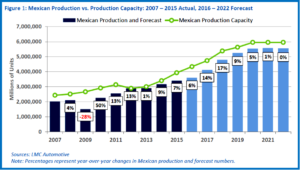

Mexican auto assembly capacity is projected to more than double in size between 2010 and 2020, per the latest study from the esteemed Center for Automotive Research in Ann Arbor Michigan. President elect Trump singled out Ford and General Motors during the campaign for their investments in Mexico, rather than the U.S. Furthermore, the Detroit Three in the just completed Canadian auto talks, all agreed to new investments contracts that covers Trump’s term. (Unifor Autoworkers Ratify Ford Canada Contract) How this works out is shaping up to be a battle grand, one where the losers will be the very autoworkers Trump promised he would protect. (Trump versus Auto Industry – Outcome Could be Ugly)

Mexican auto assembly capacity is projected to more than double in size between 2010 and 2020, per the latest study from the esteemed Center for Automotive Research in Ann Arbor Michigan. President elect Trump singled out Ford and General Motors during the campaign for their investments in Mexico, rather than the U.S. Furthermore, the Detroit Three in the just completed Canadian auto talks, all agreed to new investments contracts that covers Trump’s term. (Unifor Autoworkers Ratify Ford Canada Contract) How this works out is shaping up to be a battle grand, one where the losers will be the very autoworkers Trump promised he would protect. (Trump versus Auto Industry – Outcome Could be Ugly)

Despite what appears to be Trumps ill-informed trade views – if they are informed at all – CAR using data, not diatribes, observes that the major reason for this rapid growth of the auto industry in Mexico comes from the injection of $13.3 billion in investment to move 3.3 million units of vehicle capacity from Japan, Germany, and South Korea to Mexico rather than the movement of U.S. and Canadian capacity. While automakers and suppliers are attracted by Mexico’s low labor rates, there are many other factors behind Mexico’s growing role in the North American automotive industry.

Compounding the mostly positive Mexican analysis from CAR, it doesn’t note that roughly 2 million vehicles made in the U.S. are exported annually. If NAFTA falls apart and the exports stop, that’s roughly the equivalent of 10 final assembly plans shutting down, and that doesn’t include the U.S. plants of suppliers to automakers.

Free Trade is Working for Mexico

Combined with lower labor costs (although CAR doesn’t note the high degree of automation in newer plants that drastically cuts labor costs), Mexico’s free trade position with 40 countries and access to 47% of the world’s automotive markets provides in CAR’s view a significant competitive edge to attract automotive investment that the United States and Canada do not have. Clearly trade wars, tariffs or isolationism from a Trump mis-administration cannot address these issues.

Whatever Trump does or doesn’t do – there’s no Trump auto policy in sight or even roughed out for the displaced workers he promised to look after – growing Mexican production volumes can result in new business for U.S. and Canadian suppliers.

“Due to well-integrated North American supply chains, vehicles produced in Mexico may be comprised of up to 40% U.S. content. In fact, U.S. exports of parts and components to Mexico more than doubled between 2005 and 2014 to a level of $18.4 billion,” says CAR.

Mexico has become a key target for investment from all types of manufacturers, but especially from automakers and their suppliers, CAR notes. “While automotive assembly compensation is approximately 80% lower in Mexico than in the United States, low wages are not the only factor that makes Mexico an attractive investment destination,” says CAR.

Mexico Has an Industrial Policy. Where’s Trump’s?

Mexico offers workforce development and training programs and other aggressive development incentives. At the Federal level, Mexico is pursuing multiple coordinated strategies to support and grow a strong manufacturing base (once the core of the now threatened U.S. middle class), and many of these initiatives aim to address current weaknesses in the country’s value proposition for manufacturing industries.

The Mexican efforts – an industrial policy in AutoInformed’s view the U.S. never developed – include strengthening the educational system (Trump wants to dissolve the Department of Education), improving the legal system (Republican have blocked a vote on a legitimate U.S. Supreme Court Nominee), investing in public infrastructure (Trump claims $1 trillion coming but with no funding proposal in the face of promised tax cuts for the rich), and combating crime and violence.

On a currency basis, the relatively low value of the U.S. dollar vis-à-vis other currencies (Yen, Euro) has made Mexico the most advantageous auto manufacturing location in the NAFTA region. The dollar is now gaining strength, at least for the moment, and the Mexican peso at 18 to the $1 is as strong as it has been in a long time, maybe ever.

Simple Economics

Low production costs and low tariffs due to the broad reach of Mexico’s free trade agreements (FTAs) made it possible for the country to emerge as a prime export base—not only within NAFTA, but globally. Exports from Mexico to 44 countries are exempt from tariffs, including the 10 percent tariff the European Union assigns to imported motor vehicles.

Asian and European automakers closed production in their home countries to relocate to Mexico, and while U.S.-based automakers have not relocated production, they have responded by increasing Mexican investment to remain globally competitive.

U.S. consumer preferences, low fuel prices, and U.S. regulatory mandates no doubt have also contributed to increasing the attractiveness of Mexico as a location for passenger car production. Passenger cars overall have a lower margin than larger vehicles—such as pickup trucks, SUVs, and CUVs—and Mexico offers a way due to lower manufacturing costs, and this gains access to non-NAFTA markets where many consumers prefer cars over pickup trucks and SUVs.