A self-administered injection of economic Bubonic Plague?!?

Our friends at LMC Automotive consultancy write that if there are no significant changes to Brexit-related legislation in the UK Parliament between now and 29 March, the automatic operation of law will see the UK leave the EU, with or without a deal.

“The politics appear impossible to predict, but we can examine some aspects of a no-deal scenario, which is no longer unlikely. Our newly launched European Light Vehicle Trade Flow Forecast reveals where some of the biggest risks lie,” said LMC.

If the UK leaves the EU without a deal, then the LMC assumption would be that vehicles exported to the EU from the UK would be subject to a tariff of 10% as the UK would, by then, have become a ‘third country’ under EU trade rules.

“It is hard to imagine that the UK would not impose the same level of tariffs on vehicles imported from the EU. For an industry which, for many OEMs, sustainably operating above a 5% profit margin is difficult, this would be unwelcome,” LMC notes with classic British understatement.

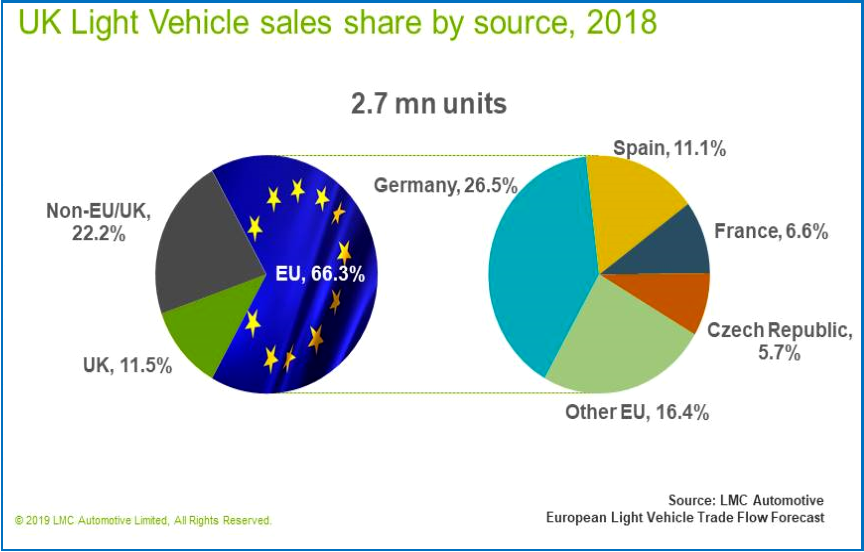

This is simple math if complicated politics: Because there is not enough margin to absorb much of the tariff-related increase, prices would rise, eventually. Around two-thirds of UK demand is sourced from EU countries, so a significant pass-through of tariffs on those vehicles would lead to a price-driven loss in UK market volume in the region of 4%, LMC predicts.

At 2018 market levels, lost volume associated with EU imports would therefore be around 100,000 units, and this would persist until the UK and EU successfully negotiated a free trade agreement, which could bring down, or completely remove, tariffs, notes LMC.

However, it’s murky as to what tariffs might be applied to UK imports from outside the EU in practice, though world trade norms imply that any tariffs imposed on EU-sourced vehicles would also have to be applied to countries without a free trade agreement with a non-EU UK (which is currently 100% of them).

“So, the tariff impact could broaden to cover the approximately 20% of non-EU Light Vehicle imports to the UK market, bringing the total lost volume to an estimated 130,000 vehicles,” predicts LMC.

Also note that other devastating impacts – such as a macroeconomic slowdown in the UK, and a further devaluation of sterling, also impacting vehicle pricing – are virtually inevitable after a no-deal exit.

“These effects could be at least as significant to volume,” warns LMC.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Doomsday? No-Deal Brexit Impact on UK Light Vehicle Market

A self-administered injection of economic Bubonic Plague?!?

Our friends at LMC Automotive consultancy write that if there are no significant changes to Brexit-related legislation in the UK Parliament between now and 29 March, the automatic operation of law will see the UK leave the EU, with or without a deal.

“The politics appear impossible to predict, but we can examine some aspects of a no-deal scenario, which is no longer unlikely. Our newly launched European Light Vehicle Trade Flow Forecast reveals where some of the biggest risks lie,” said LMC.

If the UK leaves the EU without a deal, then the LMC assumption would be that vehicles exported to the EU from the UK would be subject to a tariff of 10% as the UK would, by then, have become a ‘third country’ under EU trade rules.

“It is hard to imagine that the UK would not impose the same level of tariffs on vehicles imported from the EU. For an industry which, for many OEMs, sustainably operating above a 5% profit margin is difficult, this would be unwelcome,” LMC notes with classic British understatement.

This is simple math if complicated politics: Because there is not enough margin to absorb much of the tariff-related increase, prices would rise, eventually. Around two-thirds of UK demand is sourced from EU countries, so a significant pass-through of tariffs on those vehicles would lead to a price-driven loss in UK market volume in the region of 4%, LMC predicts.

At 2018 market levels, lost volume associated with EU imports would therefore be around 100,000 units, and this would persist until the UK and EU successfully negotiated a free trade agreement, which could bring down, or completely remove, tariffs, notes LMC.

However, it’s murky as to what tariffs might be applied to UK imports from outside the EU in practice, though world trade norms imply that any tariffs imposed on EU-sourced vehicles would also have to be applied to countries without a free trade agreement with a non-EU UK (which is currently 100% of them).

“So, the tariff impact could broaden to cover the approximately 20% of non-EU Light Vehicle imports to the UK market, bringing the total lost volume to an estimated 130,000 vehicles,” predicts LMC.

Also note that other devastating impacts – such as a macroeconomic slowdown in the UK, and a further devaluation of sterling, also impacting vehicle pricing – are virtually inevitable after a no-deal exit.

“These effects could be at least as significant to volume,” warns LMC.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.