Click to Enlarge.

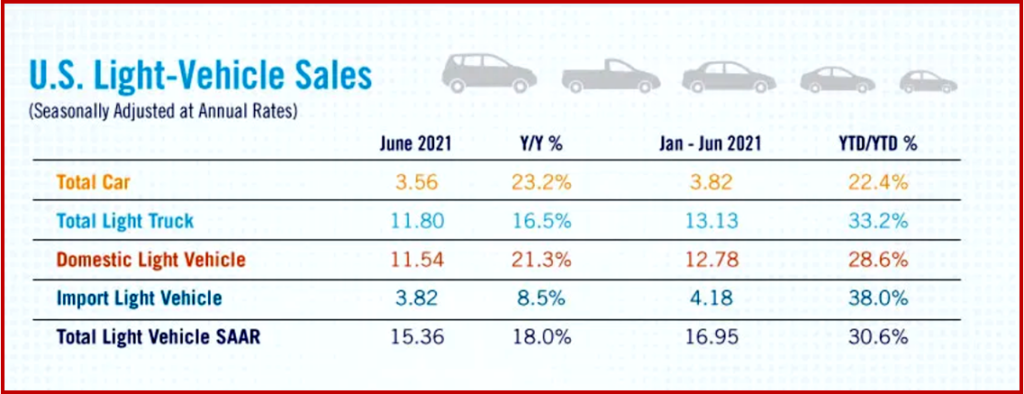

US light-vehicle sales fell for the second straight month in June. The 2021 SAAR totaled 15.4 million vehicles, an increase of up 18% compared to June 2020. However, this was down 9.9% from May 2021. Through the first half of the year franchised dealers sold 8.3 million new light vehicles, up 29.3% from first-half 2020 and down 2% from first-half 2019, according to the National Automobile Dealers Assn.

With too much demand chasing too little supply, it’s not surprising many vehicles sold at or above MSRP and automakers have slashed incentive spending. According to J.D. Power, in mid-June 75% of vehicles sold for MSRP or above, which is up from 67% in May 2021 and way higher from the pre-COVID average of 36%. AutoInformed thinks that an affordability crisis is starting to emerge, as the Biden Administration economic boom continues. (May US Light Vehicle Sales – Start of an Affordability Slump?, Ford Follows GM: Q2 2021 Earnings to Exceed Its Expectations)

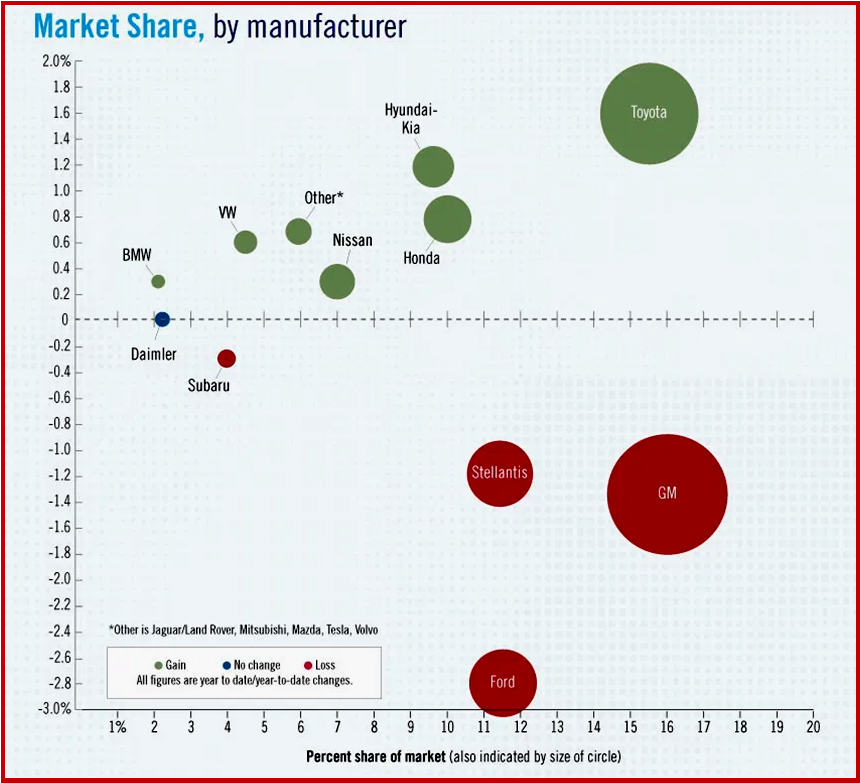

The Traditional Detroit Three all lost share – not surprising given their reliance on offshore suppliers and their rocky relationship with them. Click to Enlarge.

“The inventory crunch will likely get worse before it gets better. Inventory levels at the end of June will probably be flat compared with May 2021, at around 1.5 million units and then fall to some 1.3 million units by the end of July. Some OEMs have canceled traditional summer shutdowns, while others have limited or stopped production as they deal with the chip shortage,” said Patrick Manzi, NADA Chief Economist. (Former Chrysler Windsor Minivan Plant to Close for All of June, GM to Up Deliveries by Dropping Stop-Start on Pickups, SUVs)

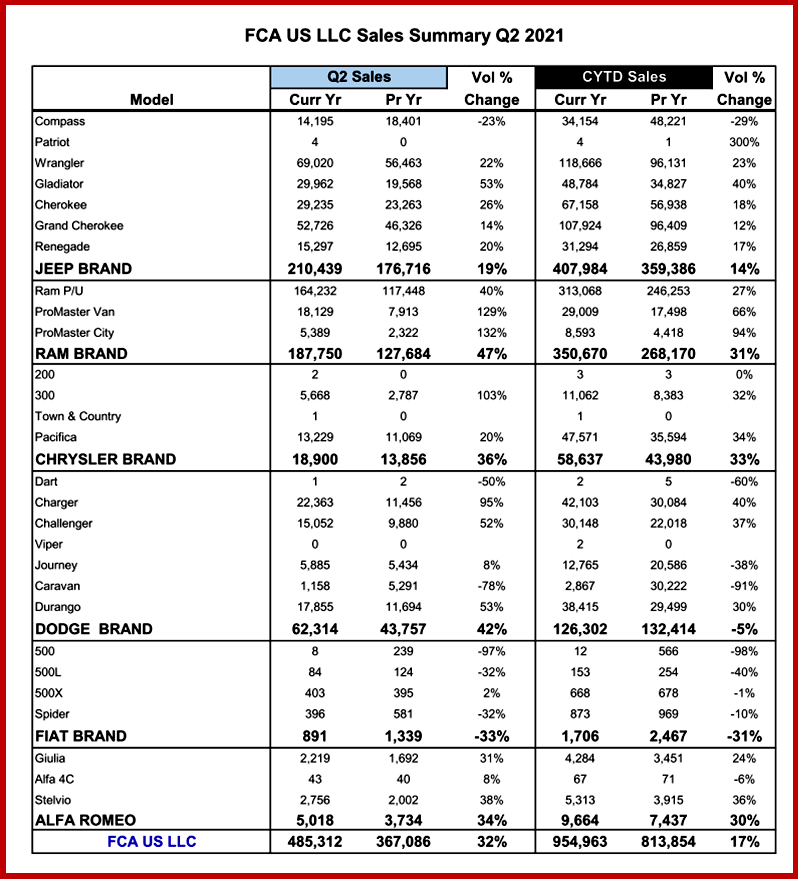

Stellantis owns FCA US. Click to Enlarge.

Click to Enlarge.

“The U.S. economy is accelerating, consumer spending is robust and jobs are plentiful,” said Elaine Buckberg, GM chief economist.

“Consumer demand for vehicles is also strong, but constrained by very tight inventories. We expect continued high demand in the second half of this year and into 2022,” said Buckberg.

GM claims it is taking steps to meet customers’ future needs, especially in capacity-constrained segments:GM announced that production of HD pickups will increase by about 1,000 trucks per month beginning in mid-July as a result of production line efficiencies delivered by the team at Flint Assembly in Michigan., GM will return full-size pickup production to Oshawa Assembly in Canada at the end of 2021.

Shipments of Chevrolet Colorado and GMC Canyon mid-size pickups built at Wentzville Assembly in Missouri increase by about 30,000 total units from mid-May through early July as the team completes dynamic vehicle testing on units held at the plant due to semiconductor supply disruptions.

Wards Intelligence forecasts North American vehicle production will see a five-year high in third-quarter 2021, reaching 4.4 million units, as OEMs try to restock dealer lots. However, virtually all industry observers and analysts think automakers will be well into 2022 before there are enough vehicles to restock dealer lots near pre-Covid pandemic levels. Additional supply chain disruptions – say from Delta variant infections that are currently spreading largely unabated could make this forecast look dumb.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Inventory Deficit Hurts June US Vehicle Sales. Again

Click to Enlarge.

US light-vehicle sales fell for the second straight month in June. The 2021 SAAR totaled 15.4 million vehicles, an increase of up 18% compared to June 2020. However, this was down 9.9% from May 2021. Through the first half of the year franchised dealers sold 8.3 million new light vehicles, up 29.3% from first-half 2020 and down 2% from first-half 2019, according to the National Automobile Dealers Assn.

With too much demand chasing too little supply, it’s not surprising many vehicles sold at or above MSRP and automakers have slashed incentive spending. According to J.D. Power, in mid-June 75% of vehicles sold for MSRP or above, which is up from 67% in May 2021 and way higher from the pre-COVID average of 36%. AutoInformed thinks that an affordability crisis is starting to emerge, as the Biden Administration economic boom continues. (May US Light Vehicle Sales – Start of an Affordability Slump?, Ford Follows GM: Q2 2021 Earnings to Exceed Its Expectations)

The Traditional Detroit Three all lost share – not surprising given their reliance on offshore suppliers and their rocky relationship with them. Click to Enlarge.

“The inventory crunch will likely get worse before it gets better. Inventory levels at the end of June will probably be flat compared with May 2021, at around 1.5 million units and then fall to some 1.3 million units by the end of July. Some OEMs have canceled traditional summer shutdowns, while others have limited or stopped production as they deal with the chip shortage,” said Patrick Manzi, NADA Chief Economist. (Former Chrysler Windsor Minivan Plant to Close for All of June, GM to Up Deliveries by Dropping Stop-Start on Pickups, SUVs)

Stellantis owns FCA US. Click to Enlarge.

Click to Enlarge.

“The U.S. economy is accelerating, consumer spending is robust and jobs are plentiful,” said Elaine Buckberg, GM chief economist.

“Consumer demand for vehicles is also strong, but constrained by very tight inventories. We expect continued high demand in the second half of this year and into 2022,” said Buckberg.

GM claims it is taking steps to meet customers’ future needs, especially in capacity-constrained segments:GM announced that production of HD pickups will increase by about 1,000 trucks per month beginning in mid-July as a result of production line efficiencies delivered by the team at Flint Assembly in Michigan., GM will return full-size pickup production to Oshawa Assembly in Canada at the end of 2021.

Shipments of Chevrolet Colorado and GMC Canyon mid-size pickups built at Wentzville Assembly in Missouri increase by about 30,000 total units from mid-May through early July as the team completes dynamic vehicle testing on units held at the plant due to semiconductor supply disruptions.

Wards Intelligence forecasts North American vehicle production will see a five-year high in third-quarter 2021, reaching 4.4 million units, as OEMs try to restock dealer lots. However, virtually all industry observers and analysts think automakers will be well into 2022 before there are enough vehicles to restock dealer lots near pre-Covid pandemic levels. Additional supply chain disruptions – say from Delta variant infections that are currently spreading largely unabated could make this forecast look dumb.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.