In May Hyundai exported its 5 millionth vehicle since imports to Europe began in 1977. The South Korean automaker is planning to almost double its market share in Europe to 5% in 2013. GM Daewoo is another big winner under the EU-South Korea FTA.

Last month, the so-called EU-South Korea Free Trade Agreement (FTA) was signed over the objections of European automakers, marking a turning point between the two economies. The trade deal removes the 8% duty on European cars imported into South Korea and 10% duties on Korean auto exports, among other sweeping provisions. Korea will also no longer allow non-tariff barriers requiring the further testing or homologation for imported European cars.

The deal is significant because the European Union is South Korea’s largest trading partner, with the bilateral trade increasing to €63.6 billion (~$90.2 b) in 2010, a 17% increase from €54.3 billion in 2009 in spite of Europe’s ongoing Great Recession. In the first two weeks of the agreement, overall trade increased about equally among the signers.

However, under current market conditions, this waiver of tariffs will not balance the current €10.7 billion trade deficit in automobiles, according to the respected consultancy Frost & Sullivan.

This is because in 2010 European automakers sold about 32,000 cars in South Korea, while South Korea exported more than 400,000 vehicles to Europe, says Frost & Sullivan Senior Research Analyst Prana Tharthiharan Natarajan in a study released today, and likely prepared for an automaker or trade group.

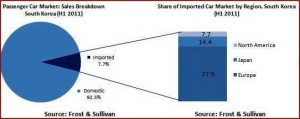

The South Korean market is less favorable for European mass-market cars to gain sufficient volume to profitably compete with the domestic brands, according to Natarajan. Even though three out of every four foreign cars sold in South Korea is of European origin, the tiny European volumes do not come anywhere near to addressing the imbalance.

Korea ranks at the very bottom — 30 out of 30 among the largest automotive markets — for auto market access, according to Ford Motor. The average among major developed economies is 40% market penetration by imported automobiles, but in Korea, the total of import vehicles from all global manufacturers in all countries entering the Korean market is around 8%. This is about 90,000 vehicles in a market that buys more than one million vehicles annually.

Natarajan suggests that European luxury car makers have a better chance in Korea. Year-to-date sales numbers show luxury cars account for 15% of the volume in the South Korean passenger car market, of a total imported car market heading towards 100,000 units this year.

German luxury car makers BMW and Mercedes-Benz have introduced discounts of about 1-1.5% on their best-selling models in South Korea, promising steeper markdown on prices, later this year.

“Frost & Sullivan estimates the combined sales of BMW, Audi and Mercedes-Benz to reach close to 60,000 units in South Korea by the end of 2011,” Natarajan continues. “And the South Korean luxury car market is expected to double over the next decade.”

No wonder then Ford of Europe – without a luxury or a near luxury brand – criticized the proposed Korean trade agreement on the eve of its adoption, which in a slightly different form is also controversial in the U.S. (Fiat and ACEA the European automakers trade group have also some out against the agreement.)

“The EU-Korea FTA was not equitably balanced, and despite some late additional amendments, we’re concerned that they will not be strong enough to provide adequate access to the Korean market for European-based OEMs,” John Gardner from Ford told AutoInformed.

“South Korea is poised to possess the upper hand as the first Asian country to have the opportunity to trade with the world’s largest economic bloc,” concludes Natarajan. “The slashing of import duty provides South Korean automakers with two options: either to offer a C-segment car at a B-Segment price band, or to pack more features into a car, so that a fully loaded South Korean car outweighs the no-frills variant of European make. The trade pact marks the beginning of a new era – one of flooding European roads with South Korean cars, and more affordable luxury cars for South Koreans.”

Despite this warning Ford in the U.S. still supports a pending Korean FTA, which is opposed by all major U.S. unions except for the United Autoworkers, and is opposed by Korean unions as well. A Ford spokesperson said the conflicting positions arise from a key difference in that the U.S. deal is “far better structured, hence we’re offering support to the U.S.-Korea FTA.” (See Korean Free Trade Agreement gets UAW, Ford Support)

The Obama Administration has been unable to bring the Korean FTA before the U.S. Congress thus far because of fierce union opposition in the face of the ongoing Great Recession and record numbers of long-term unemployed workers. (See also Korean Automakers Post Huge U.S. Sales Gains as Disputed Free Trade Agreement Heads for Congressional Approval and UAW Defends Korean FTA as Other Unions Protest Deal and AFL-CIO Rejects Korean FTA. New Trade Policy Called For and Korean Free Trade Agreement gets UAW, Ford Support and EU Proposes Banning Cars from Cities. Automakers Protest)