There were varying results for Japanese sales in the U.S. sales race in July with Toyota and Honda posting double digit declines while Nissan increased sales from July of 2010. Overall, the total U.S. light vehicle market grew less than 1% from what was a weak July of 2010 as the economy languishes and unemployment remains above 9%.

Toyota Motor Sales reported July sales of 130,802 units, a decrease of 19.7% from the same period last year on a daily selling rate (DSR) basis. On a volume basis, unadjusted for 26 selling days in July 2011 compared to 27 selling days in July 2010, TMS sales were down 22.7% from the year-ago month. Compared to June 2011, sales increased 17.9% on both a DSR and raw volume basis.

However, TMS posted its second straight month-to-month double digit sales gain, as availability continues to improve faster than originally predicted from the disruptions in production caused by the March 11th earthquake and tsunami in Japan. And for the first time since the earthquake, TMS market share is increasing, picking up almost two points from last month. Total Toyota, Lexus and Scion sales of 130,802 were up 18% from June.

Toyota Division passenger cars recorded sales of 60,088 units, a decrease of 28.3% from last July. The Camry and Camry Hybrid led passenger cars with combined monthly sales of 27,016 units. Corolla recorded sales of 17,577 units, and the Prius mid-size gas-electric hybrid reported sales of 7,907 units. The Avalon sedan posted sales of 2,698 units, which is flat compared to July 2010.

Toyota Division light trucks posted sales of 56,175 units in July, down 8.3% from the same period last year.

Lexus Division reported passenger car sales of 7,974 units, a decrease of 7.7% from the year-ago month. The ES 350 entry luxury sedan led passenger cars with sales of 2,850 units, while the IS lineup reported combined sales of 2,305 units. The al-new CT 200h premium hybrid compact posted 1,553 units in its fifth month of sales.

Lexus Division light trucks recorded sales of 6,565 units, down 29.2% from July 2010. Light trucks were led by the RX luxury utility vehicle, which reported combined July sales of 5,471 units, and the GX 460 mid-sized luxury utility vehicle posted sales of 830 units.

American Honda posted July sales of 80,502 vehicles, a decrease of 25.6%, based on the daily selling rate, the company announced today. Honda year-to-date sales reached 687,944, down 2.6% versus last year.

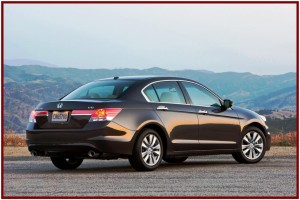

Honda Division posted July sales of 71,100, a drop of 25.7% versus July 2010. The Accord was the top-selling Honda model for July with sales of 18,308, a decrease of 25.1% compared to last year. The all-new Civic, which continues to be produced at reduced levels, posted sales of 14,006, down 37.4%. The Pilot SUV posted sales of 9,954, an increase of 8.0% versus last year.

Acura Division recorded July sales of 9,402, a decrease of 25% versus July 2010, and year-to-date sales of 70,082, down 5.5%. The MDX was the top-selling Acura model for the month with sales of 3,438 down 14.9%.

Nissan North America reported July U.S. sales of 84,601 units versus 82,337 units a year earlier, an increase of 2.7%. Nissan Division sales increased 6.4% for the month at 77,191 units. Sales of Infiniti vehicles decreased 24.1% from the prior year, to 7,410 units, possibly reflecting a larger negative influence than effects of the Japan earthquake, as other luxury makers, notably Acura, Cadillac and Jaguar declined at double digit rates.

Nissan vehicles posted July sales of 77,191 units, an increase of 6.4% over the 72,573 units sold in July 2010.

Infiniti sales totaled 7,410 units for the month of July, a decrease of 25.9% versus 9,764 a year earlier.

“Unemployment, production shortages, and uncertainty over our economic stability have all contributed to a sluggish summer for sales,” said American International Automobile Dealer Association President Cody Lusk. “In the fall, we expect stabilizing gas prices, rising consumer confidence, and a return to normal inventory levels to drive an increase in transactions.”