Click to Enlarge.

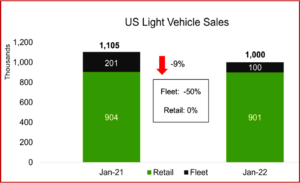

Limited inventories pulled down US sales in January to just over 1 million units, according to the LMC Automotive consultancy. This was the scrawniest January since 2014. However, the -9% YoY decline marks the smallest percentage loss since monthly sales turned negative in the summer of 2021, said LMC. (Read AutoInformed on January US New Vehicle Sales to Decline. Profits, Prices Up; NADA Predicts 2022 New-Vehicle Sales of 15.4M, up 3.4%)

The annualized selling rate, aka SAAR, improved from the average during the last six months. At 15.2 million units/year, this was the strongest SAAR since the 15.4-million-unit level in June 2021. Nevertheless, the average daily volume fell short of 42,000 units, but was consistent with the average daily volume of Q4 2021. Plus ca change…

Even with an average $45,000 transaction price squeezing people, retail demand remained the driving force of the market because the wealthy fared very well during the Covid crisis. The Biden Administration’s economic recovery, in AutoInformed’s view, also played a huge roll with its surging job creation and forward thinking in the Infrastructure Investment and Jobs Act , or the stalled Build Back Better strategy universally opposed by the Republicans who are largely responsible for the covid disaster that destroyed the US economy.

Used car trade-in values at breathtaking highs also helped. Initial data, says LMC, indicates that retail sales totaled approximately 900,000 units, forcing fleet sales to the lowest level since the pandemic started. Fleet deliveries have been losing share since October as manufacturers with tight inventories don’t need the discounted sales.

LMC also noted that changes in the sales ranking that happened last year remained in place in January. “Even with extremely low days’ supply of its core products, Toyota remained the market leader, while GM faced the steepest YoY decline of any OEM. The Hyundai Group continues to outsell the Honda Group, which had its weakest month since April 2020. Tesla achieved a significant milestone in January by taking the sales lead in the Premium segment. Among the main OEMs, Tesla’s 42% YoY growth was the strongest, driving Premium vehicle sales to more than 16% of total sales. This is the second-highest share ever, just behind December’s,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive

Keeping with a long-standing trend, another record was set in January as SUVs reached 57% of total sales for the first time, even with some high-volume models, such as the Chevrolet Equinox and Honda CR-V, having a weak month. Pickups were the second most popular body type, at a far-off 20%.”

Outlook?

“As we push into 2022, the economy and auto industry continue to face a wide array of risks, including continuing manufacturing stress from supply chain disruptions and labor shortages. The addition of headwinds from inflation concerns, COVID-19 variants and restrictions, and even a geopolitical shock could mark 2022 as the third year in a row with the natural balance of supply and demand negatively impacted by outside variables,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

January 2022 US Sales Off 9%. Chips, Supply Chain Issues Bite

Click to Enlarge.

Limited inventories pulled down US sales in January to just over 1 million units, according to the LMC Automotive consultancy. This was the scrawniest January since 2014. However, the -9% YoY decline marks the smallest percentage loss since monthly sales turned negative in the summer of 2021, said LMC. (Read AutoInformed on January US New Vehicle Sales to Decline. Profits, Prices Up; NADA Predicts 2022 New-Vehicle Sales of 15.4M, up 3.4%)

The annualized selling rate, aka SAAR, improved from the average during the last six months. At 15.2 million units/year, this was the strongest SAAR since the 15.4-million-unit level in June 2021. Nevertheless, the average daily volume fell short of 42,000 units, but was consistent with the average daily volume of Q4 2021. Plus ca change…

Even with an average $45,000 transaction price squeezing people, retail demand remained the driving force of the market because the wealthy fared very well during the Covid crisis. The Biden Administration’s economic recovery, in AutoInformed’s view, also played a huge roll with its surging job creation and forward thinking in the Infrastructure Investment and Jobs Act , or the stalled Build Back Better strategy universally opposed by the Republicans who are largely responsible for the covid disaster that destroyed the US economy.

Used car trade-in values at breathtaking highs also helped. Initial data, says LMC, indicates that retail sales totaled approximately 900,000 units, forcing fleet sales to the lowest level since the pandemic started. Fleet deliveries have been losing share since October as manufacturers with tight inventories don’t need the discounted sales.

LMC also noted that changes in the sales ranking that happened last year remained in place in January. “Even with extremely low days’ supply of its core products, Toyota remained the market leader, while GM faced the steepest YoY decline of any OEM. The Hyundai Group continues to outsell the Honda Group, which had its weakest month since April 2020. Tesla achieved a significant milestone in January by taking the sales lead in the Premium segment. Among the main OEMs, Tesla’s 42% YoY growth was the strongest, driving Premium vehicle sales to more than 16% of total sales. This is the second-highest share ever, just behind December’s,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive

Keeping with a long-standing trend, another record was set in January as SUVs reached 57% of total sales for the first time, even with some high-volume models, such as the Chevrolet Equinox and Honda CR-V, having a weak month. Pickups were the second most popular body type, at a far-off 20%.”

Outlook?

“As we push into 2022, the economy and auto industry continue to face a wide array of risks, including continuing manufacturing stress from supply chain disruptions and labor shortages. The addition of headwinds from inflation concerns, COVID-19 variants and restrictions, and even a geopolitical shock could mark 2022 as the third year in a row with the natural balance of supply and demand negatively impacted by outside variables,” said Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.