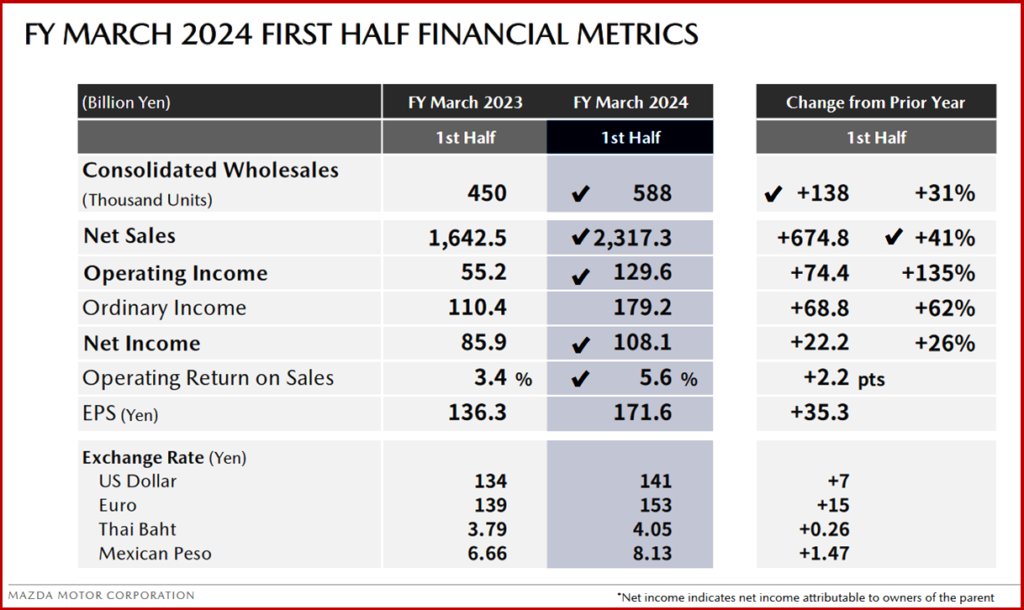

Mazda Motor Corporation in Japan (Tokyo Stock Exchange Code No. 7261) posted record highs record highs for all profit line items for the first half of the Japanese fiscal year (April – September 2023). Net sales of ¥2,317.3 billion led to an operating income ¥129.6 billion, and net income ¥108.1 billion (~$7.2B). New SUVs, especially in North America, resulted in a strong per-unit revenue. Foreign exchange also contributed to the results. Global sales were 616,000 units, up 20% year on year, or ~100,000 units.

“Through the introduction of our Large product CX-90, following the introduction of the CX-60, and ongoing strong performance of mainstay products such as the CX-5, global sales volume increased 20% from the prior year. Other contributing factors were an improvement in market mix with a 40% year-on-year increase in sales in North America, mainly in the high-profit US market,” said Masahiro Moro, President and CEO Mazda Motor Corporation.

Click to enlarge.

FY Ending March 2024 First Half Results

- Operating income was 129.6 billion yen, up from 55.2 billion yen in the prior year, and net income attributable to owners of the parent was 108.1 billion yen. Including net sales, all of these figures were record highs for the first half of the year.

- As a result, operating income and net income attributable to owners of the parent for the first half reached 72% and 83% respectively of the full year forecast announced in May.

- Although the suspension of operations due to typhoons and tight logistics prevented us from reaching our production and wholesale unit targets, we achieved record highs for per-unit revenue and variable profit.

- Through the introduction of our Large product CX-90, following the introduction of the CX-60, and ongoing strong performance of mainstay products such as the CX-5, global sales volume increased 20% from the prior year. Other contributing factors were an improvement in market mix with a 40% year-on-year increase in sales in North America, mainly in the high-profit US market, our efforts to improve per-unit price, and recent foreign exchange rates.

- We realize these results reflect the efforts of a host of people including our business partners, dealers and employees, and we would like to express our sincere gratitude to them.

- In the second half, we plan to increase CX-50 production at our Alabama plant, where we have commenced two-shift operations, and to ramp up production of Large products. We expect solid sales to continue mainly in markets such as North America, Australia and Europe.

- In the second half, although we assume that the yen will appreciate from what it was in the first half, we expect stable performance.

- Accordingly, we will revise our full-year outlook upward and take on the challenge of achieving net sales of 4.8 trillion yen, operating income of 250 billion yen, and net income attributable to owners of the parent of 170 billion yen, all of which are record highs for Mazda.

- Regarding dividends, the interim dividend is up 5 yen to 25 yen per share, and the year-end dividend forecast is 25 yen per share. We will decide on the year-end dividend amount after comprehensively considering business progress in the second half, future growth investment, and other factors.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Mazda Posts Net Income of $7.2 Billion for First Half of Japanese Fiscal Year

Mazda Motor Corporation in Japan (Tokyo Stock Exchange Code No. 7261) posted record highs record highs for all profit line items for the first half of the Japanese fiscal year (April – September 2023). Net sales of ¥2,317.3 billion led to an operating income ¥129.6 billion, and net income ¥108.1 billion (~$7.2B). New SUVs, especially in North America, resulted in a strong per-unit revenue. Foreign exchange also contributed to the results. Global sales were 616,000 units, up 20% year on year, or ~100,000 units.

“Through the introduction of our Large product CX-90, following the introduction of the CX-60, and ongoing strong performance of mainstay products such as the CX-5, global sales volume increased 20% from the prior year. Other contributing factors were an improvement in market mix with a 40% year-on-year increase in sales in North America, mainly in the high-profit US market,” said Masahiro Moro, President and CEO Mazda Motor Corporation.

Click to enlarge.

FY Ending March 2024 First Half Results

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.