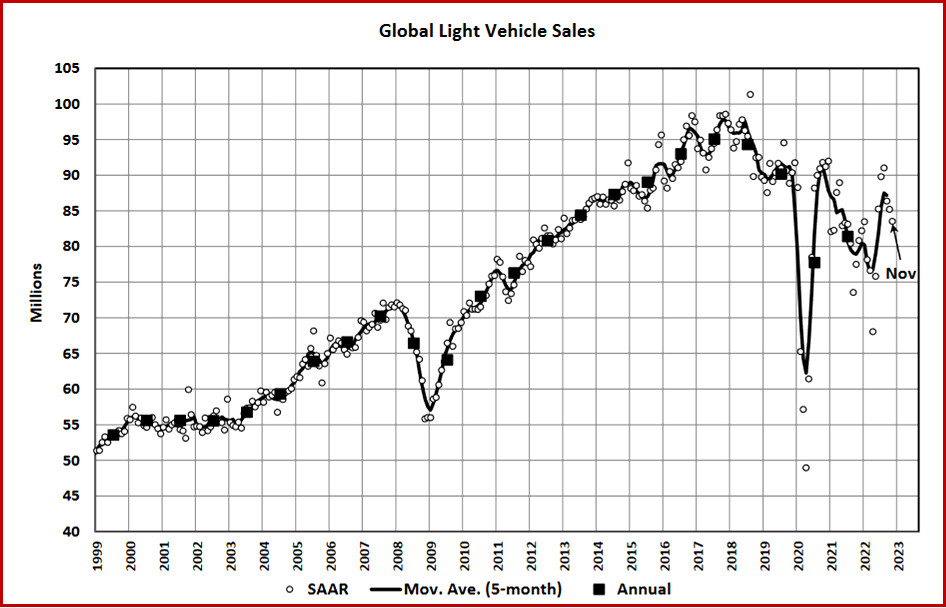

November’s Global Light Vehicle (LV) selling rate eased back to 84 million units/year from October’s revised 85 million units/year, according to data and analysis just released by the LMC Automotive consultancy.*

In gross registration terms, November rose 3.2% YoY (year-on-year) to 7 million units. The year-to-date (YTD) figure now stands at under 1% below the corresponding period in 2021, though this is a weak base for comparison., LMC noted. China’s market decelerated sharply in November. In YoY terms, sales fell by 7% in November, ending five straight months of strong rebound. North America and Europe are still struggling YTD as supply-side factors continue to hamper sales.

Click for more information.

North America

US Light Vehicle (LV) sales grew by 11.6% YoY in November, to 1.1 million units. The YoY gain was largely a result of weak sales a year ago, while the selling rate fell from 15.2 million units/year in October to 14.2 million units/year in November. Inventory levels are climbing, but average transaction prices hit a new all‐time record in November, at US$46,246. Fleet sales are picking up some of the slack from the retail market, accounting for around 18.4% of volumes in November, the highest share since March 2020.

Initial estimates put Canadian sales at 126k units in November, a YoY gain of 9.8%. The selling rate is thought to have slipped to 1.67 million units/year, from 1.72 million units/year in October. Again, the YoY comparison is flattered by a slump in Q4 2021 amid the worst of the inventory shortages. In Mexico, sales were up by 15.7% YoY in November, to 95k units, but the selling rate slowed to 1.0 million units/year, from 1.1 million units/year in October.

Europe

The West European selling rate rose to 13.8 million units/year in November – the second strongest performance of the year behind August. In raw monthly registration terms, November increased 15% YoY, with 1.1 million cars registered. Year‐to‐date (YTD), however, the market remains down (‐8% YoY) owing to vehicle supply constraints hampering market activity.

The East European selling rate grew slightly from the previous month to 3.0 million units/year. Despite the increase in sales for November, the market is still down 28% YTD due to the war in Ukraine restricting supplies and sanctions decimating Russia’s sales.

China

The Chinese market decelerated sharply in November, amid sporadic lock-downs across the country and an increasingly uncertain economic outlook. Preliminary data indicates that the November selling rate was 24.9 million units/year, down 12% from a robust October. In YoY terms, sales (i.e., wholesales) fell by 7% in November, ending five straight months of strong rebound. Both production and sales were disrupted by COVID‐19 outbreaks and lock-downs in major cities, including Guangdong and Chongqing. Reportedly more than 40% of dealerships in the country had to suspend operations last month.

New Electric Vehicle sales, however, continued to perform relatively well. According to advance data, NEV sales expanded by 58% YoY in November, led by BYD and Tesla, and accounted for almost 29% of Passenger Vehicle sales. The government has extended the temporary purchase tax exemptions for NEVs until December 2023, which should continue to support NEV sales next year. Looking ahead, the abrupt end of the zero‐COVID policy and surging infections raise a concern for the near‐term sales outlook.

Elsewhere in Asia

In Japan, the selling rate accelerated to 4.8 million units/year, the highest rate since April 2021. Continuing improvements in component supplies helped boost production and thus sales, especially for Mini Vehicles (which account for about 40% of total LV sales). Demand continues to outstrip supply as consumers face extended delivery times for their vehicles. Despite the improvements, sales contracted by 6% YTD. The market is heading for a worst sales year since 2011, the year of Tohoku earthquake and tsunami.

In Korea, too, sales gathered momentum in the run‐up to the expiry of the temporary excise tax cut at the end of this year. The November selling rate reached 1.8 million units/year, the highest rate since early 2021, boosted by strong sales of imported vehicles. In contrast, sales growth of domestically built vehicles was modest, despite production having expanded by 25%. Prior to the unionized truckers’ strike, Hyundai and Kia built up inventory, but prioritized the export markets leaving low supply for the local market.

South America

Brazilian LV sales increased by 18.7% YoY in November, to 192k units, while the selling rate accelerated to 2.3 million units/year, from 2.0 million units/year in October, the strongest rate since February 2021. The start of the FIFA World Cup did not appear to hinder the market, as it has on previous occasions, but some of these November sales were likely delayed from October, due to the election and subsequent protests.

In Argentina, sales are estimated to have grown by 20.1% YoY in November, to 31k units. The selling rate improved to 428k units/year in November, from 401k units/year in October. This was the fastest selling rate since November 2020. Despite government restrictions, imported models gained slightly last month, enabling this relatively upbeat result.

AutoInformed on

*LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, the acclaimed Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

November Global Light Vehicle Selling Rate Lessens

November’s Global Light Vehicle (LV) selling rate eased back to 84 million units/year from October’s revised 85 million units/year, according to data and analysis just released by the LMC Automotive consultancy.*

In gross registration terms, November rose 3.2% YoY (year-on-year) to 7 million units. The year-to-date (YTD) figure now stands at under 1% below the corresponding period in 2021, though this is a weak base for comparison., LMC noted. China’s market decelerated sharply in November. In YoY terms, sales fell by 7% in November, ending five straight months of strong rebound. North America and Europe are still struggling YTD as supply-side factors continue to hamper sales.

Click for more information.

North America

US Light Vehicle (LV) sales grew by 11.6% YoY in November, to 1.1 million units. The YoY gain was largely a result of weak sales a year ago, while the selling rate fell from 15.2 million units/year in October to 14.2 million units/year in November. Inventory levels are climbing, but average transaction prices hit a new all‐time record in November, at US$46,246. Fleet sales are picking up some of the slack from the retail market, accounting for around 18.4% of volumes in November, the highest share since March 2020.

Initial estimates put Canadian sales at 126k units in November, a YoY gain of 9.8%. The selling rate is thought to have slipped to 1.67 million units/year, from 1.72 million units/year in October. Again, the YoY comparison is flattered by a slump in Q4 2021 amid the worst of the inventory shortages. In Mexico, sales were up by 15.7% YoY in November, to 95k units, but the selling rate slowed to 1.0 million units/year, from 1.1 million units/year in October.

Europe

The West European selling rate rose to 13.8 million units/year in November – the second strongest performance of the year behind August. In raw monthly registration terms, November increased 15% YoY, with 1.1 million cars registered. Year‐to‐date (YTD), however, the market remains down (‐8% YoY) owing to vehicle supply constraints hampering market activity.

The East European selling rate grew slightly from the previous month to 3.0 million units/year. Despite the increase in sales for November, the market is still down 28% YTD due to the war in Ukraine restricting supplies and sanctions decimating Russia’s sales.

China

The Chinese market decelerated sharply in November, amid sporadic lock-downs across the country and an increasingly uncertain economic outlook. Preliminary data indicates that the November selling rate was 24.9 million units/year, down 12% from a robust October. In YoY terms, sales (i.e., wholesales) fell by 7% in November, ending five straight months of strong rebound. Both production and sales were disrupted by COVID‐19 outbreaks and lock-downs in major cities, including Guangdong and Chongqing. Reportedly more than 40% of dealerships in the country had to suspend operations last month.

New Electric Vehicle sales, however, continued to perform relatively well. According to advance data, NEV sales expanded by 58% YoY in November, led by BYD and Tesla, and accounted for almost 29% of Passenger Vehicle sales. The government has extended the temporary purchase tax exemptions for NEVs until December 2023, which should continue to support NEV sales next year. Looking ahead, the abrupt end of the zero‐COVID policy and surging infections raise a concern for the near‐term sales outlook.

Elsewhere in Asia

In Japan, the selling rate accelerated to 4.8 million units/year, the highest rate since April 2021. Continuing improvements in component supplies helped boost production and thus sales, especially for Mini Vehicles (which account for about 40% of total LV sales). Demand continues to outstrip supply as consumers face extended delivery times for their vehicles. Despite the improvements, sales contracted by 6% YTD. The market is heading for a worst sales year since 2011, the year of Tohoku earthquake and tsunami.

In Korea, too, sales gathered momentum in the run‐up to the expiry of the temporary excise tax cut at the end of this year. The November selling rate reached 1.8 million units/year, the highest rate since early 2021, boosted by strong sales of imported vehicles. In contrast, sales growth of domestically built vehicles was modest, despite production having expanded by 25%. Prior to the unionized truckers’ strike, Hyundai and Kia built up inventory, but prioritized the export markets leaving low supply for the local market.

South America

Brazilian LV sales increased by 18.7% YoY in November, to 192k units, while the selling rate accelerated to 2.3 million units/year, from 2.0 million units/year in October, the strongest rate since February 2021. The start of the FIFA World Cup did not appear to hinder the market, as it has on previous occasions, but some of these November sales were likely delayed from October, due to the election and subsequent protests.

In Argentina, sales are estimated to have grown by 20.1% YoY in November, to 31k units. The selling rate improved to 428k units/year in November, from 401k units/year in October. This was the fastest selling rate since November 2020. Despite government restrictions, imported models gained slightly last month, enabling this relatively upbeat result.

AutoInformed on

*LMC Automotive

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

The Global Light Vehicle Sales Forecast is published in association with Jato Dynamics Ltd. It uses macro-economic forecasts generated by LMC’s partner, the acclaimed Oxford Economics, which, combined with an examination of demographics, fiscal and regulatory influences by LMC’s own specialist automotive research team, presents twelve-year forecasts at a global, regional and country level for Light Vehicle demand in 137 countries.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.