The Global Light Vehicle selling rate improved to 61.5 mn for May, from 49 mn in April, reflecting then easing lockdown measures, according to respected consultancy LMC. The global selling rate is now predicted to reach the 80 mn units/year mark towards the end of 2020 down from 90.3m, assuming there is no major second wave of COVID-19.

The Global Light Vehicle selling rate improved to 61.5 mn for May, from 49 mn in April, reflecting then easing lockdown measures, according to respected consultancy LMC. The global selling rate is now predicted to reach the 80 mn units/year mark towards the end of 2020 down from 90.3m, assuming there is no major second wave of COVID-19.

This now looks like a long shot to AutoInformed with the US leading the way in spreading new infections and fatalities from the maskless and clueless Trump misadministration. In the US, a repetition of the ‘cash for clunkers’ scheme could potentially lift sales, “but this has yet to be fully debated or agreed,” says LMC.

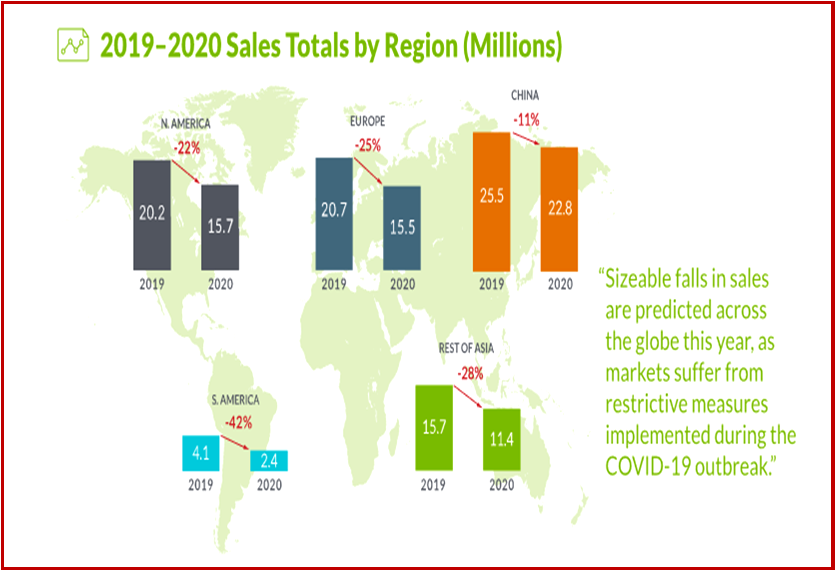

The world’s largest vehicle market, China will see relatively lower year-on-year fall in sales, “having dealt with the virus swiftly and efficiently,” says LMC. The selling rate in China bounced back at 26 million units/year for May, demonstrating a strong V-shaped recovery. There was no central government support beyond incentives already in place.

South America sales are forecast to fall 42%, with the region’s largest market, Brazil, being heavily affected by the pandemic and sharp economic contraction.

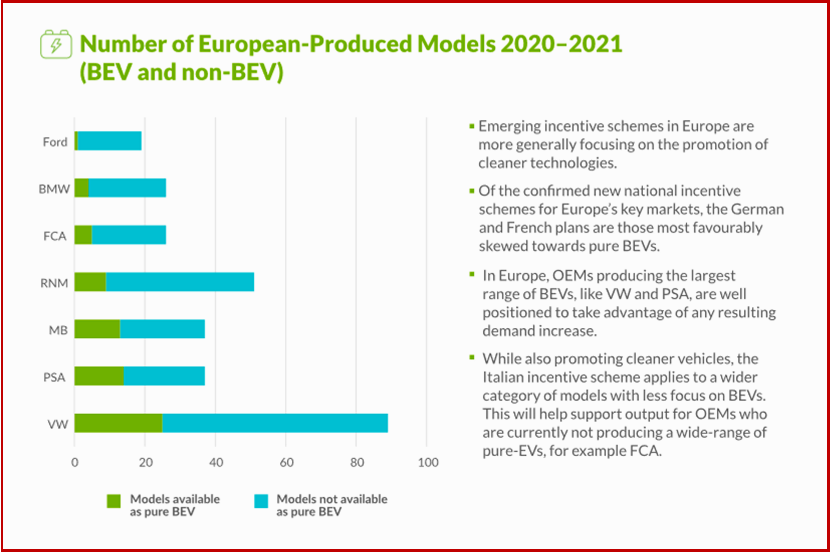

“European outlook for this year remains weak, though some support from government will come in the form of incentives — often with an EV focus,” says LMC. “Emerging incentive schemes in Europe are generally focusing on the promotion of cleaner technologies. Of the confirmed new national incentive schemes for Europe’s key markets, the German and French plans are those most favorably skewed towards pure BEVs.

“In Europe, OEMs producing the largest range of BEVs, such as VW and PSA, are well positioned to take advantage of any resulting demand increase. While also promoting cleaner vehicles, the Italian incentive scheme applies to a wider category of models with less focus on BEVs. This will help support output for OEMs who are currently not producing a wide-range of pure-EVs, for example FCA whose home market is Italy.

“In many of their aims, central banks have succeeded. Financial markets have stabilised, equity markets have quickly recovered, and spreads have narrowed again. The corporate sector has resorted to new issuance on a generous scale. Even so, many challenges lie ahead. Financial markets may have become too complacent – given that we are still at an early stage of the crisis and its fallout. The outlook for the world economy is still highly uncertain. At best, we have only just overcome the liquidity phase of the crisis in the countries that are now relaxing restrictions. In many others, the health crisis is still acute. And the epidemic could flare up again anywhere,” says Agustín Carstens, General Manager of the Bank for International Settlements.