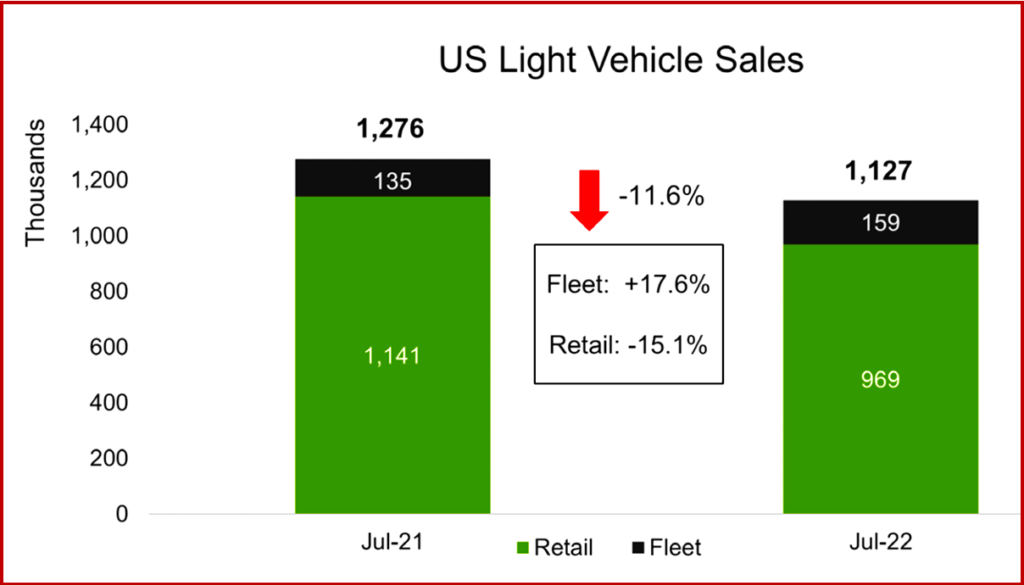

US Light Vehicle sales in July performed mostly in line with the June results, according to LMC Automotive,* which means they are still stalled at ~1.13 million units. “While the selling rate improved slightly for the second consecutive month, to 13.3 million units. Yet, the inventory crisis has forced the US to lose 1.65 million units of potential demand so far in 2022 – equivalent of total sales in Canada last year,” LMC noted. (AutoInformed on: US July Sales Forecast Down. Prices, Profits Still Records)

Compared to July 2021, sales fell by 11.6% – only January’s decline of 10.2% was better thus far in 2022. However, last July was hampered by the chip shortage. Since 2000, this July was only better than the period of the Great Recession in 2008-2011. Year-to-date, sales stand at 7.91 million units, down by 17.3% YoY.

Click to Enlarge.

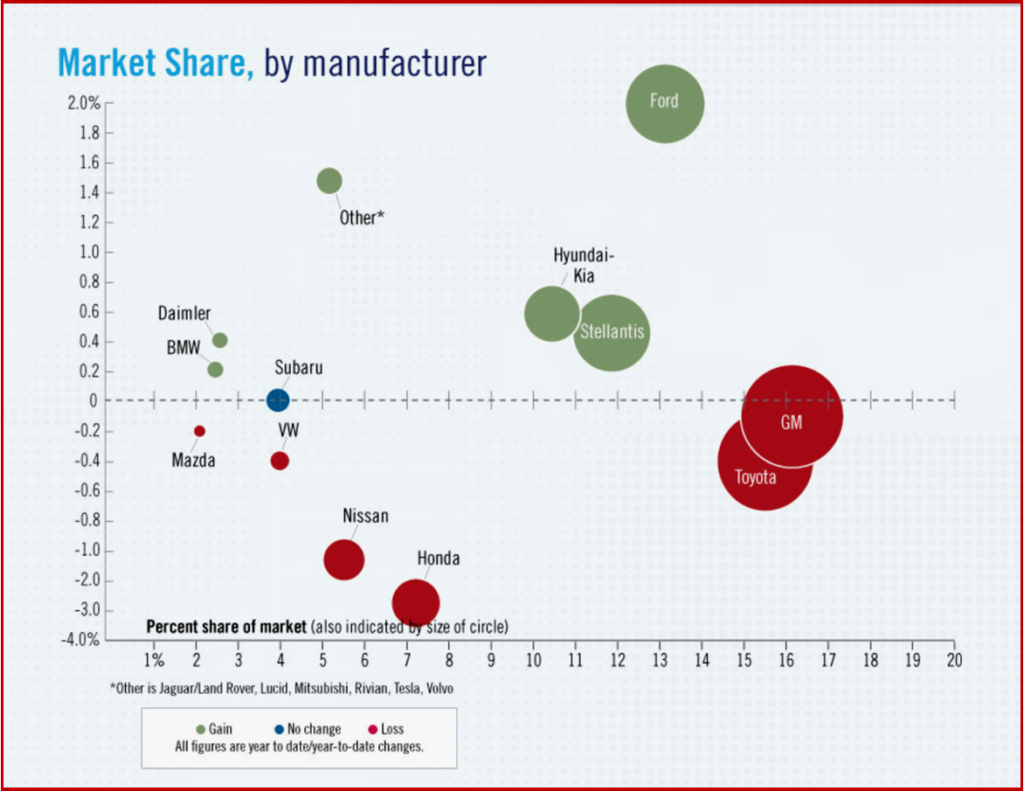

Toyota outsold General Motors for the first time since January, while the Toyota brand remained the market leader. Tesla remains one of the fastest-growing makes, but Non-Premium brands enjoyed a rebound in volume and took away some share from Premium.

“July sales were slightly behind the June volumes, but not all OEMs were that stable. GM lost more than 20,000 units, and it was outsold by Toyota for the first time since January. On the positive side, Ford, Mazda and Toyota gained the most volume from June. Toyota remained the bestselling brand, but its lead over Ford shrank considerably this month. Toyota was ahead of Ford by 2,400 units, down from the 8,000-unit lead in June. When it comes to models, the F-150 and RAV4 continue to fight fiercely for the sales crown, and this month the F-150 was ahead by 600 units. As these Non-Premium makes recover, Premium’s share was shy of 16% for the first time in three months,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

There’s an affordability crisis looming, AutoInformed predicts. Click to Enlarge.

The July volume converts into an annualized rate of 13.3 million units, ~300,000 units higher than in the previous month. Nevertheless, the daily selling rate edged down by about 100 units, to 43,400 units/selling day. Compared to last year, when July had one extra day, the average fell by 3,900 units/selling day.

Under the pressure of record high transaction prices, retail sales remained under 1 million units for the third consecutive month, but still increased their share of total sales. They are estimated to have accounted for 86% of total sales, 2 ppts more than in June. In the yearly comparison, only fleet sales enjoyed positive results, as OEMs diverted inventory to retail sales in 2021 amid the worst of the inventory crisis.

The average monthly payment for a new vehicle reached an all-time high, topping $700, J.D. Power said. The average monthly payment for a new vehicle is on track to be $708, +$81 dollars compared with July 2021. The usual reasons are cited:

- higher new-vehicle transaction prices,

- rising interest rates and lower discounts.

July 2022’s average transaction price, per J.D. Power, is expected to reach $45,869, a tad short of the all-time record set last month. Automaker average incentive spending per unit in July should total just $894, down 54.7% year-over-year – the third straight month below $1,000. However, demand for used vehicles remains strong because of the tight supply of new vehicles. In July 2022, average trade-in equity remains a near-record-high $10,083, up 37.4% from July 2021, according to J.D. Power.

LMC Automotive

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

July US Light Vehicle Sales Still Stalled

US Light Vehicle sales in July performed mostly in line with the June results, according to LMC Automotive,* which means they are still stalled at ~1.13 million units. “While the selling rate improved slightly for the second consecutive month, to 13.3 million units. Yet, the inventory crisis has forced the US to lose 1.65 million units of potential demand so far in 2022 – equivalent of total sales in Canada last year,” LMC noted. (AutoInformed on: US July Sales Forecast Down. Prices, Profits Still Records)

Compared to July 2021, sales fell by 11.6% – only January’s decline of 10.2% was better thus far in 2022. However, last July was hampered by the chip shortage. Since 2000, this July was only better than the period of the Great Recession in 2008-2011. Year-to-date, sales stand at 7.91 million units, down by 17.3% YoY.

Click to Enlarge.

Toyota outsold General Motors for the first time since January, while the Toyota brand remained the market leader. Tesla remains one of the fastest-growing makes, but Non-Premium brands enjoyed a rebound in volume and took away some share from Premium.

“July sales were slightly behind the June volumes, but not all OEMs were that stable. GM lost more than 20,000 units, and it was outsold by Toyota for the first time since January. On the positive side, Ford, Mazda and Toyota gained the most volume from June. Toyota remained the bestselling brand, but its lead over Ford shrank considerably this month. Toyota was ahead of Ford by 2,400 units, down from the 8,000-unit lead in June. When it comes to models, the F-150 and RAV4 continue to fight fiercely for the sales crown, and this month the F-150 was ahead by 600 units. As these Non-Premium makes recover, Premium’s share was shy of 16% for the first time in three months,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive.

There’s an affordability crisis looming, AutoInformed predicts. Click to Enlarge.

The July volume converts into an annualized rate of 13.3 million units, ~300,000 units higher than in the previous month. Nevertheless, the daily selling rate edged down by about 100 units, to 43,400 units/selling day. Compared to last year, when July had one extra day, the average fell by 3,900 units/selling day.

Under the pressure of record high transaction prices, retail sales remained under 1 million units for the third consecutive month, but still increased their share of total sales. They are estimated to have accounted for 86% of total sales, 2 ppts more than in June. In the yearly comparison, only fleet sales enjoyed positive results, as OEMs diverted inventory to retail sales in 2021 amid the worst of the inventory crisis.

The average monthly payment for a new vehicle reached an all-time high, topping $700, J.D. Power said. The average monthly payment for a new vehicle is on track to be $708, +$81 dollars compared with July 2021. The usual reasons are cited:

July 2022’s average transaction price, per J.D. Power, is expected to reach $45,869, a tad short of the all-time record set last month. Automaker average incentive spending per unit in July should total just $894, down 54.7% year-over-year – the third straight month below $1,000. However, demand for used vehicles remains strong because of the tight supply of new vehicles. In July 2022, average trade-in equity remains a near-record-high $10,083, up 37.4% from July 2021, according to J.D. Power.

LMC Automotive

*LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.