Click to Enlarge.

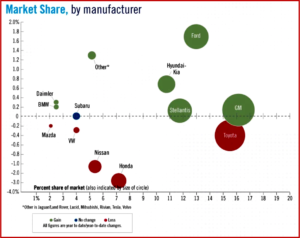

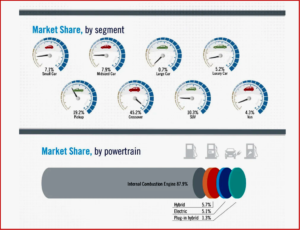

As the seasons turn, the US light vehicle market continues to exhibit mixed signals this year with often conflicting or seemingly wrong trends and developments.

New light-vehicle sales in September 2022 resulted in a SAAR of 13.5 million units. This was an increase of 9.6% from a year ago. The increase in volume, along with record transaction prices, result in consumers on a pace to spend ~$43.7 billion on new vehicles in September – the highest level ever in September and a 12% increase from September 2021.

However, September 2021 was the weakest since May 2020, because of pandemic induced supply chain disruptions and parts shortages, which saw the lowest saleable inventory for more than three decades.

Click to Enlarge.

“While not a return to normal by any means, inventory levels at the end of September 2022 should be above the bottom seen a year ago and should be higher than the end of August 2022’s 1.27 million units on the ground and in transit. September 2022’s sales brought the Q3 2022 average SAAR to 13.3 million units, roughly flat compared with Q2. Sales in September continued to be limited by available inventory but were also impacted somewhat by Hurricane Ian. Despite improvements to vehicle availability, some consumers may be stepping back from the current market and its higher-trimmed, higher-priced mix of vehicles,” said Patrick Manzi, Chief Economist for the National Automobile dealers Association.

The paradox revolves around transaction prices. They were close to record levels in September. J.D. Power said the average new-vehicle transaction price is projected to reach $45,622, up 10.3% year-over-year and the fourth-highest price ever. There is evidence of some consumer hesitation because of the mix of available vehicles, but it hasn’t been enough to change OEM incentive spending.

Average incentive spending per unit is expected to total $936, down 47.8% year-over-year – the fifth straight month of sub-$1000 average incentive spending per J.D. Power. As the Federal Reserve continues to increase the federal funds rate to allegedly cool inflation – a questionable proposition according to some economists, rates for new- and used-vehicle finance contracts have also risen. According to J.D. Power, the average interest rate on a new-vehicle finance contract will likely reach 5.71% in September. The month’s average interest rate would represent an increase of 169 basis points from September. (see AutoInformed: US July Sales Forecast Down. Prices, Profits Still Records; Record September for US New-Vehicle Spending at $45,622)

The outlook? “For the rest of 2022, we expect that inventory levels will continue to increase slowly but steadily, hopefully providing consumers with more vehicle choices. The Fed will likely push rates even higher at its final two meetings of the year, putting even more upward pressure on consumers’ average monthly payments. New light-vehicle sales should end the year down from 2021’s full- year total, but we still foresee 2022 as being another great year for America’s franchised dealers,” said Manzi.

The lingering question is the effect on working people who need vehicles?

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

NADA Cautious on 2022 US Light Vehicle Sales Outlook

Click to Enlarge.

As the seasons turn, the US light vehicle market continues to exhibit mixed signals this year with often conflicting or seemingly wrong trends and developments.

New light-vehicle sales in September 2022 resulted in a SAAR of 13.5 million units. This was an increase of 9.6% from a year ago. The increase in volume, along with record transaction prices, result in consumers on a pace to spend ~$43.7 billion on new vehicles in September – the highest level ever in September and a 12% increase from September 2021.

However, September 2021 was the weakest since May 2020, because of pandemic induced supply chain disruptions and parts shortages, which saw the lowest saleable inventory for more than three decades.

Click to Enlarge.

“While not a return to normal by any means, inventory levels at the end of September 2022 should be above the bottom seen a year ago and should be higher than the end of August 2022’s 1.27 million units on the ground and in transit. September 2022’s sales brought the Q3 2022 average SAAR to 13.3 million units, roughly flat compared with Q2. Sales in September continued to be limited by available inventory but were also impacted somewhat by Hurricane Ian. Despite improvements to vehicle availability, some consumers may be stepping back from the current market and its higher-trimmed, higher-priced mix of vehicles,” said Patrick Manzi, Chief Economist for the National Automobile dealers Association.

The paradox revolves around transaction prices. They were close to record levels in September. J.D. Power said the average new-vehicle transaction price is projected to reach $45,622, up 10.3% year-over-year and the fourth-highest price ever. There is evidence of some consumer hesitation because of the mix of available vehicles, but it hasn’t been enough to change OEM incentive spending.

Average incentive spending per unit is expected to total $936, down 47.8% year-over-year – the fifth straight month of sub-$1000 average incentive spending per J.D. Power. As the Federal Reserve continues to increase the federal funds rate to allegedly cool inflation – a questionable proposition according to some economists, rates for new- and used-vehicle finance contracts have also risen. According to J.D. Power, the average interest rate on a new-vehicle finance contract will likely reach 5.71% in September. The month’s average interest rate would represent an increase of 169 basis points from September. (see AutoInformed: US July Sales Forecast Down. Prices, Profits Still Records; Record September for US New-Vehicle Spending at $45,622)

The outlook? “For the rest of 2022, we expect that inventory levels will continue to increase slowly but steadily, hopefully providing consumers with more vehicle choices. The Fed will likely push rates even higher at its final two meetings of the year, putting even more upward pressure on consumers’ average monthly payments. New light-vehicle sales should end the year down from 2021’s full- year total, but we still foresee 2022 as being another great year for America’s franchised dealers,” said Manzi.

The lingering question is the effect on working people who need vehicles?

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.