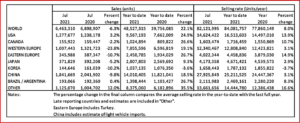

Click to Enlarge.

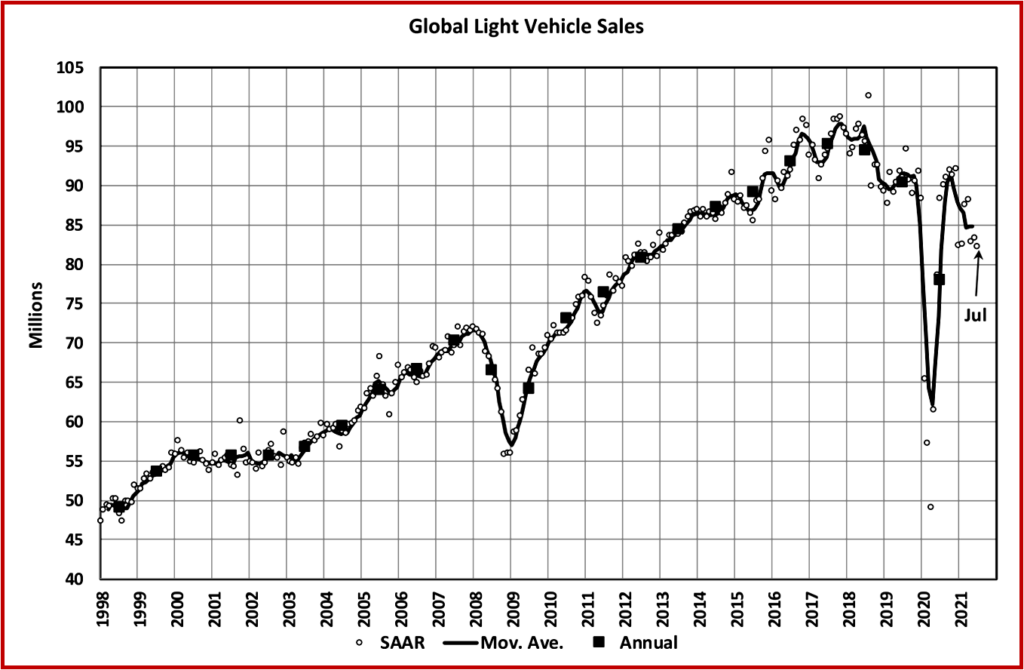

The Global Light Vehicle (LV) selling rate was 82,000,000 units/year in July, according to consultancy LMC Automotive. This continues the softening trend of recent months. “The semiconductor shortage held back the post-lockdown recovery of vehicle sales in Europe, while its impact on inventories in the US meant average transaction prices soared. Meanwhile, rising Delta variant cases threaten to worsen the outlook in parts of Asia,” LMC said in a release today.

Soaring transaction prices mean the industry could face an affordability crisis – particularly in the United States as the Biden Administration recovery is continuing but threatened by the growing problems and deaths caused by the Delta variant of Covid 19. (See AutoInformed.com on US Vehicle Sales Drop in July for Third Month Running; Inventory Deficit Hurts June US Vehicle Sales. Again; 2021 Q2 US Sales – Light-Trucks, Crossovers, SUVs Rule)

Click to Enlarge.

North America

The US light vehicle market suffered from low inventories during July. Sales grew by only 3.2% YoY, to 1.28 mn units, a slight increase compared to July 2020’s pandemic-affected result. Worse, the selling rate decelerated further, to 14.6 mn units/year, from 15.4 mn units/year in June. This was the lowest rate since June 2020. The disparity between supply and demand saw average transaction prices soar to $40,879 in July, the first time this figure has ever been above $40,000. Under the Economics 101 heading this meant that incentives fell to a record low of just 4.6% of MSRP, or $1,968 per unit.

Canada, light vehicle sales fell by 2.2% YoY in July, to 156k units. This was the first YoY decline since February, while the selling rate decreased to 1.6 mn units/year in July, from 1.73 mn units/year in June. Although the COVID-19 situation has improved in Canada, according to LMC, the industry is now being significantly affected by inventory shortages.

Mexican light vehicle sales were up by 12.6% YoY in July, to 82k units, but the selling rate fell for a third consecutive month, to 994k units/year, from 1.07 mn units/year in June.

Europe

The West European selling rate dropped to 12.3 mn units/year in July, from 13.7 mn units/year in June. The supply-side problem of the availability of semiconductor chips “is clearly having a negative impact on selling rate recovery in the region, holding back the post-lockdown rebound in demand,” said LMC.

In Eastern Europe, the selling rate fell to 4.0 mn units/year in July, from 4.5 mn units/year in June. In Russia, the selling rate was likely held back by the semiconductor shortage, while Poland’s PV selling rate has recently seen an improvement to 500k units/year, thanks to a sustained fall in COVID-19 cases. (See AutoInformed.com on Botched Vaccinations Haunt EU Vehicle Sales During May)

China

Advance data from the Chinese market showed regained momentum in July. The July selling rate reached 27.9 mn units/year, up 10% from a weak June, and was the highest rate since December 2020. In the first seven months of this year, the selling rate averaged 25.2 mn units/year, above the 2020 result of 24.4 mn units, but still below the 2019 sales of 25.5 mn units. “In YoY terms, sales declined by nearly 10% in July, but increased by 19% YTD, due to distortions caused by the pandemic,” said LMC.

In July, New Electric Vehicle sales expanded by a hardy 180% YoY. Most global brands suffered YoY declines due to the global chip shortage, while Chinese brands, such as GAC Motor, Great Wall and Changan, continued to perform well. “Looking ahead, the fast spread of the Delta variant across the country and tightened social restrictions present a risk to economic activity and new vehicle sales,” warned LMC.

Other Asia

In Japan, the July selling rate was 4.17 mn units/year, up slightly from June, but that was the second lowest rate in a year. The chip shortage and supply-chain disruptions from the spread of the virus in other parts of Asia led to supply restrictions. In addition, the skyrocketing number of COVID-19 infections hurt consumer confidence. The selling rate averaged 4.7 mn units/year YTD, compared to the 2019 result of 5.1 mn units.

Preliminary data indicates that Korea’s selling rate slowed to 1.66 mn units/year in July, down 7% from June. The chip problem improved, but supply was disrupted by Hyundai’s temporarily halt in production at its Asan plant to prepare the facility for BEV production. The soaring number of COVID-19 cases and the strict social distancing measures in the Greater Seoul area also undermined sales, according to LMC.

South America

Brazilian LV sales fell by 0.5% YoY in July, to 163k units. This represents the first YoY contraction since February, when the year-ago month was unaffected by the pandemic. “The weak state of the market was underlined by the fact that the selling rate fell to 1.77 mn units/year in July, from 1.97 mn units/year in June, and July’s rate was the lowest since June 2020. As production lines for some key models remain halted amid the chip shortage, inventory of those models has virtually run out, decimating sales.,” said LMC.

Argentina LV sales grew by 5.3% YoY in July, to 30k units. The selling rate declined to 345,000 units/year in July, from 399,000 units/year in June. “With sales seemingly having been distorted somewhat by coronavirus restrictions being in place in May but eased in June, July’s selling rate would appear to represent a fairer picture of the current state of the market,” LMC said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

July Global Sales Days Dogged by Delta, Semiconductors

Click to Enlarge.

The Global Light Vehicle (LV) selling rate was 82,000,000 units/year in July, according to consultancy LMC Automotive. This continues the softening trend of recent months. “The semiconductor shortage held back the post-lockdown recovery of vehicle sales in Europe, while its impact on inventories in the US meant average transaction prices soared. Meanwhile, rising Delta variant cases threaten to worsen the outlook in parts of Asia,” LMC said in a release today.

Soaring transaction prices mean the industry could face an affordability crisis – particularly in the United States as the Biden Administration recovery is continuing but threatened by the growing problems and deaths caused by the Delta variant of Covid 19. (See AutoInformed.com on US Vehicle Sales Drop in July for Third Month Running; Inventory Deficit Hurts June US Vehicle Sales. Again; 2021 Q2 US Sales – Light-Trucks, Crossovers, SUVs Rule)

Click to Enlarge.

North America

The US light vehicle market suffered from low inventories during July. Sales grew by only 3.2% YoY, to 1.28 mn units, a slight increase compared to July 2020’s pandemic-affected result. Worse, the selling rate decelerated further, to 14.6 mn units/year, from 15.4 mn units/year in June. This was the lowest rate since June 2020. The disparity between supply and demand saw average transaction prices soar to $40,879 in July, the first time this figure has ever been above $40,000. Under the Economics 101 heading this meant that incentives fell to a record low of just 4.6% of MSRP, or $1,968 per unit.

Canada, light vehicle sales fell by 2.2% YoY in July, to 156k units. This was the first YoY decline since February, while the selling rate decreased to 1.6 mn units/year in July, from 1.73 mn units/year in June. Although the COVID-19 situation has improved in Canada, according to LMC, the industry is now being significantly affected by inventory shortages.

Mexican light vehicle sales were up by 12.6% YoY in July, to 82k units, but the selling rate fell for a third consecutive month, to 994k units/year, from 1.07 mn units/year in June.

Europe

The West European selling rate dropped to 12.3 mn units/year in July, from 13.7 mn units/year in June. The supply-side problem of the availability of semiconductor chips “is clearly having a negative impact on selling rate recovery in the region, holding back the post-lockdown rebound in demand,” said LMC.

In Eastern Europe, the selling rate fell to 4.0 mn units/year in July, from 4.5 mn units/year in June. In Russia, the selling rate was likely held back by the semiconductor shortage, while Poland’s PV selling rate has recently seen an improvement to 500k units/year, thanks to a sustained fall in COVID-19 cases. (See AutoInformed.com on Botched Vaccinations Haunt EU Vehicle Sales During May)

China

Advance data from the Chinese market showed regained momentum in July. The July selling rate reached 27.9 mn units/year, up 10% from a weak June, and was the highest rate since December 2020. In the first seven months of this year, the selling rate averaged 25.2 mn units/year, above the 2020 result of 24.4 mn units, but still below the 2019 sales of 25.5 mn units. “In YoY terms, sales declined by nearly 10% in July, but increased by 19% YTD, due to distortions caused by the pandemic,” said LMC.

In July, New Electric Vehicle sales expanded by a hardy 180% YoY. Most global brands suffered YoY declines due to the global chip shortage, while Chinese brands, such as GAC Motor, Great Wall and Changan, continued to perform well. “Looking ahead, the fast spread of the Delta variant across the country and tightened social restrictions present a risk to economic activity and new vehicle sales,” warned LMC.

Other Asia

In Japan, the July selling rate was 4.17 mn units/year, up slightly from June, but that was the second lowest rate in a year. The chip shortage and supply-chain disruptions from the spread of the virus in other parts of Asia led to supply restrictions. In addition, the skyrocketing number of COVID-19 infections hurt consumer confidence. The selling rate averaged 4.7 mn units/year YTD, compared to the 2019 result of 5.1 mn units.

Preliminary data indicates that Korea’s selling rate slowed to 1.66 mn units/year in July, down 7% from June. The chip problem improved, but supply was disrupted by Hyundai’s temporarily halt in production at its Asan plant to prepare the facility for BEV production. The soaring number of COVID-19 cases and the strict social distancing measures in the Greater Seoul area also undermined sales, according to LMC.

South America

Brazilian LV sales fell by 0.5% YoY in July, to 163k units. This represents the first YoY contraction since February, when the year-ago month was unaffected by the pandemic. “The weak state of the market was underlined by the fact that the selling rate fell to 1.77 mn units/year in July, from 1.97 mn units/year in June, and July’s rate was the lowest since June 2020. As production lines for some key models remain halted amid the chip shortage, inventory of those models has virtually run out, decimating sales.,” said LMC.

Argentina LV sales grew by 5.3% YoY in July, to 30k units. The selling rate declined to 345,000 units/year in July, from 399,000 units/year in June. “With sales seemingly having been distorted somewhat by coronavirus restrictions being in place in May but eased in June, July’s selling rate would appear to represent a fairer picture of the current state of the market,” LMC said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.