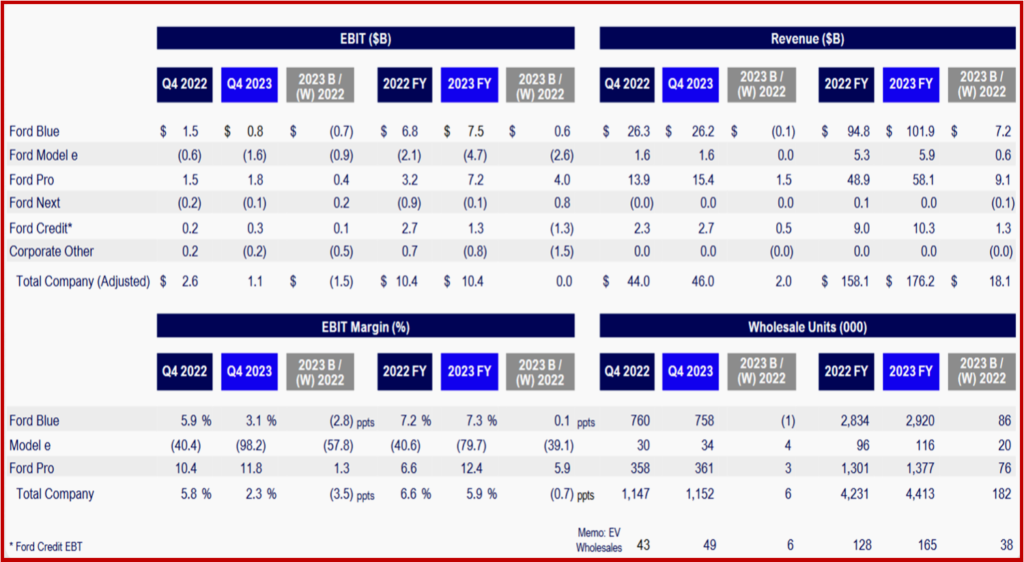

Ford Motor (NYSE: F) posted fourth-quarter 2023 revenue of $46 billion, an increase of 4% from the same period a year ago on comparable vehicle volumes. However, a net loss of $526 million in the period was attributable to a $1.7 billion pretax, non-cash accounting loss related to the re-measurement of pension and other post-retirement employee benefits plans. Adjusted earnings before interest and taxes, or EBIT, totaled $1.1 billion. For full-year 2023, revenue was up 11% to $176 billion. Net income improved year-over-year to $4.3 billion; adjusted EBIT of $10.4 billion was essentially flat year-over-year and at the high end of guidance that Ford provided following ratification of its new contracts with the UAW in the US and Unifor in Canada.

CFO John Lawler said that Ford’s robust cash flow and disciplined capital allocation enable vital investments in Ford+ while also returning value to shareholders – targeting distributions of 40% to 50% of adjusted free cash flow. Ford declared a first-quarter regular dividend of 15 cents per share and a supplemental dividend of 18 cents per share. The dividends are payable March 1 to shareholders of record at the close of business on Feb. 16. Lawler said that Ford “will improve capital efficiency by both selectively reducing investments and raising the bar on expected returns for initiatives that the company greenlights.”

Click for more.

Profitability and cash flow from outside North America in 2023 represented a positive change from a combined loss of about~$2 billion in 2020. The improvement in those markets Ford claimed reflected benefits from lower capital approaches in China and elsewhere, and continued strength of the Ranger mid-size pickup and Everest SUV.

Operating cash flow was $14.9 billion for all of 2023. Free cash flow (FCF) of $6.8 billion was better than the company’s outlook of $5.0 billion to $5.5 billion. Ford’s balance sheet remains strong, with nearly $29 billion in cash and more than $46 billion in liquidity at the end of the year.

The outlook for full-year 2024 includes adjusted EBIT of $10 billion to $12 billion, adjusted FCF of $6 billion to $7 billion, and capital spending of $8 billion to $9.5 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Ford Motor Posts 2023 Net Income of $4.3 Billion

Ford Motor (NYSE: F) posted fourth-quarter 2023 revenue of $46 billion, an increase of 4% from the same period a year ago on comparable vehicle volumes. However, a net loss of $526 million in the period was attributable to a $1.7 billion pretax, non-cash accounting loss related to the re-measurement of pension and other post-retirement employee benefits plans. Adjusted earnings before interest and taxes, or EBIT, totaled $1.1 billion. For full-year 2023, revenue was up 11% to $176 billion. Net income improved year-over-year to $4.3 billion; adjusted EBIT of $10.4 billion was essentially flat year-over-year and at the high end of guidance that Ford provided following ratification of its new contracts with the UAW in the US and Unifor in Canada.

CFO John Lawler said that Ford’s robust cash flow and disciplined capital allocation enable vital investments in Ford+ while also returning value to shareholders – targeting distributions of 40% to 50% of adjusted free cash flow. Ford declared a first-quarter regular dividend of 15 cents per share and a supplemental dividend of 18 cents per share. The dividends are payable March 1 to shareholders of record at the close of business on Feb. 16. Lawler said that Ford “will improve capital efficiency by both selectively reducing investments and raising the bar on expected returns for initiatives that the company greenlights.”

Click for more.

Profitability and cash flow from outside North America in 2023 represented a positive change from a combined loss of about~$2 billion in 2020. The improvement in those markets Ford claimed reflected benefits from lower capital approaches in China and elsewhere, and continued strength of the Ranger mid-size pickup and Everest SUV.

Operating cash flow was $14.9 billion for all of 2023. Free cash flow (FCF) of $6.8 billion was better than the company’s outlook of $5.0 billion to $5.5 billion. Ford’s balance sheet remains strong, with nearly $29 billion in cash and more than $46 billion in liquidity at the end of the year.

The outlook for full-year 2024 includes adjusted EBIT of $10 billion to $12 billion, adjusted FCF of $6 billion to $7 billion, and capital spending of $8 billion to $9.5 billion.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.