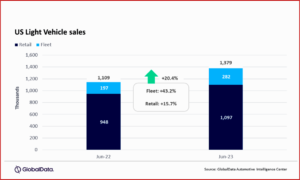

US light vehicles sales grew by 20.5% compared Year-over-Year in June, to 1.38 million units according to numbers just released by the respected consultancy GlobalData.* The first half of 2023 has US LV sales estimated to have increased by 13.1% YoY, to 7.68 million units as the Biden Administration recovery continues.

“In recent years we have become accustomed to almost constant change, but the story in the first half of 2023 was remarkably consistent. Light Vehicle sales continued the trend of solid results in June, without quite hitting the heights seen before the pandemic,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

Volumes easily surpassed year-ago levels, due somewhat to 2022’s weakness, which was hurt by inventory shortages. June inventory levels are projected to have risen by ~2.2% MoM in June, to 1.85 million units in industry speak a days’ supply figure of 35 days, up from 33 days in May. Both domestic production and imports continue to improve, suggesting that inventory should increase during the coming months. However, sales remained 8.6% below 2019 levels in the first six months of the year, showing that there is still some way to go before the market recovers to its pre-pandemic state.

“As inventories have increased, some unfulfilled demand from the past two years of shortages was met, and willing buyers were found despite sky-high transaction prices and still-suppressed incentive levels. Fleet is shoring up the total market as retail sales are somewhat modest, but it was not unusual for 20% of the market to come from fleet channels before the pandemic, which is in line with what we have seen year-to-date. Economic forecasts for H2 2023 remain relatively gloomy, making us cautious about prospects for auto sales, but if the expected recession continues to be delayed, there is some upside risk over the next six months,” said Oakley.

“The fact that average transaction prices are up a meager 1.6% year over year in June is notable,” said Michelle Krebs, executive analyst at Cox Automotive. “A year ago, the industry was looking at transaction prices that were consistently up 10-12% year over year. With no inventory in place, it was inflation gone wild. Now, as inventory has been consistently building and supply and demand are finding a balance, the price gains seem to be well under control. In fact, average transaction prices are down from the start of the year. That’s good news for shoppers.”

Global Forecast

Light Vehicle sales continue the recovery mode and are sightly outperforming expectations, according to Global Data. The May selling rate hit 89.0 million units, the highest level since August of 2022. “The outlook for the year was nudged up to 86.3 million units, an increase of 200,000 from last month and 7% higher than 2022. We estimate 3.5-4 million units of unfilled demand is remaining, so there is reason to be cautiously optimistic despite the high level of uncertainty in the second half of the year,” said GlobalData.

“The US auto market is one of the top outperforming markets in the world currently, as consumers display fortitude in the wake of the pandemic and with economic and market risk on the horizon. The outlook for 2023 has been increased by 500,000 units since January and has the ability to push through 15.5 million units if risk dissipates as the second half of 2023 progresses,” said Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData.

Ahead of the consumer price index (CPI) released for June, the most widely used measure of inflation, we published data on new-vehicle pricing from Kelley Blue Book. The average transaction price of a new vehicle in the U.S. rose modestly in June to $48,808, now up only 1.6% year over year. A year ago, prices at this point were up 12% year over year. Also, for the first time in more than a decade, prices are DOWN nearly 2% from January. In many ways, this makes 2023 a unicorn year.

In this newsletter, we highlight access to auto credit, which improved in June after hitting a two-year low in May, according to the Dealertrack Credit Availability Index, and the Manheim Used Vehicle Value Index (MUVVI), which shows wholesale values down 4.2% in June from May and down 10.3% from a year ago.

Chris Frey, senior manager of Economic and Industry Insights for Cox Automotive, notes: “Buyers at auction look to have taken an early summer break, and while used retail inventory has been improving over the last several weeks, we are expecting less volatility in wholesale price movements through year-end.”

Patrick Manzi, NADA Chief Economist said, “After a pause at its June meeting, the Fed has signaled it will increase the Fed Funds Rate further in coming months. These higher rates will be a headwind for new-vehicle sales. But there is still pent-up demand from retail and fleet customers, and high used-vehicle values will help consumers with their trade-in values. We expect new light-vehicle sales in the second half of the year to be similar to the first half. As a result, we have increased our overall 2023 forecast to 15.2 million units.”