Click chart for more information.

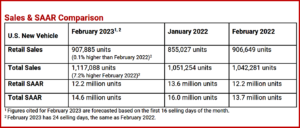

New-vehicle sales in the US for February, including retail and non-retail transactions, are projected to reach 1,117,100 units, a 7.2% increase from February 2022, according to a joint forecast from J.D. Power and LMC Automotive* just released. (autoinformed.com on: January US Vehicle Sales Up as Transaction Prices Hit Record)

Retail sales of new vehicles this month are expected to reach 907,900 units, a 0.1% increase from February 2022. New-vehicle transaction prices continue to rise, with the average price reaching a February record of $46,229, a 4.8% increase from a year ago. Consumers are forecast to spend ~$42.0 billion on new vehicles this month—the most ever for the month of February and an increase of 5.0% from February 2022, as the Biden Administration economic recovery continues.

“Despite economic headwinds, the auto industry is on track to deliver year-over-year sales growth alongside record transaction prices and record consumer expenditures for the month of February. Improving vehicle availability is allowing more retail and fleet customers who have been waiting on the sidelines to finally buy a new vehicle,” said Thomas King, president of the data and analytics division at J.D. Power.

“The February total sales growth is due primarily to increased sales to fleet customers—up 54%—as manufacturers increase production and make more vehicles available to this segment of the industry. Availability for retail customers is improving but remains extremely low, which is keeping prices and dealer profitability well above historic levels,” King said.

“As expected with improved supply, dealer profits are taking a step back but remain well above pre-pandemic levels. Total retailer profit per unit—inclusive of grosses and finance and insurance income—is on pace to be $3,820. This is down 23.3% from a year ago but still more than double 2019. The decline is due primarily to fewer vehicles being sold above MSRP. In February, 31% of new vehicles are being sold above MSRP, down from the high of 48% in July 2022.,” King said. “Total aggregate retailer profit from new-vehicle sales for the month of February is projected to be down 23.2% from February 2022, reaching $3.5 billion for the second-highest February on record.”

“Manufacturer discounts are up slightly from a month ago, but they remain historically low. The average incentive spend per vehicle is tracking toward $1,335, a 4.7% increase from a year ago. Incentive spending per vehicle expressed as a percentage of the average vehicle MSRP is trending at 2.8%, down 0.1 percentage points from February 2022. One of the factors contributing to the low level of spending is the absence of discounts on vehicles that are leased. This month, leasing is accounting for just 18% of retail sales. In February 2019, leases accounted for 31% of all new-vehicle retail sales,” King said.

Electric Vehicles

“The U.S. electric vehicle infrastructure and charging network will be put to the test in 2023,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. Retail share of battery electric vehicles (BEVs) in the United States is on track to end February at a record 8.5%, an increase of 74% from February 2022. Including plug-in hybrids (PHEVs), share for electric vehicles will exceed 10% for the first time. This surge in demand for vehicles follows consumers having higher satisfaction with Level 2 charging in Q4 2022, but the industry must address declining satisfaction with DCFC fast charging or risk getting out over their skis with EV owners.

“Satisfaction with the condition of L2 chargers and cost of charging improved, driven by upgrades made by network operators. A good portion of the decline of L2 charging earlier in the year was attributed to the cost of charging, but now in comparison to high DCFC charging costs, L2 charging looks like a bargain. In contrast, DCFC customer satisfaction declined 14 points in Q4 2022, driven by cost, availability and speed. Customers are not experiencing the full charging rate at all DCFC chargers, either due to vehicle limitations or demand control by charging network or utility provider.

“Having lost ground, Tesla has emerged as the most-considered EV brand among shoppers, with 44% either ‘very likely’ or ‘somewhat likely’ to consider the brand for their next EV purchase.

“Availability of EVs is improving. According to the J.D. Power EV Index, overall EV availability has increased 5 index points, driven largely by an increase of lower-priced, lower trim-level versions of popular models, such as the Ford F-150 Lightning,” said Krear.

Global Sales Forecast

“Global light-vehicle sales in February are forecast to be positive, with volume forecast to increase 7%. However, the selling rate is expected to retreat to below 80 million units, just 200,000 units above February 2022. Eastern Europe remains the drag on global volume with an expected decline of 22% from a year ago,” said Jeff Schuster, group head and executive vice president, automotive at GlobalData, parent of LMC Automotive. (autoinformed.com on: January Global Light Vehicle Sales Flat at 83 Million)

“The forecast for 2023 is holding at a 6% increase, with global light-vehicle sales rounding up to 85.9 million units. While the outlook still bears a high level of uncertainty, disruption is easing some and other risks also appear to be more balanced. Markets are resilient and economies around the world are holding up fairly well, which should keep the automotive recovery on track,” Schuster said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Recession? US Consumer Auto Spending at Record Levels

Click chart for more information.

New-vehicle sales in the US for February, including retail and non-retail transactions, are projected to reach 1,117,100 units, a 7.2% increase from February 2022, according to a joint forecast from J.D. Power and LMC Automotive* just released. (autoinformed.com on: January US Vehicle Sales Up as Transaction Prices Hit Record)

Retail sales of new vehicles this month are expected to reach 907,900 units, a 0.1% increase from February 2022. New-vehicle transaction prices continue to rise, with the average price reaching a February record of $46,229, a 4.8% increase from a year ago. Consumers are forecast to spend ~$42.0 billion on new vehicles this month—the most ever for the month of February and an increase of 5.0% from February 2022, as the Biden Administration economic recovery continues.

“Despite economic headwinds, the auto industry is on track to deliver year-over-year sales growth alongside record transaction prices and record consumer expenditures for the month of February. Improving vehicle availability is allowing more retail and fleet customers who have been waiting on the sidelines to finally buy a new vehicle,” said Thomas King, president of the data and analytics division at J.D. Power.

“The February total sales growth is due primarily to increased sales to fleet customers—up 54%—as manufacturers increase production and make more vehicles available to this segment of the industry. Availability for retail customers is improving but remains extremely low, which is keeping prices and dealer profitability well above historic levels,” King said.

“As expected with improved supply, dealer profits are taking a step back but remain well above pre-pandemic levels. Total retailer profit per unit—inclusive of grosses and finance and insurance income—is on pace to be $3,820. This is down 23.3% from a year ago but still more than double 2019. The decline is due primarily to fewer vehicles being sold above MSRP. In February, 31% of new vehicles are being sold above MSRP, down from the high of 48% in July 2022.,” King said. “Total aggregate retailer profit from new-vehicle sales for the month of February is projected to be down 23.2% from February 2022, reaching $3.5 billion for the second-highest February on record.”

“Manufacturer discounts are up slightly from a month ago, but they remain historically low. The average incentive spend per vehicle is tracking toward $1,335, a 4.7% increase from a year ago. Incentive spending per vehicle expressed as a percentage of the average vehicle MSRP is trending at 2.8%, down 0.1 percentage points from February 2022. One of the factors contributing to the low level of spending is the absence of discounts on vehicles that are leased. This month, leasing is accounting for just 18% of retail sales. In February 2019, leases accounted for 31% of all new-vehicle retail sales,” King said.

Electric Vehicles

“The U.S. electric vehicle infrastructure and charging network will be put to the test in 2023,” said Elizabeth Krear, vice president, electric vehicle practice at J.D. Power. Retail share of battery electric vehicles (BEVs) in the United States is on track to end February at a record 8.5%, an increase of 74% from February 2022. Including plug-in hybrids (PHEVs), share for electric vehicles will exceed 10% for the first time. This surge in demand for vehicles follows consumers having higher satisfaction with Level 2 charging in Q4 2022, but the industry must address declining satisfaction with DCFC fast charging or risk getting out over their skis with EV owners.

“Satisfaction with the condition of L2 chargers and cost of charging improved, driven by upgrades made by network operators. A good portion of the decline of L2 charging earlier in the year was attributed to the cost of charging, but now in comparison to high DCFC charging costs, L2 charging looks like a bargain. In contrast, DCFC customer satisfaction declined 14 points in Q4 2022, driven by cost, availability and speed. Customers are not experiencing the full charging rate at all DCFC chargers, either due to vehicle limitations or demand control by charging network or utility provider.

“Having lost ground, Tesla has emerged as the most-considered EV brand among shoppers, with 44% either ‘very likely’ or ‘somewhat likely’ to consider the brand for their next EV purchase.

“Availability of EVs is improving. According to the J.D. Power EV Index, overall EV availability has increased 5 index points, driven largely by an increase of lower-priced, lower trim-level versions of popular models, such as the Ford F-150 Lightning,” said Krear.

Global Sales Forecast

“Global light-vehicle sales in February are forecast to be positive, with volume forecast to increase 7%. However, the selling rate is expected to retreat to below 80 million units, just 200,000 units above February 2022. Eastern Europe remains the drag on global volume with an expected decline of 22% from a year ago,” said Jeff Schuster, group head and executive vice president, automotive at GlobalData, parent of LMC Automotive. (autoinformed.com on: January Global Light Vehicle Sales Flat at 83 Million)

“The forecast for 2023 is holding at a 6% increase, with global light-vehicle sales rounding up to 85.9 million units. While the outlook still bears a high level of uncertainty, disruption is easing some and other risks also appear to be more balanced. Markets are resilient and economies around the world are holding up fairly well, which should keep the automotive recovery on track,” Schuster said.

*LMC Automotive – a GlobalData Company

LMC Automotive is a leading independent and exclusively automotive focused provider of global forecasting and market intelligence in the areas of vehicle sales, production, powertrains and electrification. The company’s global client base includes car and truck makers, component manufacturers and suppliers, financial, logistics and government institutions. LMC Automotive is part of the LMC group, as is J.D. Power. LMC is also the world’s leading economic and business consultancy for the agribusiness sector. For more information about LMC Automotive, visit www.lmc-auto.com. or contact LMC directly at forecasting@lmc-auto.com.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.