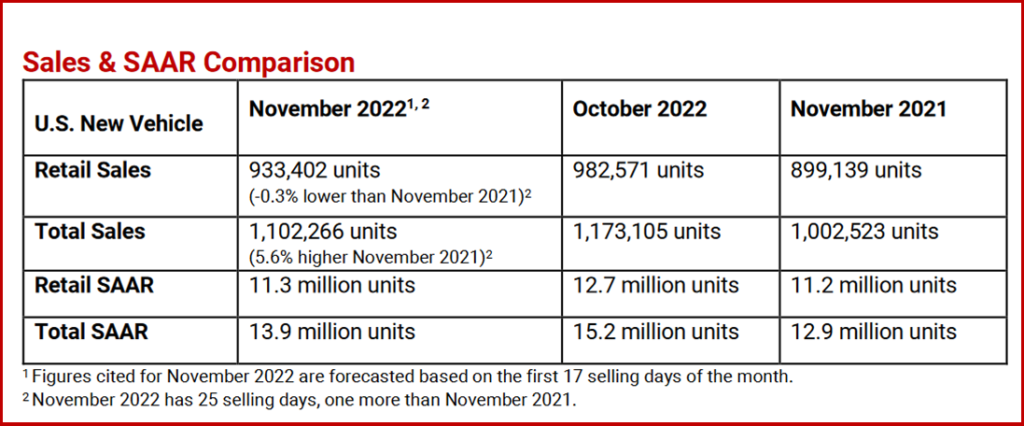

Retail sales of new vehicles this month are expected to reach 933,400, a 0.3% decrease from November 2021, according to a joint forecast from J.D. Power and LMC Automotive just released. November 2022 has one additional selling day than November 2021. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 3.8% from 2021.

New-vehicle transaction prices continue to rise, but slower than earlier this year. The average price in November will set a record for the month of $45,872, an increase of 3.1% from a year ago. The record transaction prices mean that buyers are predicted to spend nearly $42.8 billion on new vehicles this month, the highest level ever for the month of November and a 7.0% increase from November 2021 as the Biden Administration recovery continues.

Click for more information.

“November results demonstrate that vehicle production is continuing to improve, with available retail inventory exceeding one million units for a second consecutive month and a larger share of manufacturers’ production being allocated to fleet customers. The increased production is enabling a 9.9% increase in total vehicle sales (non-selling day adjusted) for the month of November,” said Thomas King, president of the data and analytics division at J.D. Power.

“Dealer profits are falling but remain extraordinarily strong. Total retailer profit per unit, inclusive of grosses and finance and insurance income, is on pace to be $4359, down 15.4% from a year ago, but still more than double 2019 levels. The decline is due primarily to fewer vehicles being sold above MSRP. In November, nearly 41% of new vehicles are being sold above MSRP, which is down from 50% in July 2022,” said King.

Total aggregate retailer profit from new-vehicle sales for the month of November is projected to be down 12.2% from November 2021, reaching $4.1 billion, the second-best November on record.

US Sales Executive Summary

- The average new-vehicle retail transaction price in November is expected to reach $45,872, a 3.1% increase from November 2021. The previous high for any month, $46,171, was set in July 2022.

- Average incentive spending per unit in November is expected to reach $1,009, down from $1,551 in November 2021. Spending as a percentage of the average MSRP is expected to fall to 2.2%, down 1.3 percentage points from November 2021.

- Average incentive spending per unit on trucks/SUVs in November is expected to be $1,024, down $525 from a year ago, while the average spending on cars is expected to be $1,014, down $544 from a year ago.

- Retail buyers are on pace to spend $42.8 billion on new vehicles, up $2.8 billion from November 2021.

- Truck/SUVs are on pace to account for 77.6% of new-vehicle retail sales in November.

- Fleet sales are expected to total 168,900 units in November, up 56.8% from November 2021 on a selling day adjusted basis. Fleet volume is expected to account for 15% of total light-vehicle sales, up from 10% a year ago.

- Average interest rates for new vehicle loans are expected to increase to 6.37%, 238 basis points higher than a year ago.

Global Sales Outlook

“October was in line with expectations and, at a selling rate of 85.4 million units, was up nearly 8 million units from October 2021. Sales volume increased 10% from a year ago but year-to-date volume was down 1% and remained 10% lower than pre-pandemic year-to-date 2019. High-growth markets include India (27%), North America (14%) and Western Europe (12%). China saw a cooling of the growth rate for a third consecutive month but was still up nearly 8% from a year ago,” said Jeff Schuster, president, global forecasts, LMC Automotive.

“The selling rate is expected to increase slightly in November to 86.5 million units but volume growth from November 2021 is expected to be moderate at 8%. The potential for new lock-downs in China and a rail strike in the United States add some risk to the outlook for November and December, but inventory is generally improving.

“The full-year outlook for 2022 has slipped to 81.5 million units, which is just 70,000 units higher than 2021. In 2023, we expect to see a re-balancing of supply and demand, and the overall volume effect due to supply disruption should fall to 2.9 million units from 7.3 million units in 2022. The 2023 outlook is tempered slightly by weakening economic conditions, down to 84.6 million units from our previous forecast. The market remains quite dynamic as some improving variables are countered by negative ones,” Schuster said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

November US New Vehicle Sales Forecast Record Consumer Spending of $42.8B. Global Sales Good, but Fluid

Retail sales of new vehicles this month are expected to reach 933,400, a 0.3% decrease from November 2021, according to a joint forecast from J.D. Power and LMC Automotive just released. November 2022 has one additional selling day than November 2021. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 3.8% from 2021.

New-vehicle transaction prices continue to rise, but slower than earlier this year. The average price in November will set a record for the month of $45,872, an increase of 3.1% from a year ago. The record transaction prices mean that buyers are predicted to spend nearly $42.8 billion on new vehicles this month, the highest level ever for the month of November and a 7.0% increase from November 2021 as the Biden Administration recovery continues.

Click for more information.

“November results demonstrate that vehicle production is continuing to improve, with available retail inventory exceeding one million units for a second consecutive month and a larger share of manufacturers’ production being allocated to fleet customers. The increased production is enabling a 9.9% increase in total vehicle sales (non-selling day adjusted) for the month of November,” said Thomas King, president of the data and analytics division at J.D. Power.

“Dealer profits are falling but remain extraordinarily strong. Total retailer profit per unit, inclusive of grosses and finance and insurance income, is on pace to be $4359, down 15.4% from a year ago, but still more than double 2019 levels. The decline is due primarily to fewer vehicles being sold above MSRP. In November, nearly 41% of new vehicles are being sold above MSRP, which is down from 50% in July 2022,” said King.

Total aggregate retailer profit from new-vehicle sales for the month of November is projected to be down 12.2% from November 2021, reaching $4.1 billion, the second-best November on record.

US Sales Executive Summary

Global Sales Outlook

“October was in line with expectations and, at a selling rate of 85.4 million units, was up nearly 8 million units from October 2021. Sales volume increased 10% from a year ago but year-to-date volume was down 1% and remained 10% lower than pre-pandemic year-to-date 2019. High-growth markets include India (27%), North America (14%) and Western Europe (12%). China saw a cooling of the growth rate for a third consecutive month but was still up nearly 8% from a year ago,” said Jeff Schuster, president, global forecasts, LMC Automotive.

“The selling rate is expected to increase slightly in November to 86.5 million units but volume growth from November 2021 is expected to be moderate at 8%. The potential for new lock-downs in China and a rail strike in the United States add some risk to the outlook for November and December, but inventory is generally improving.

“The full-year outlook for 2022 has slipped to 81.5 million units, which is just 70,000 units higher than 2021. In 2023, we expect to see a re-balancing of supply and demand, and the overall volume effect due to supply disruption should fall to 2.9 million units from 7.3 million units in 2022. The 2023 outlook is tempered slightly by weakening economic conditions, down to 84.6 million units from our previous forecast. The market remains quite dynamic as some improving variables are countered by negative ones,” Schuster said.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.