual in late January, which meant that several valid selling days were lost, compared to January 2016, thereby impacting volumes for the month. However, a review of the inventory index and the sales structure of the market suggests that the tame volume in January came about not only because of the shortened selling period, but also from the payback effect of the 50% reduction in the purchase tax rebate, which began to impact the market in early 2017.

This was obvious with the slowdown in the sub-segments that had most gained from the tax reduction on small-engine vehicles – Compact Cars, Compact SUVs and Compact MPVs. The Non-Premium Compact Car segment grew by a measly +1% in January, in contrast to growth of +13% in 2016.

Compact Economy MPVs declined by -12%, versus a rise of +18% last year, while Compact Economy SUVs improved by , compared to +73% in 2016. Several hot models saw sales normalize, as demonstrated by Great Wall’s H6, which sold 40,474 units in January, down from a record-high of 70,292 units last December.

However, SUV is still presumed to remain a hot segment in 2017, as several new products will be launched this year. These will range from Mini to Full-size in terms of vehicle size and from Economy to Premium in terms of status. Having surged by +44% in January, the Mid-Size Economy SUV sector could offer a new opportunity for Chinese automakers. (This of course is a global trend).

During recent years, there has been an obvious consumption upgrade trend in the Chinese auto market and local brands have kept pace by adjusting their SUV product lines to meet this push up market. Examples within the Mid-size SUV segment were seen with the Trumpchi GS8 and Changan CS95, both of which offer performance levels and visual appeal that have exceeded consumer expectations by industry observers.

In terms of powertrain and comfort levels (i.e., NVH), these locally made models are keeping up with their Non-Premium overseas competitors. When it comes to ADAS and intelligent interconnection technology, one could even say that Chinese brands are ahead of their foreign rivals.

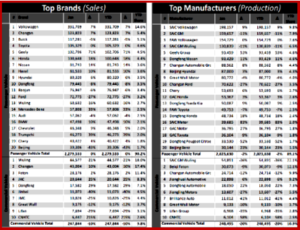

In the Premium segment, Mercedes-Benz had a strong performance in January, with an increase in sales of 33% YoY in the month. Conversely, Audi put in a negative performance. We expect to see the competition among the top-ranked Premium marques (i.e., Audi, BMW and Mercedes-Benz) intensify in the future, as more locally-produced products under each of these brands will be added. Meanwhile, the second tier of Premium brands is catching up fast, which will lead to market share gains for the segment in the next few years.

Several automakers have published their sales targets for the year ahead, some of which are aggressive, while others are relatively conservative. It looks like a zero-sum market, given that for every winner, there will be a corresponding loser, per LMC: “It is safe to say that the halcyon days triggered by the tax incentive in 2016 are now over and the market is set to stabilize during 2017.”