General Motors Co. (NYSE: GM) is holding its 2nd Annual Global Business Conference today in Warren, Mich., CEO Dan Akerson opened the conference with some gallows humor as investors are panicked over the global economic outlook, and sent GM stock trading under $25, well below its IPO price of $33 last fall – and way off its $39.48 high since GM emerged from bankruptcy and resumed public trading last November.

Akerson said it’s a good thing GM had a strong Q2 otherwise the share price would be a lot uglier. (See General Motors Post Q2 Earnings of $2.5 Billion. Most from N.A.)

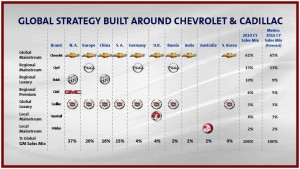

Akerson reaffirmed a dual global brand strategy – Chevrolet as the value brand, and Cadillac as a premium brand. Chevrolet had good results in the first half of 2011 – 2.35 million units with sale gains in all of its major markets. Cadillac presents a difficult challenge since it’s hardly international, and Akerson readily admits that “we have a lot of work to do.”

Cadillac will expand its model lineup in 2012 with a new entry in the compact luxury segment codenamed ATS. GM’s luxury division will also introduce a new large XTS sedan. Both cars are derived from current GM large and small car architectures. Cadillac will also start production in China during the Q4 of 2012, the world’s largest car market, and one that GM is the number one automaker in.

Cadillac sales declined sharply in the U.S. during July, with disappointing total sales of 11,119, a 26% decrease compared to last July as its aging vehicle line was affected by increased incentives from German brands and Ford’s Lincoln near luxury line. Both of the new Cadillac models are aimed squarely at German luxury offerings which are global in scope. Cadillac remains a regional brand. (See Cadillac to Introduce New Small and Large Cars in 2012)

During the program, senior leaders reviewed GM’s progress and outline plans for further improvement. In a sense GM is playing a “beat the reaper” game – can GM increase share and sales of less profitable small cars such as the Chevrolet Sonic, which is just entering production, at a greater rate than the drop off in truck sales and larger per unit profits in North America, while growing in Eastern Europe, South America and Asia?

On a cost cutting side one program with great promise involves vehicle architectures. Akerson said “We need to simplify.” The company said that by 2018 it plans to cut that number to 14 from the 30 currently in use.