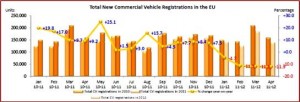

Four months into 2012, the commercial vehicle sales downturn continued its negative trend (-10.1%) as all major markets shrank.

In April, commercial vehicle sales in the EU decreased by 11.9% in what was an across the board decline, ACEA said this morning in Brussels. New registrations fell by 1.2% in France, 1.6% in Germany, 13.3% in the UK, 28.9% in Spain and 38.6% in Italy, according to the trade group comprised of European vehicle manufacturers.

Unlike the car market in Europe, which is in its fifth straight year of declining sales year-over-year, the commercial vehicle market was posting small gains until about a year ago. The declines since then are an ominous sign that EU economic problems are deepening as voters are turning out existing governments and demanding economic stimulus packages from new or surviving ruling elites. Expanding debt ridden national economies has thus far have been resisted mostly by the German government, which has a relatively stronger economy with manageable debt keeping it in power for the moment. The EU commission in Brussels is insisting that debt be kept as a small percentage of actual GDP, creating a viscous cycle where spending cuts contracts the economy, creating the need for great spending cuts.

Four months into 2012, the commercial vehicle sales downturn continued its negative trend (-10.1%) as all major markets shrank. France remained the largest market, despite a 4.7% contraction, followed by Germany (-1.2%) and the UK (-9.8%). Spain (-24.1%) and Italy (-36.7%) recorded more severe drops. In total, 589,987 vehicles were registered throughout the period.

This is more trouble for virtually all European automakers and daunting news for Fiat, Ford Motor, and General Motors stakeholders as losses mount with no end in sight.

In April, vans weighing less than 3.5 tons, such as the Ford Transit, posted the largest drop (-13.3%), at 110,573 units. While the French market (-0.5%) and the German (-1.9%) were relatively stable, the British (-19.8%), Spanish (-30.4%) and Italian (-38.3%) posted what could only be called disastrous results. From January to April, the EU registered 479,456 new vans, or 11.7% fewer than in the same period a year ago. Looking at the major markets, downturn ranged from -0.4% in Germany to -5.2% in France, -15.7% in the UK, -23.8% in Spain and -37.8% in Italy.

In April, 18,930 new heavy trucks were registered or -7% fewer y-o-y. Performances varied across countries as Germany (+3.5%) and the UK (+11.8%) posted growth, whereas France (-6.8%), Spain (-13.6%) and Italy (-41.1%) saw declines. Four months into the year, new heavy truck registrations were down -4.2%, amounting to 75,189 units. The largest markets, Germany (-1.2%) and France (-1.4%) contracted the least. Spain (-19.9%) and Italy (-23.8%) experienced more significant downturns, while the UK was the only market to post growth (+14.7%).

Results in the truck segment varied in April, as Italy (-44.4%), Spain (-13.9%) and France (-5.8%) performed less well than last year, while the German market remained stable and the British expanded (+17.2%). In total, 25,447 new trucks were registered, or -6.9% less than in April 2011. Cumulative results from January to April were also dropped, leading to an overall -3.6% decline in the EU, at 100,133 new trucks. The French market stayed unchanged, while the German slightly declined (-3.2%) although it remained the largest market. Spain (-21.4%) and Italy (-28.3%) contracted more sharply.

In April, buses and coaches were once again the only segment to record slightly positive results (+0.6%), mainly driven by the British market (+13.3%). From January to April, it posted a strong 52.1% upturn, while all others declined, except for the German (+6.7%). Both markets contributed to sustaining demand, leading to an overall 4.9% growth of the segment that totaled 10,398 units.