Click for more.

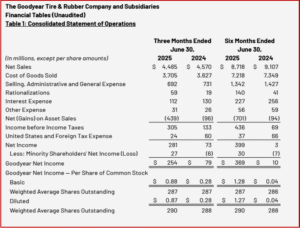

The Goodyear Tire & Rubber Company (NASDAQ: GT) today posted a Q2 2025 loss of $48 million compared to a net income of $48 million in Q2 of 2024. Goodyear during H1 2025 had net sales of $8.7 billion, with tire unit volumes totaling 76.4 million. Goodyear net income was $369 million ($1.27 per share) compared to Goodyear net income of $10 million (4 cents per share) a year ago. Goodyear’s first six months 2025 saw net sales of$8.7 billion, with tire unit volumes totaling 76.4 million. Goodyear net income was $369 million ($1.27 per share) compared to Goodyear net income of $10 million (4 cents per share) a year ago. Nonetheless, the stock market punished the stock dropping it ~17% from the previous day closing as the impending Trump tariff recession appears to be underway. Tariff costs at Goodyear are now estimated at, gulp, $350,000,000 for 2025.

“The second quarter proved challenging in both our consumer and commercial businesses, driven by industry disruption stemming from shifts in global trade – including a surge of low-cost imports across our key markets,” said Mark Stewart, Goodyear CEO. “We expect conditions to stabilize in the coming quarters, and we see clear opportunity ahead as we capitalize on our strong U.S. manufacturing footprint. We continue to expect to exceed the original goals for Goodyear Forward both in terms of cost savings and proceeds from asset sales.

“Year-to-Date Results

Click for more.

Goodyear’s first six months 2025 net sales were $8.7 billion, with tire unit volumes totaling 76.4 million. Goodyear H1 net income was $369 million ($1.27 per share) compared to Goodyear net income of $10 million (4 cents per share) a year ago. The first six months of 2025 included several substantial items including, on a pre-tax basis, a combined estimated gain on the sales of the OTR tire business and the Dunlop Brand of $645 million, rationalization charges of $140 million and Goodyear Forward [the restructuring plan] costs of $11 million. The first six months of 2024 included, on a pre-tax basis, rationalization charges of $41 million and Goodyear Forward costs of $67 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.

Goodyear H1 adjusted net loss was $59 million compared to adjusted net income of $65 million in the prior year. Adjusted earnings per share was a loss of $0.21, compared to earnings of $0.23 in the prior year. Per share amounts are diluted.

The company reported segment operating income of $354 million in the first six months of 2025, compared to $574 million a year ago. After adjusting for the sale of its OTR tire business, which was completed in February 2025, segment operating income declined $185 million, driven by higher raw materials. Segment operating income reflects unfavorable net price/mix versus raw material costs of $193 million, inflation and other costs of $179 million, non-recurrence of the 2024 net insurance recoveries of $52 million, and lower tire volume of $70 million. These headwinds were partially offset by benefits from Goodyear Forward of $395 million.

“While short term outlook definitely remains turbulent given the industry environment broadly, we’re staying very focused on what we can control and what we continue to deliver,” said Stewart on the earnings call this morning. “We’re continuing to execute ahead of schedule on Goodyear Forward. [the restructuring plan] We’re continuing to take the right cost control actions. We’re taking smart pricing actions in the marketplaces.

“And we’re gaining share in the profitable premium segments of the market. We continue to sharpen that portfolio and at the same time strengthen our balance sheet as we’ve shared. We’re really focused again on refreshing the existing product lines, bringing the new power lines into the market, into the premium spaces. And despite these near-term headwinds, I am very confident as the market stabilizes, our momentum will return. The Goodyear team is committed to execution and delivering results.” said Stewart, CEO and President, Goodyear.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Goodyear Posts H1 2025 Loss of $59 million

Click for more.

The Goodyear Tire & Rubber Company (NASDAQ: GT) today posted a Q2 2025 loss of $48 million compared to a net income of $48 million in Q2 of 2024. Goodyear during H1 2025 had net sales of $8.7 billion, with tire unit volumes totaling 76.4 million. Goodyear net income was $369 million ($1.27 per share) compared to Goodyear net income of $10 million (4 cents per share) a year ago. Goodyear’s first six months 2025 saw net sales of$8.7 billion, with tire unit volumes totaling 76.4 million. Goodyear net income was $369 million ($1.27 per share) compared to Goodyear net income of $10 million (4 cents per share) a year ago. Nonetheless, the stock market punished the stock dropping it ~17% from the previous day closing as the impending Trump tariff recession appears to be underway. Tariff costs at Goodyear are now estimated at, gulp, $350,000,000 for 2025.

“The second quarter proved challenging in both our consumer and commercial businesses, driven by industry disruption stemming from shifts in global trade – including a surge of low-cost imports across our key markets,” said Mark Stewart, Goodyear CEO. “We expect conditions to stabilize in the coming quarters, and we see clear opportunity ahead as we capitalize on our strong U.S. manufacturing footprint. We continue to expect to exceed the original goals for Goodyear Forward both in terms of cost savings and proceeds from asset sales.

“Year-to-Date Results

Click for more.

Goodyear’s first six months 2025 net sales were $8.7 billion, with tire unit volumes totaling 76.4 million. Goodyear H1 net income was $369 million ($1.27 per share) compared to Goodyear net income of $10 million (4 cents per share) a year ago. The first six months of 2025 included several substantial items including, on a pre-tax basis, a combined estimated gain on the sales of the OTR tire business and the Dunlop Brand of $645 million, rationalization charges of $140 million and Goodyear Forward [the restructuring plan] costs of $11 million. The first six months of 2024 included, on a pre-tax basis, rationalization charges of $41 million and Goodyear Forward costs of $67 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.

Goodyear H1 adjusted net loss was $59 million compared to adjusted net income of $65 million in the prior year. Adjusted earnings per share was a loss of $0.21, compared to earnings of $0.23 in the prior year. Per share amounts are diluted.

The company reported segment operating income of $354 million in the first six months of 2025, compared to $574 million a year ago. After adjusting for the sale of its OTR tire business, which was completed in February 2025, segment operating income declined $185 million, driven by higher raw materials. Segment operating income reflects unfavorable net price/mix versus raw material costs of $193 million, inflation and other costs of $179 million, non-recurrence of the 2024 net insurance recoveries of $52 million, and lower tire volume of $70 million. These headwinds were partially offset by benefits from Goodyear Forward of $395 million.

“While short term outlook definitely remains turbulent given the industry environment broadly, we’re staying very focused on what we can control and what we continue to deliver,” said Stewart on the earnings call this morning. “We’re continuing to execute ahead of schedule on Goodyear Forward. [the restructuring plan] We’re continuing to take the right cost control actions. We’re taking smart pricing actions in the marketplaces.

“And we’re gaining share in the profitable premium segments of the market. We continue to sharpen that portfolio and at the same time strengthen our balance sheet as we’ve shared. We’re really focused again on refreshing the existing product lines, bringing the new power lines into the market, into the premium spaces. And despite these near-term headwinds, I am very confident as the market stabilizes, our momentum will return. The Goodyear team is committed to execution and delivering results.” said Stewart, CEO and President, Goodyear.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.