AutoData said the seasonally adjusted annual rate (SAAR) was 13.8 million units in May, putting it under the 14 million mark for the first time in 2012. Sales for all brands unadjusted for days rose 25.7% y-o-y and 13.4% ytd.

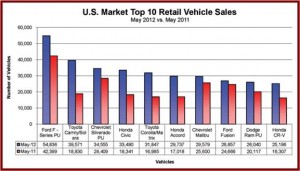

Five of the Top Ten selling vehicles in the U.S. during May came from the Detroit Three as strong pickup truck sales continued and the Chevrolet Malibu and Ford Fusion had solid months.

As it has for 30 years, the F-150 led the list, and strong sales of the Chevrolet Silverado allowed it to nudge Honda out of third place with the Toyota Camry still in second place as it was in April. The Dodge Ram also reappeared in the Top Ten for the first time since February. All of the other spots were taken by Honda and Toyota, each with three models in the Top Ten.

Offshore brands maintained their lead in the U.S. auto market, holding to 54.5% of all vehicles sold in the United States last month with sales of 727,607, according to AutoData. Asian automakers held a 45.5% share, up slightly from 45.3% in April and up 40.7% from production disrupted last May. They sold 605,570 units, up from 536,069 in April. For the year-to-date, Asians are up 46%.

European brands sold 122,037 units, up from 118,017 last month, with a 9.3 percent improvement for the year to date. They held a 9.1 percent share of the market, however, a slight decrease from their 10% share ytd. Domestic brands finished the month with a 45.5% share of the market and sales of 606,993 units.

“Despite disappointing jobs numbers, Americans are still buying new cars,” said AIADA President Cody Lusk. “A combination of new models, low gas prices, and pent up demand are driving sales.”