Click to Enlarge.

The LMC consultancy says that it does not currently anticipate any excess downtime due to the COVID-19 pandemic, but there is no denying that the risk remains.

It’s tough to ignore the mounting number of cases and the rising death toll unless you are the president. Deaths from the virus have exceeded 1,000 for a week with no end in sight – for the first time since May. Covid cases continue to flood the US with more than 4.6 million people infected with the virus, according to the CDC.

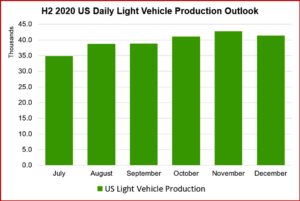

LMC notes that projected regional and export demand, along with inventory replenishment, has it forecast that US automakers will produce nearly 40,000 vehicles daily in the second half of 2020.

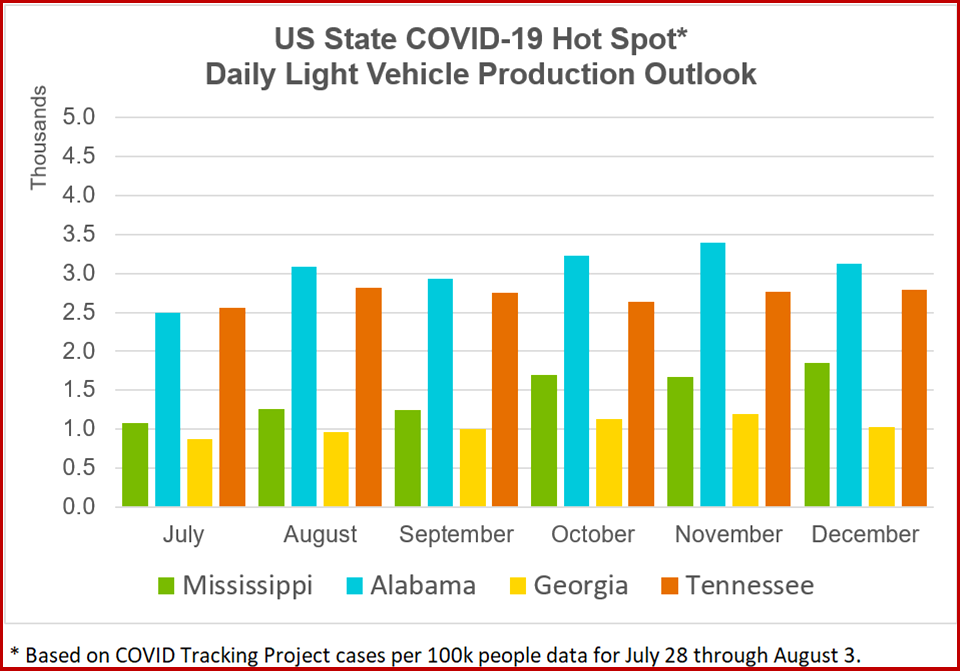

Southern auto plants in COVID hotspots make some very profitable vehicles. But for how long?

“Based on an average plant working week of 5.5 days, a halt of all US production for a week would cost the industry about 220,000 vehicles. In the case of a localized outbreak, with only 20% of the plants suspended, then we would lose roughly 45,000 units of production in that same week,” says. Bill Rinna, Director of Americas Vehicle Forecasts at LMC.

However, not all months are created equal. “the impact of a shutdown would depend upon its timing – from a volume standpoint, a closure in the month of October would be worse than in September, for example.”

Not all plants are created equal either. The suspension of Ford’s Kentucky Truck plant, which builds 1,400 Ford Super Duties, Expeditions and Lincoln Navigators on a daily basis, would have a far greater impact than, say, if production were to be halted at GM’s Orion plant, which builds the Chevrolet Bolt and soon-to-be-discontinued Sonic at a rate of around 250 units a day.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Auto Plant Downtime Looming as COVID-19 Thrives?

Click to Enlarge.

The LMC consultancy says that it does not currently anticipate any excess downtime due to the COVID-19 pandemic, but there is no denying that the risk remains.

It’s tough to ignore the mounting number of cases and the rising death toll unless you are the president. Deaths from the virus have exceeded 1,000 for a week with no end in sight – for the first time since May. Covid cases continue to flood the US with more than 4.6 million people infected with the virus, according to the CDC.

LMC notes that projected regional and export demand, along with inventory replenishment, has it forecast that US automakers will produce nearly 40,000 vehicles daily in the second half of 2020.

Southern auto plants in COVID hotspots make some very profitable vehicles. But for how long?

“Based on an average plant working week of 5.5 days, a halt of all US production for a week would cost the industry about 220,000 vehicles. In the case of a localized outbreak, with only 20% of the plants suspended, then we would lose roughly 45,000 units of production in that same week,” says. Bill Rinna, Director of Americas Vehicle Forecasts at LMC.

However, not all months are created equal. “the impact of a shutdown would depend upon its timing – from a volume standpoint, a closure in the month of October would be worse than in September, for example.”

Not all plants are created equal either. The suspension of Ford’s Kentucky Truck plant, which builds 1,400 Ford Super Duties, Expeditions and Lincoln Navigators on a daily basis, would have a far greater impact than, say, if production were to be halted at GM’s Orion plant, which builds the Chevrolet Bolt and soon-to-be-discontinued Sonic at a rate of around 250 units a day.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.