Click to Enlarge.

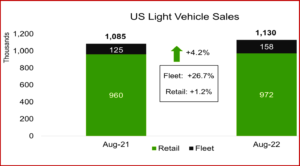

Thanks to an accounting quirk, US Light Vehicle sales were up by 4% YoY compared to August 2021. This positive number comes from a weak 2021 base and an extra selling day, instead of a real recovery of the market, according to an analysis by LMC Automotive* just released. However, actual volumes in the last three months have been flat at ~1.13 million units.

Perhaps in an inadvertent nod to the ongoing Biden Administration recovery, LMC observed that “the sales ranking resembled normal times, with General Motors, Toyota and the Ford F-150 leading the sales charts by OEM, brand and model, respectively. This was Kia’s best-ever August, and the brand moved into the fourth position in terms of sales volume last month. Trucks accounted for 79% of sales.”

August is traditionally one of the strongest months of the year. Not this weak year, sales were lower just in 2010, 2011 and 2021. The month brought the accumulated sales volume to just over 9 million units, a decline of 15% from the first eight months of 2021.

“The industry is still struggling with the combination of lean inventories, very expensive vehicles, and higher interest rates. Yet, stable sales for three months are not a bad sign considering all these negatives factors and suggest that demand remains higher than supply,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive

“Nevertheless, OEMs are performing very differently. Honda faced the steepest decline in sales in August, down by 38% YoY, while Tesla sales soared by 86% from August 2021. General Motors and Hyundai had better results than in July, but Toyota, Ford and Stellantis sold fewer vehicles in August from the previous month. GM was ahead of Toyota by more than 18,000 units last month and led the market with a 16.7% share. However, Toyota remained the most popular brand, outselling Ford by just 2,600 units,” said Amorim.

Compact Non-Premium SUV was the most popular segment in the country, accounting for 17.7% of sales – it gained 1.4 pp of share, more than any other segment. While Midsize Non-Premium SUV remained the second-largest segment and kept its share just over 16%, some of its key players continue to struggle with lean inventories. Large Pickup was the third-largest segment in August, accounting for 15% of total sales. Overall, Pickup sales were ahead of Car volumes by about 20,000 units.

With three months of flat volume and the daily selling rate at 43,500 during the summer, “little has changed at the US top-line level since earlier this year. The market remains constrained by supply, while some level of demand has also been pulled back. We now expect only a mild increase in the daily selling rate through the end of the year, which has triggered a further 200,000-unit cut to the 2022 forecast. 2022 US Light Vehicle volume is now at 13.8 million units, a decline from 2021 of 7%. As we progress toward the end of 2022, there is still 150,000 units of risk to the forecast. The weaker outlook continues into early 2023, resulting in a slight cut in the forecast to 15.4 million units from 15.5 million. Risk of nearly 500,000 units remains concentrated in the first half of 2023, given the high level of uncertainty,” LMC said.

“The US auto market is not expected to see much relief before the end 2022 or into early 2023. While the Fed walks a tightrope to keep the economy out of a traditional recession, risks are elevated throughout 2023. However, even if the market moves into recession, the auto industry is somewhat insulated from a pullback given the ongoing supply constraints. Capacity utilization is well below normal levels at 61% though as supply of parts improves, we could see an initial overbuild until the market finds the true level of underlying demand,’’ according to Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive.

The global Light Vehicle selling rate in July was 90.3 million units/year, exceeding the 90-million mark for the first time since December 2020. Volume increased by 5.1% to 6.9 million because of another record selling rate in China (37 million units/year). Other Asian markets helped with the gains in July: ASEAN market was up by 51% YoY and India and Korea both increasing by 17%. A continuing boost from China has increased the outlook for 2022 global Light Vehicle sales by 1 million units to 81.8 million, a meager increase of 0.4% from 2021.

*LMC Automotive is a leading independent and exclusively automotive-focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Parked: August US Light Vehicle Sales Still at 1.1M

Click to Enlarge.

Thanks to an accounting quirk, US Light Vehicle sales were up by 4% YoY compared to August 2021. This positive number comes from a weak 2021 base and an extra selling day, instead of a real recovery of the market, according to an analysis by LMC Automotive* just released. However, actual volumes in the last three months have been flat at ~1.13 million units.

Perhaps in an inadvertent nod to the ongoing Biden Administration recovery, LMC observed that “the sales ranking resembled normal times, with General Motors, Toyota and the Ford F-150 leading the sales charts by OEM, brand and model, respectively. This was Kia’s best-ever August, and the brand moved into the fourth position in terms of sales volume last month. Trucks accounted for 79% of sales.”

August is traditionally one of the strongest months of the year. Not this weak year, sales were lower just in 2010, 2011 and 2021. The month brought the accumulated sales volume to just over 9 million units, a decline of 15% from the first eight months of 2021.

“The industry is still struggling with the combination of lean inventories, very expensive vehicles, and higher interest rates. Yet, stable sales for three months are not a bad sign considering all these negatives factors and suggest that demand remains higher than supply,” said Augusto Amorim, Senior Manager, Americas Vehicle Sales Forecasts, LMC Automotive

“Nevertheless, OEMs are performing very differently. Honda faced the steepest decline in sales in August, down by 38% YoY, while Tesla sales soared by 86% from August 2021. General Motors and Hyundai had better results than in July, but Toyota, Ford and Stellantis sold fewer vehicles in August from the previous month. GM was ahead of Toyota by more than 18,000 units last month and led the market with a 16.7% share. However, Toyota remained the most popular brand, outselling Ford by just 2,600 units,” said Amorim.

Compact Non-Premium SUV was the most popular segment in the country, accounting for 17.7% of sales – it gained 1.4 pp of share, more than any other segment. While Midsize Non-Premium SUV remained the second-largest segment and kept its share just over 16%, some of its key players continue to struggle with lean inventories. Large Pickup was the third-largest segment in August, accounting for 15% of total sales. Overall, Pickup sales were ahead of Car volumes by about 20,000 units.

With three months of flat volume and the daily selling rate at 43,500 during the summer, “little has changed at the US top-line level since earlier this year. The market remains constrained by supply, while some level of demand has also been pulled back. We now expect only a mild increase in the daily selling rate through the end of the year, which has triggered a further 200,000-unit cut to the 2022 forecast. 2022 US Light Vehicle volume is now at 13.8 million units, a decline from 2021 of 7%. As we progress toward the end of 2022, there is still 150,000 units of risk to the forecast. The weaker outlook continues into early 2023, resulting in a slight cut in the forecast to 15.4 million units from 15.5 million. Risk of nearly 500,000 units remains concentrated in the first half of 2023, given the high level of uncertainty,” LMC said.

“The US auto market is not expected to see much relief before the end 2022 or into early 2023. While the Fed walks a tightrope to keep the economy out of a traditional recession, risks are elevated throughout 2023. However, even if the market moves into recession, the auto industry is somewhat insulated from a pullback given the ongoing supply constraints. Capacity utilization is well below normal levels at 61% though as supply of parts improves, we could see an initial overbuild until the market finds the true level of underlying demand,’’ according to Jeff Schuster, President, Americas Operations and Global Vehicle Forecasts, LMC Automotive.

The global Light Vehicle selling rate in July was 90.3 million units/year, exceeding the 90-million mark for the first time since December 2020. Volume increased by 5.1% to 6.9 million because of another record selling rate in China (37 million units/year). Other Asian markets helped with the gains in July: ASEAN market was up by 51% YoY and India and Korea both increasing by 17%. A continuing boost from China has increased the outlook for 2022 global Light Vehicle sales by 1 million units to 81.8 million, a meager increase of 0.4% from 2021.

*LMC Automotive is a leading independent and exclusively automotive-focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s client base from around the globe includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group. LMC is the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.