Click to Enlarge.

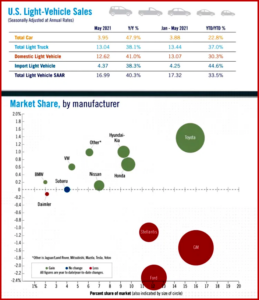

U.S. new light-vehicle sales were okay in May 2021, but fell from April’s highs. May’s Seasonally Adjusted Annual Rate, aka SAAR, was 17 million units. However, April’s SAAR was revised upward to 18.8 million units. May 2021’s SAAR was up 40.3% from May 2020’s, when light-vehicle sales had just begun to recover from April 2020’s pandemic lows under the previous “drink bleach” administration.

A 17 million-unit SAAR in conventional auto-exec-think would be celebrated as strong: “Even as the historic sales pace slowed slightly, this was the strongest May since 2015, and several brands celebrated their best-ever monthly volume. The annualized rate fell from 18.8 million units in April to 17.2 million units last month, in line with the SAAR registered in both 2018 at17.2 million units and 2019 at 17.4 million units,” said consultancy LMC. (April Sales Shower US Market More than 18 Million Times, US New Vehicle Sales in May Forecast as Record Setting. Global Sales are Another Matter Entirely)

But there is more going on here, AutoInformed opines, given current market conditions. While automakers and the business press have been chasing the semi-conductor shortage, many claim May’s drop in sales are the effects of a supply and demand imbalance. However, the vehicle mix of highly-equipped vehicles, plentiful low-interest-rate money, and the headlong rush into electric vehicles – priced above an average working person’s ability to carry the loan – are starting to make light vehicles un-affordable to the working and middle classes. For example Ford Motor set record electrified vehicle sales – up 184 % on F-150 PowerBoost Hybrid, Mustang Mach-E, Escape and Explorer Hybrid models

If this continues, there is trouble ahead for the economy. (Ford to Up Electrification Spend to $30B by 2025. Wants 40% All-Electric Global Volume By 2030, BMW Group – Hydrogen is Key Technology for Future, GM Needs Range, Battery Cost Cuts to Speed EV Plans)

“May 2021 began with total inventory of 1.97 million units, down 17.9% from the beginning of April 2021 and off 39.6% from the start of May 2020. Inventory has been especially constrained in some of the hottest market segments and among the most popular models. Pickups, which were in high demand throughout the past year, represented just 16.6% of new vehicles sold in May 2021, the lowest market share for the segment since March 2019,” said Patrick Manzi, NADA Chief Economist. Large Pickups were up by just 10% and lost 3.6 pp of share from a year ago May.

Car market share posted its first year-over-year gain since December 2012, rising to 24.2% from 23.1%. Manzi says it’s another sign that customers may be settling for second- or third-choice vehicles when unable to find a vehicle in their preferred segment.

“Many dealers have encouraged customers to place orders for the exact vehicle they want if it’s not available on the lot. As a result, many new vehicles arriving at dealer lots have already been sold, and the ones that aren’t spoken for aren’t available for long,” said Manzi. According to J.D. Power, 33.4% of vehicles sold in May 2021 sat on the lot less than 10 days, up from 18.2% in May 2019. (Whither US Vehicle Sales in 2021? Is 14 Million a Stretch?)

Retail demand has been roaring, with many reports of the most popular models selling at or above MSRP. With such strong demand, OEMs cut incentive spending more in May. Average incentive spending per unit, per J.D. Power, is forecast to total $2,957—down from $4,825 in May 2020 and $3,878 in May 2019.

“With no end in sight for the supply shortage as sales volumes outpace new-vehicle production, June will likely be a tough month for many dealers. Vehicle production probably won’t improve significantly until later this summer, as supply shortages persist for the rest of the year,” said Manzi.

Therefore prices will rise…

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

May US Light Vehicle Sales – Start of an Affordability Slump?

Click to Enlarge.

U.S. new light-vehicle sales were okay in May 2021, but fell from April’s highs. May’s Seasonally Adjusted Annual Rate, aka SAAR, was 17 million units. However, April’s SAAR was revised upward to 18.8 million units. May 2021’s SAAR was up 40.3% from May 2020’s, when light-vehicle sales had just begun to recover from April 2020’s pandemic lows under the previous “drink bleach” administration.

A 17 million-unit SAAR in conventional auto-exec-think would be celebrated as strong: “Even as the historic sales pace slowed slightly, this was the strongest May since 2015, and several brands celebrated their best-ever monthly volume. The annualized rate fell from 18.8 million units in April to 17.2 million units last month, in line with the SAAR registered in both 2018 at17.2 million units and 2019 at 17.4 million units,” said consultancy LMC. (April Sales Shower US Market More than 18 Million Times, US New Vehicle Sales in May Forecast as Record Setting. Global Sales are Another Matter Entirely)

But there is more going on here, AutoInformed opines, given current market conditions. While automakers and the business press have been chasing the semi-conductor shortage, many claim May’s drop in sales are the effects of a supply and demand imbalance. However, the vehicle mix of highly-equipped vehicles, plentiful low-interest-rate money, and the headlong rush into electric vehicles – priced above an average working person’s ability to carry the loan – are starting to make light vehicles un-affordable to the working and middle classes. For example Ford Motor set record electrified vehicle sales – up 184 % on F-150 PowerBoost Hybrid, Mustang Mach-E, Escape and Explorer Hybrid models

If this continues, there is trouble ahead for the economy. (Ford to Up Electrification Spend to $30B by 2025. Wants 40% All-Electric Global Volume By 2030, BMW Group – Hydrogen is Key Technology for Future, GM Needs Range, Battery Cost Cuts to Speed EV Plans)

“May 2021 began with total inventory of 1.97 million units, down 17.9% from the beginning of April 2021 and off 39.6% from the start of May 2020. Inventory has been especially constrained in some of the hottest market segments and among the most popular models. Pickups, which were in high demand throughout the past year, represented just 16.6% of new vehicles sold in May 2021, the lowest market share for the segment since March 2019,” said Patrick Manzi, NADA Chief Economist. Large Pickups were up by just 10% and lost 3.6 pp of share from a year ago May.

Car market share posted its first year-over-year gain since December 2012, rising to 24.2% from 23.1%. Manzi says it’s another sign that customers may be settling for second- or third-choice vehicles when unable to find a vehicle in their preferred segment.

“Many dealers have encouraged customers to place orders for the exact vehicle they want if it’s not available on the lot. As a result, many new vehicles arriving at dealer lots have already been sold, and the ones that aren’t spoken for aren’t available for long,” said Manzi. According to J.D. Power, 33.4% of vehicles sold in May 2021 sat on the lot less than 10 days, up from 18.2% in May 2019. (Whither US Vehicle Sales in 2021? Is 14 Million a Stretch?)

Retail demand has been roaring, with many reports of the most popular models selling at or above MSRP. With such strong demand, OEMs cut incentive spending more in May. Average incentive spending per unit, per J.D. Power, is forecast to total $2,957—down from $4,825 in May 2020 and $3,878 in May 2019.

“With no end in sight for the supply shortage as sales volumes outpace new-vehicle production, June will likely be a tough month for many dealers. Vehicle production probably won’t improve significantly until later this summer, as supply shortages persist for the rest of the year,” said Manzi.

Therefore prices will rise…

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.