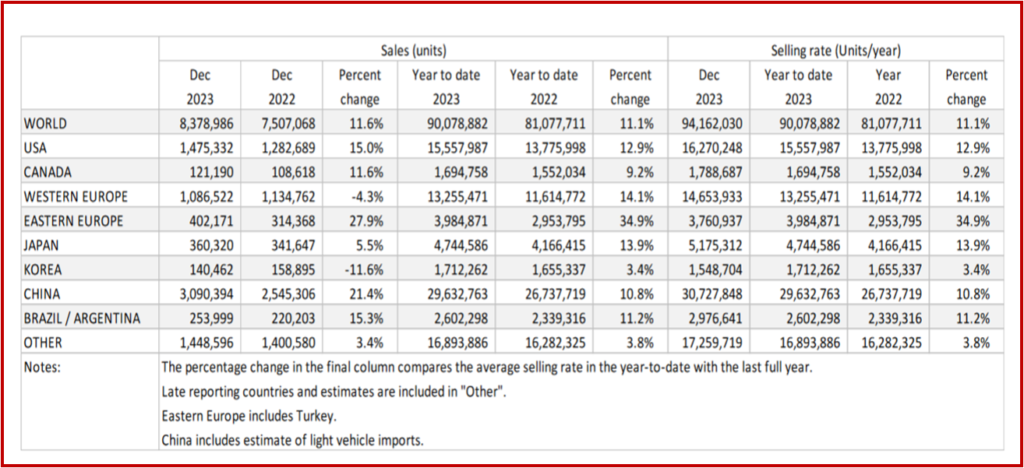

The Global Light Vehicle (LV) selling rate for December 2023 was 94 million units annually, according to an analysis just released by the respected GlobalData* consultancy. This continues rising results since the middle of the year. The LV market grew 11.6% YoY to 8.4 million in December, finishing 2023 with 90 million units. This is 11% higher than the 2022 total. (AutoInformed: November Global Light Vehicle Sales at 94,000,000 Annually)

“Sales in the US were helped by year-end discounts offered by the automakers along with higher incentives. While Western Europe reached 13.3 million units in 2023, 14.1% higher than 2022, the LV market in December fell by 4.3% YoY led by Germany which had a strong base in 2022. For China, total LV sales in 2023 was up nearly 11% with Passenger Vehicle sales benefiting from stronger competition and aggressive price cuts,” the GlobalData light vehicle forecasting team said.

Click for more GlobalData.

GlobalData Commentary

North America

The US Light Vehicle market grew by 15.0% YoY in December, to 1.48 million units. Following the strong boost in sales at the end of 2023, the selling rate reached 16.3 million units/year in December, up from 15.5 million units/year reported in November. Sales in December have been historically driven by a boost in year-end discounts offered by the automakers. Transaction prices continued to remain at an elevated level in December, the average price was $46,207, up by $586 from November. Incentives also jumped in December, to $2633, up by $320 MoM. For the year, sales totaled 15.6 million units, a YoY gain of 12.9%.

In December, Canadian Light Vehicles sales reached 121,200 units, an increase of 11.6% YoY. The selling rate was little changed in December, at 1.79 million units/year. For the full year, Canadian sales totaled 1.69 million units, up by 9.2% YoY.

Mexican sales expanded by 18.1% in December to 142,300 units. However, the boost in sales at the end of the year is consistent with historical norms as the selling rate slightly dropped in December to 1.58 million units/year.

Europe

The Western Europe LV market registered 1.1 million units in December, 4.3% lower than December 2022. The decline is driven mainly by Germany which had a strong December 2022 due to consumers pulling forward purchases before EV incentives ended in January 2023. Overall, the region totaled 13.3 million units (+14.1% YoY) helped by easing of supply constraints but we expect weak economic conditions to affect sales in 2024.

The Eastern European LV market registered 402,000 units in December, almost 28% higher than December 2022. Overall, the region finished with almost 4 million units which is 35% higher than the 2022 total. Recovery in Ukraine and Russia is helping LV sales in the region as the supply situation improves.

China

Preliminary data indicates that sales in China (i.e., wholesales that include exports) remained robust at the end of 2023. The December selling rate was 30.7 million units/year, the seventh consecutive month that the rate exceeded the 30 million-unit mark – although December registered the fourth straight month of the MoM decline from an abnormally high 36 million units/year in August. YoY sales increased by 21% in December, due partially to a low base.

During full-year 2023, total Light Vehicle (LV) sales reached a record high of 29.6 million units, up nearly 11%. In 2023, exports of Passenger Vehicles (PVs) increased by about 65% YoY, accounting for 15% of total PV deliveries (strong shipments to Russia and Mexico). Domestic sales of PVs fared well, too, expanding by 4.2% YoY. In H2 2023, intensifying competition and aggressive price cuts across the brands (both foreign and Chinese) helped boost sales. Chinese brands expanded their market share to 55% of total PV sales last year, benefiting from their strong NEV (hybrids and pure EVs) offerings. With exports and domestic sales combined, NEV sales totaled 9.5 million units last year

Elsewhere in Asia

The Japanese market ended 2023 on a strong note. In December, the selling rate reached 5.18 million units/year and sales expanded by 5.5% YoY. However, sales of Mini Vehicles (which account for nearly 40% of total Light Vehicle sales) declined by 3.5% YoY, as Daihatsu has halted shipments of all of its vehicles, in the wake of its scandal over the safety test. In full-year 2023, Japan’s total LV sales increased by almost 14%, thanks to the improved supply of semiconductors.

The Korean market decelerated sharply at the end of 2023. The December selling rate was 1.55 million units/year, the weakest rate in almost two years. In YoY terms, sales declined by 11.6% in December, with most OEMs, except GM Korea, recording double-digit declines. Sales were hampered by higher financing costs, as well as weak consumer sentiment. In full-year 2023, however, sales expanded by 3.4% to 1.71 million units, supported by the temporary tax cut (which expired at the end of June 2023).

South America

Brazilian Light Vehicle sales grew by 17.2% YoY in December, to 236, 600 units. This is the third consecutive month in which sales have exceeded 200,000, but only the fourth month in 2023 to break through this level. As the result for the year is finalized, the selling rate for December increased to 2.57 million units/year, up from 2.40 million units/year reported in November. Inventory levels dropped further in December to 210,100, down from 251,500 in November, driven mainly by rental companies.

In Argentina, Light Vehicle sales reached 17 ,400 units in December, down by 5.1% YoY. Historically, sales are extremely weak in December due to seasonality, but with economic headwinds picking up at the end of 2023, the selling rate dropped to 408,100 units/year in December, from the 467,400 units/year reported in November. For 2023 overall, volumes grew to 423,00, a YoY increase of 11.4%, the highest sales total since 2019.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

December Global Light Vehicle Sales at 92,000,000 Annual Rate

The Global Light Vehicle (LV) selling rate for December 2023 was 94 million units annually, according to an analysis just released by the respected GlobalData* consultancy. This continues rising results since the middle of the year. The LV market grew 11.6% YoY to 8.4 million in December, finishing 2023 with 90 million units. This is 11% higher than the 2022 total. (AutoInformed: November Global Light Vehicle Sales at 94,000,000 Annually)

“Sales in the US were helped by year-end discounts offered by the automakers along with higher incentives. While Western Europe reached 13.3 million units in 2023, 14.1% higher than 2022, the LV market in December fell by 4.3% YoY led by Germany which had a strong base in 2022. For China, total LV sales in 2023 was up nearly 11% with Passenger Vehicle sales benefiting from stronger competition and aggressive price cuts,” the GlobalData light vehicle forecasting team said.

Click for more GlobalData.

GlobalData Commentary

North America

The US Light Vehicle market grew by 15.0% YoY in December, to 1.48 million units. Following the strong boost in sales at the end of 2023, the selling rate reached 16.3 million units/year in December, up from 15.5 million units/year reported in November. Sales in December have been historically driven by a boost in year-end discounts offered by the automakers. Transaction prices continued to remain at an elevated level in December, the average price was $46,207, up by $586 from November. Incentives also jumped in December, to $2633, up by $320 MoM. For the year, sales totaled 15.6 million units, a YoY gain of 12.9%.

In December, Canadian Light Vehicles sales reached 121,200 units, an increase of 11.6% YoY. The selling rate was little changed in December, at 1.79 million units/year. For the full year, Canadian sales totaled 1.69 million units, up by 9.2% YoY.

Mexican sales expanded by 18.1% in December to 142,300 units. However, the boost in sales at the end of the year is consistent with historical norms as the selling rate slightly dropped in December to 1.58 million units/year.

Europe

The Western Europe LV market registered 1.1 million units in December, 4.3% lower than December 2022. The decline is driven mainly by Germany which had a strong December 2022 due to consumers pulling forward purchases before EV incentives ended in January 2023. Overall, the region totaled 13.3 million units (+14.1% YoY) helped by easing of supply constraints but we expect weak economic conditions to affect sales in 2024.

The Eastern European LV market registered 402,000 units in December, almost 28% higher than December 2022. Overall, the region finished with almost 4 million units which is 35% higher than the 2022 total. Recovery in Ukraine and Russia is helping LV sales in the region as the supply situation improves.

China

Preliminary data indicates that sales in China (i.e., wholesales that include exports) remained robust at the end of 2023. The December selling rate was 30.7 million units/year, the seventh consecutive month that the rate exceeded the 30 million-unit mark – although December registered the fourth straight month of the MoM decline from an abnormally high 36 million units/year in August. YoY sales increased by 21% in December, due partially to a low base.

During full-year 2023, total Light Vehicle (LV) sales reached a record high of 29.6 million units, up nearly 11%. In 2023, exports of Passenger Vehicles (PVs) increased by about 65% YoY, accounting for 15% of total PV deliveries (strong shipments to Russia and Mexico). Domestic sales of PVs fared well, too, expanding by 4.2% YoY. In H2 2023, intensifying competition and aggressive price cuts across the brands (both foreign and Chinese) helped boost sales. Chinese brands expanded their market share to 55% of total PV sales last year, benefiting from their strong NEV (hybrids and pure EVs) offerings. With exports and domestic sales combined, NEV sales totaled 9.5 million units last year

Elsewhere in Asia

The Japanese market ended 2023 on a strong note. In December, the selling rate reached 5.18 million units/year and sales expanded by 5.5% YoY. However, sales of Mini Vehicles (which account for nearly 40% of total Light Vehicle sales) declined by 3.5% YoY, as Daihatsu has halted shipments of all of its vehicles, in the wake of its scandal over the safety test. In full-year 2023, Japan’s total LV sales increased by almost 14%, thanks to the improved supply of semiconductors.

The Korean market decelerated sharply at the end of 2023. The December selling rate was 1.55 million units/year, the weakest rate in almost two years. In YoY terms, sales declined by 11.6% in December, with most OEMs, except GM Korea, recording double-digit declines. Sales were hampered by higher financing costs, as well as weak consumer sentiment. In full-year 2023, however, sales expanded by 3.4% to 1.71 million units, supported by the temporary tax cut (which expired at the end of June 2023).

South America

Brazilian Light Vehicle sales grew by 17.2% YoY in December, to 236, 600 units. This is the third consecutive month in which sales have exceeded 200,000, but only the fourth month in 2023 to break through this level. As the result for the year is finalized, the selling rate for December increased to 2.57 million units/year, up from 2.40 million units/year reported in November. Inventory levels dropped further in December to 210,100, down from 251,500 in November, driven mainly by rental companies.

In Argentina, Light Vehicle sales reached 17 ,400 units in December, down by 5.1% YoY. Historically, sales are extremely weak in December due to seasonality, but with economic headwinds picking up at the end of 2023, the selling rate dropped to 408,100 units/year in December, from the 467,400 units/year reported in November. For 2023 overall, volumes grew to 423,00, a YoY increase of 11.4%, the highest sales total since 2019.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.