If Chinese sales double – and it’s not a bad bet - China would dominate GM’s volume in a way unheard of since GM had almost 60% share in the U.S. market in 1960.

Just before the opening today of the Shanghai Motor Show, GM China Group President and Managing Director Kevin Wale predicted that GM will double its sales volume in China from about 2.35 million units in 2010 to around 5 million units by 2015. China has been GM’s largest market for the past two years where it is the Number One automaker.

The GM announcement – no surprise to industry observers who track sales and capacity numbers closely – came as Wale outlined a multi-brand strategy – under a five-year plan – that will see GM introducing more than 60 new models and major product upgrades. Its two mainstream brands, Buick and Chevrolet, will account for nearly half of the long marketing march.

If Chinese sales double – and it’s not a bad bet – China would dominate GM’s volume in a way unheard of since GM had almost 60% share in the U.S. market in 1960 in what was then the world’s largest and most prosperous market. How much of the profits are repatriated remains to be seen. China clearly is now and for the foreseeable future the world’s largest auto market.

Buick in China will introduce about 12 new and upgraded products as what GM says is the leading premium vehicle brand in China. (Although Audi, BMW and Mercedes would argue this.) In addition to rolling out a variety of new vehicles, Buick will also offer its customers the latest technologies, which apparently means the increasing capabilities of GM’s OnStar telematics subsidiary will continue to appear.

Chevrolet will present 15 new models and upgrades, which will range from affordable small cars to mid-size sedans. Chevrolet will also bring to the market a new lineup of SUVs and unspecified performance vehicles, which means Corvette or Camaro might appear alongside smaller, more affordable pocket-rockets like the Sonic.

Wale emphasized that GM will continue to “leverage” its unmatched local vehicle development capability, including its Pan Asia Technical Automotive Center (PATAC) joint venture in China.

In fact, due to a job creating industrial policy dictated by the Communist Chinese government, China is actually benefiting from leverage as all western automakers must establish joint ventures with local Chinese companies – some of them former munitions makers and military suppliers – in order to gain access to the lucrative market.

In the early years after China’s accession to the World Trade organization in 2001, Chinese auto industry jobs mostly took the form of factory workers who were hired by the local Communist party – even in western JV plants. However, white collar engineering, design, manufacturing and administrative jobs – once the foundation of the U.S. middle class – are becoming more important. (See Ford to Double White Collar Workers in China by 2015)

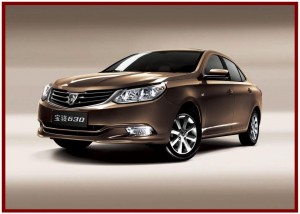

The Baojun 630 sedan will have its global motor show premiere on the SAIC-GM-Wuling (SGMW) stand at Auto Shanghai 2011. SGMW, a joint venture between GM China, Shanghai Automotive Industry Corporation Group (SAIC) and Wuling Motors, was launched in 2002. SGMW makes a range of Wuling mini-trucks and minivans, and the Chevrolet Le Chi minicar. In 2010, SGMW had record Chinese sales of 1,226,860 vehicles. .

“Successful new models like the Chevrolet New Sail and new Buick GL8, and the upcoming Baojun 630, have all been developed in China,” Wales said, proving the problem the U.S. political class faces trying to create jobs as the Great Recession lingers on.

Neither the Democratic nor Republican party has come up with a credible industrial or job creation policy thus far as unemployment and underemployment remain at post depression highs that were once unthinkable.