Click for more.

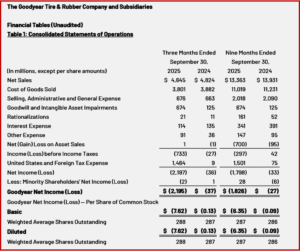

The Goodyear Tire & Rubber Company (NASDAQ:GT)* posted Q3 2025 results today that showed a net loss of $2.2 billion ($7.62 per share) compared to a Goodyear net loss of $37 million (13 cents per share) a year ago. Third quarter 2025 adjusted net income was $82 million compared to adjusted net income of $102 million in Q3 of last year. Adjusted earnings per share was $0.28, compared to $0.36 (diluted) in Q3 2024.

“We delivered a meaningful increase in segment operating income relative to the second quarter in an industry environment that continued to be marked by global trade disruption,” said Mark Stewart, chief executive officer and president. “This growth underscores our strong product portfolio and the consistency of our execution under the Goodyear Forward plan, both of which we expect to support further acceleration in our earnings during the fourth quarter.”

Goodyear’s Q3 2025 net sales were $4.6 billion, with tire unit volumes totaling 40 million. The third quarter of 2025 included several significant items, including a non-cash deferred tax asset valuation allowance of $1.4 billion, a non-cash goodwill impairment charge of $674 million and, on a pre-tax basis, rationalization charges of $21 million and Goodyear Forward [the restructuring plan in standard English – Autocrat] costs of $8 million. Including these items, Goodyear net loss was $2.2 billion ($7.62 per share) compared to Goodyear net loss of $37 million (13 cents per share) a year ago.

The third quarter of 2024 included, on a pre-tax basis, Goodyear Forward costs of $25 million and rationalization charges of $11 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.

Segment Results

The company reported segment operating income of $287 million in Q3 of 2025, compared to $346 million a year ago. After adjusting for the sale of its Off-the-Road (OTR) tire business, segment operating income declined $49 million. The change in segment operating income reflects benefits from Goodyear Forward of $185 million, partly offset by inflation and other costs of $137 million, the impact of lower volume of $90 million, and $17 million for the non-recurrence of the 2024 insurance recoveries, net of expenses.

Goodyear Forward

Goodyear Forward delivered benefits of $185 million during the third quarter of 2025. The company expects to achieve approximately $1.5 billion of annualized run-rate benefits by year-end 2025.

Additionally, on 31 October, Goodyear completed the previously announced $650 million sale of its Chemical business for cash proceeds of $580 million, net of working capital adjustments, including an adjustment for inter-company receivables, before transaction fees and taxes. The sale of the Chemical business followed the divestitures of the OTR tire business and the Dunlop brand earlier in the year. Total proceeds of approximately $2.2 billion will be used to reduce the company’s debt balance.

Year-to-Date Results

Goodyear’s first nine months 2025 net sales were $13.4 billion, with tire unit volumes totaling 116.4 million. The first nine months of 2025 included several significant items, including a non-cash deferred tax asset valuation allowance of $1.4 billion, a non-cash goodwill impairment charge of $674 million and, on a pre-tax basis, a combined estimated gain on the sales of the OTR tire business and the Dunlop brand of $640 million, rationalization charges of $161 million and Goodyear Forward costs of $19 million. Goodyear net loss was $1.8 billion ($6.35 per share) compared to Goodyear net loss of $27 million (9 cents per share) a year ago.

The first nine months of 2024 included, on a pre-tax basis, Goodyear Forward costs of $92 million and rationalization charges of $52 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.

First nine months 2025 adjusted net income was $23 million compared to adjusted net income of $168 million in the prior year. Adjusted earnings per share was $0.08, compared to $0.58 in the prior year.

The company reported segment operating income of $641 million in the first nine months of 2025, compared to $920 million a year ago. After adjusting for the sale of its OTR tire business, which was completed in February 2025, segment operating income declined $234 million, driven by higher raw materials and lower volume. Segment operating income reflects benefits from Goodyear Forward of $580 million, inflation and other costs of $316 million, the impact of lower volume of $193 million, unfavorable net price/mix versus raw material costs of $174 million, and non-recurrence of the 2024 insurance recoveries, net of expenses, of $69 million.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Goodyear Tire Posts Q3 2025 Loss of $2.2 Billion

Click for more.

The Goodyear Tire & Rubber Company (NASDAQ:GT)* posted Q3 2025 results today that showed a net loss of $2.2 billion ($7.62 per share) compared to a Goodyear net loss of $37 million (13 cents per share) a year ago. Third quarter 2025 adjusted net income was $82 million compared to adjusted net income of $102 million in Q3 of last year. Adjusted earnings per share was $0.28, compared to $0.36 (diluted) in Q3 2024.

“We delivered a meaningful increase in segment operating income relative to the second quarter in an industry environment that continued to be marked by global trade disruption,” said Mark Stewart, chief executive officer and president. “This growth underscores our strong product portfolio and the consistency of our execution under the Goodyear Forward plan, both of which we expect to support further acceleration in our earnings during the fourth quarter.”

Goodyear’s Q3 2025 net sales were $4.6 billion, with tire unit volumes totaling 40 million. The third quarter of 2025 included several significant items, including a non-cash deferred tax asset valuation allowance of $1.4 billion, a non-cash goodwill impairment charge of $674 million and, on a pre-tax basis, rationalization charges of $21 million and Goodyear Forward [the restructuring plan in standard English – Autocrat] costs of $8 million. Including these items, Goodyear net loss was $2.2 billion ($7.62 per share) compared to Goodyear net loss of $37 million (13 cents per share) a year ago.

The third quarter of 2024 included, on a pre-tax basis, Goodyear Forward costs of $25 million and rationalization charges of $11 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.

Segment Results

The company reported segment operating income of $287 million in Q3 of 2025, compared to $346 million a year ago. After adjusting for the sale of its Off-the-Road (OTR) tire business, segment operating income declined $49 million. The change in segment operating income reflects benefits from Goodyear Forward of $185 million, partly offset by inflation and other costs of $137 million, the impact of lower volume of $90 million, and $17 million for the non-recurrence of the 2024 insurance recoveries, net of expenses.

Goodyear Forward

Goodyear Forward delivered benefits of $185 million during the third quarter of 2025. The company expects to achieve approximately $1.5 billion of annualized run-rate benefits by year-end 2025.

Additionally, on 31 October, Goodyear completed the previously announced $650 million sale of its Chemical business for cash proceeds of $580 million, net of working capital adjustments, including an adjustment for inter-company receivables, before transaction fees and taxes. The sale of the Chemical business followed the divestitures of the OTR tire business and the Dunlop brand earlier in the year. Total proceeds of approximately $2.2 billion will be used to reduce the company’s debt balance.

Year-to-Date Results

Goodyear’s first nine months 2025 net sales were $13.4 billion, with tire unit volumes totaling 116.4 million. The first nine months of 2025 included several significant items, including a non-cash deferred tax asset valuation allowance of $1.4 billion, a non-cash goodwill impairment charge of $674 million and, on a pre-tax basis, a combined estimated gain on the sales of the OTR tire business and the Dunlop brand of $640 million, rationalization charges of $161 million and Goodyear Forward costs of $19 million. Goodyear net loss was $1.8 billion ($6.35 per share) compared to Goodyear net loss of $27 million (9 cents per share) a year ago.

The first nine months of 2024 included, on a pre-tax basis, Goodyear Forward costs of $92 million and rationalization charges of $52 million. Goodyear Forward costs are comprised of advisory, legal and consulting fees and costs associated with planned asset sales.

First nine months 2025 adjusted net income was $23 million compared to adjusted net income of $168 million in the prior year. Adjusted earnings per share was $0.08, compared to $0.58 in the prior year.

The company reported segment operating income of $641 million in the first nine months of 2025, compared to $920 million a year ago. After adjusting for the sale of its OTR tire business, which was completed in February 2025, segment operating income declined $234 million, driven by higher raw materials and lower volume. Segment operating income reflects benefits from Goodyear Forward of $580 million, inflation and other costs of $316 million, the impact of lower volume of $193 million, unfavorable net price/mix versus raw material costs of $174 million, and non-recurrence of the 2024 insurance recoveries, net of expenses, of $69 million.

*AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.