Constant freshenings: It is simply the price of the ante’ needed to play the next model year in a multi, multi-billion competitive poker game.

It’s true that we have devoted a fair amount of space at AutoInformed on connected vehicles, autonomous ones, and the large investments to make the current dream or is that nightmare of automakers come to fruition. However, while vehicle manufacturers and suppliers are pursuing such capital-intensive projects, the core business – new products in the showroom is proceeding apace.

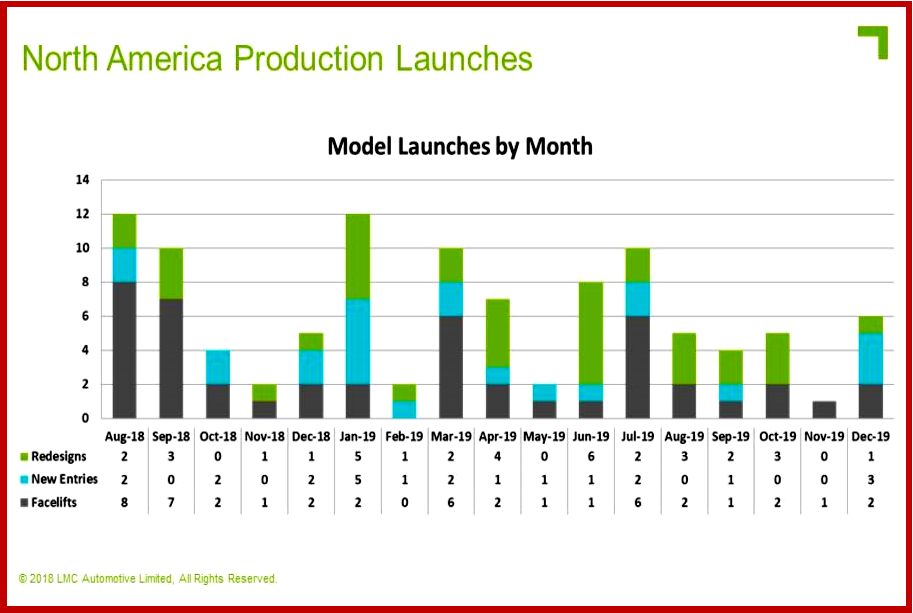

Industry stakeholders will be further challenged over the next 17 months as numerous critical new vehicle launches will add to the strain of an already stressed industry,” says Bill Rinna, in charge of Americas Vehicle Forecasts at LMC Automotive.

LMC predicts 105 all-new, redesigned and face-lifted model launches at plants over that time-frame – an average of six a month – as automakers freshen and fill white spaces (translation more crossover SUVs) in showrooms, localized production of previously imported models because of trade and currency and market relevancy issues and keep current models fresh in look and electronics.

It is simply the price of the ante’ needed to play the next model year in a multi, multi-billion competitive poker game. There’s no liar’s hand here. There are few if any bad vehicles out there; so, the showrooms need to be fresh as awareness leads to consideration and then – it’s hoped – purchase or lease.

Of that total, 33 models (31%) will launch between now and the end of the year, much higher than last year’s total of 19 during the same period. Such a concerted level of product activity puts pressure not only on the vehicle manufacturers, but also on the suppliers who provide content across multiple automakers and vehicle programs., Renna observes.

Consider GM. While already in the process of ramping up the all-important next generations of the Chevrolet Silverado and GMC Sierra Light Duty at its Fort Wayne plant, the OEM is also launching the new Cadillac XT4 this month and will begin production of the reinvented Chevrolet Blazer at Ramos Arizpe by the end of the year. Factor in the facelifts to the Chevrolet Camaro, Cruze and Malibu and it promises to be a busy few months for GM.

While obviously smaller than regional powerhouse GM, Daimler, too, will have a challenging year-end period, with key vehicle launches at new plants to produce the A-Class, as well as the start of full production of the redesigned Sprinter Van at a new North American facility. The model is currently fully built in Germany and reassembled locally as a way of circumventing the Chicken Tax. All this while Daimler also puts in place a contingency plan, given its high exposure to import and export tariffs.

And this is just a snapshot of a couple of the players in the region. Others, such as Ford, Toyota and Renault-Nissan-Mitsubishi, will face similar challenges in the short term.

“The final months of the year will certainly be extremely demanding,” says LMC., particularly with a cloud of uncertainty hanging over the industry. On the flipside, with so many new and refreshed vehicles on offer, consumers should reap the benefits of this flurry of activity.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Don’t Like Change? Avoid the Auto Biz

Constant freshenings: It is simply the price of the ante’ needed to play the next model year in a multi, multi-billion competitive poker game.

It’s true that we have devoted a fair amount of space at AutoInformed on connected vehicles, autonomous ones, and the large investments to make the current dream or is that nightmare of automakers come to fruition. However, while vehicle manufacturers and suppliers are pursuing such capital-intensive projects, the core business – new products in the showroom is proceeding apace.

Industry stakeholders will be further challenged over the next 17 months as numerous critical new vehicle launches will add to the strain of an already stressed industry,” says Bill Rinna, in charge of Americas Vehicle Forecasts at LMC Automotive.

LMC predicts 105 all-new, redesigned and face-lifted model launches at plants over that time-frame – an average of six a month – as automakers freshen and fill white spaces (translation more crossover SUVs) in showrooms, localized production of previously imported models because of trade and currency and market relevancy issues and keep current models fresh in look and electronics.

It is simply the price of the ante’ needed to play the next model year in a multi, multi-billion competitive poker game. There’s no liar’s hand here. There are few if any bad vehicles out there; so, the showrooms need to be fresh as awareness leads to consideration and then – it’s hoped – purchase or lease.

Of that total, 33 models (31%) will launch between now and the end of the year, much higher than last year’s total of 19 during the same period. Such a concerted level of product activity puts pressure not only on the vehicle manufacturers, but also on the suppliers who provide content across multiple automakers and vehicle programs., Renna observes.

Consider GM. While already in the process of ramping up the all-important next generations of the Chevrolet Silverado and GMC Sierra Light Duty at its Fort Wayne plant, the OEM is also launching the new Cadillac XT4 this month and will begin production of the reinvented Chevrolet Blazer at Ramos Arizpe by the end of the year. Factor in the facelifts to the Chevrolet Camaro, Cruze and Malibu and it promises to be a busy few months for GM.

While obviously smaller than regional powerhouse GM, Daimler, too, will have a challenging year-end period, with key vehicle launches at new plants to produce the A-Class, as well as the start of full production of the redesigned Sprinter Van at a new North American facility. The model is currently fully built in Germany and reassembled locally as a way of circumventing the Chicken Tax. All this while Daimler also puts in place a contingency plan, given its high exposure to import and export tariffs.

And this is just a snapshot of a couple of the players in the region. Others, such as Ford, Toyota and Renault-Nissan-Mitsubishi, will face similar challenges in the short term.

“The final months of the year will certainly be extremely demanding,” says LMC., particularly with a cloud of uncertainty hanging over the industry. On the flipside, with so many new and refreshed vehicles on offer, consumers should reap the benefits of this flurry of activity.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.