The Securities and Exchange Commission announced today charges against global mining and metals company, Rio Tinto, for violations of the Foreign Corrupt Practices Act (FCPA) arising out of a bribery scheme involving a consultant in Guinea. The company has agreed to pay a $15 million civil penalty to settle the SEC’s charges.

Ford Motor* (NYSE: F) and Stellantis** (NYSE: STLA), among other large international corporations, have supply contracts or business relationships with the mining conglomerate involving electric vehicle battery materials. Whether this is a bum in the road or a longer-term impediment to EV advancement is an open and ongoing matter subject to debate in industrial and public policy sectors.

Rio Tinto has agreed to pay a $15 million civil penalty to settle the SEC’s charges. The SEC’s order finds that, in July 2011, Rio Tinto hired a French investment banker and close friend of a former senior Guinean government official as a consultant to help the company retain its mining rights in the Simandou mountain region in Guinea. The consultant began working on behalf of Rio Tinto without a written agreement defining the scope of his services or deliverables.

Eventually the mining rights were retained, and the consultant was paid $10.5 million for his services, which Rio Tinto never verified. The SEC’s investigation uncovered that the consultant, acting as Rio Tinto’s agent, offered and attempted to make an improper payment of at least $822,000 to a Guinean government official in connection with the consultant’s efforts to help Rio Tinto retain its mining rights. Furthermore, none of the payments to the consultant was accurately reflected in Rio Tinto’s books and records, and the company failed to have sufficient internal accounting controls in place to detect or prevent the misconduct. The mine has not been developed by Rio Tinto.

“Even well-designed controls need committed managers to be effective,” said Charles E. Cain, Chief of the SEC Division of Enforcement’s FCPA Unit. “Here, deficient controls were no match for managers determined to hire a consultant whose only ostensible qua

Rio Tinto consented to the SEC’s order without admitting or denying the findings that it violated the books and records and internal accounting controls provisions of the Securities Exchange Act of 1934 and agreed to pay a $15 million civil penalty.

The SEC’s investigation was conducted by Sana Muttalib and was supervised by Ansu N. Banerjee. The SEC appreciates the assistance of Australian Securities & Investments Commission, the Australian Federal Police, and the United Kingdom Serious Fraud Office.

*Ford has a MOU with Rio Tinto, exploring a significant lithium off-take agreement from its Rincon project in Argentina. This is part of a multi-metal MOU that leverages the scale of Ford’s aluminum business and includes a potential opportunity on copper.

Click for more information.

**Stellantis the mega merger of Fiat Chrysler and Peugeot – last week announced a$155 million investment in EV batteries by acquiring a 14.2% equity stake in McEwen Copper, a subsidiary of Canadian mining company McEwen Mining. McEwen owns the Los Azules project in Argentina and the Elder Creek project in Nevada, US. With this investment, Stellantis will become McEwen Copper’s second largest shareholder, along with Rio Tinto, through its copper leaching technology venture, Nuton. Los Azules plans to produce 100,000 tons per year of cathode copper at 99.9% purity starting in 2027. The resources can secure the operation for at least 33 years, Stellantis** said. Its brands include Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys.

McEwen Copper

McEwen Copper Inc. holds 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA. Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.2 billion pounds at a grade of 0.48% Cu (Indicated category) and an additional 19.3 billion pounds at a grade of 0.33% Cu (Inferred category).

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

SEC Charges Mining Company Rio Tinto with Bribery

The Securities and Exchange Commission announced today charges against global mining and metals company, Rio Tinto, for violations of the Foreign Corrupt Practices Act (FCPA) arising out of a bribery scheme involving a consultant in Guinea. The company has agreed to pay a $15 million civil penalty to settle the SEC’s charges.

Ford Motor* (NYSE: F) and Stellantis** (NYSE: STLA), among other large international corporations, have supply contracts or business relationships with the mining conglomerate involving electric vehicle battery materials. Whether this is a bum in the road or a longer-term impediment to EV advancement is an open and ongoing matter subject to debate in industrial and public policy sectors.

Rio Tinto has agreed to pay a $15 million civil penalty to settle the SEC’s charges. The SEC’s order finds that, in July 2011, Rio Tinto hired a French investment banker and close friend of a former senior Guinean government official as a consultant to help the company retain its mining rights in the Simandou mountain region in Guinea. The consultant began working on behalf of Rio Tinto without a written agreement defining the scope of his services or deliverables.

Eventually the mining rights were retained, and the consultant was paid $10.5 million for his services, which Rio Tinto never verified. The SEC’s investigation uncovered that the consultant, acting as Rio Tinto’s agent, offered and attempted to make an improper payment of at least $822,000 to a Guinean government official in connection with the consultant’s efforts to help Rio Tinto retain its mining rights. Furthermore, none of the payments to the consultant was accurately reflected in Rio Tinto’s books and records, and the company failed to have sufficient internal accounting controls in place to detect or prevent the misconduct. The mine has not been developed by Rio Tinto.

“Even well-designed controls need committed managers to be effective,” said Charles E. Cain, Chief of the SEC Division of Enforcement’s FCPA Unit. “Here, deficient controls were no match for managers determined to hire a consultant whose only ostensible qua

Rio Tinto consented to the SEC’s order without admitting or denying the findings that it violated the books and records and internal accounting controls provisions of the Securities Exchange Act of 1934 and agreed to pay a $15 million civil penalty.

The SEC’s investigation was conducted by Sana Muttalib and was supervised by Ansu N. Banerjee. The SEC appreciates the assistance of Australian Securities & Investments Commission, the Australian Federal Police, and the United Kingdom Serious Fraud Office.

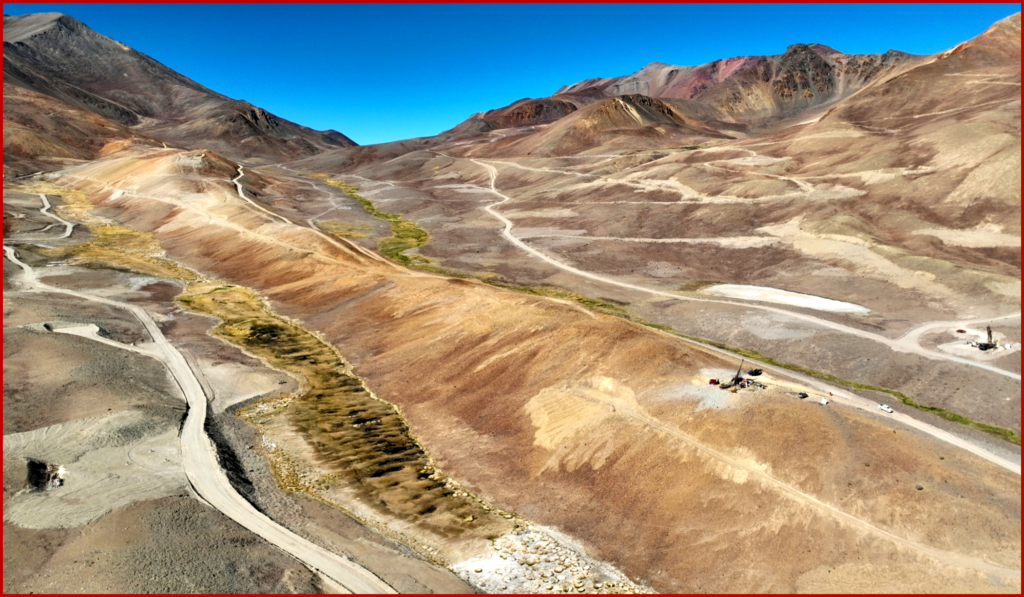

*Ford has a MOU with Rio Tinto, exploring a significant lithium off-take agreement from its Rincon project in Argentina. This is part of a multi-metal MOU that leverages the scale of Ford’s aluminum business and includes a potential opportunity on copper.

Click for more information.

**Stellantis the mega merger of Fiat Chrysler and Peugeot – last week announced a$155 million investment in EV batteries by acquiring a 14.2% equity stake in McEwen Copper, a subsidiary of Canadian mining company McEwen Mining. McEwen owns the Los Azules project in Argentina and the Elder Creek project in Nevada, US. With this investment, Stellantis will become McEwen Copper’s second largest shareholder, along with Rio Tinto, through its copper leaching technology venture, Nuton. Los Azules plans to produce 100,000 tons per year of cathode copper at 99.9% purity starting in 2027. The resources can secure the operation for at least 33 years, Stellantis** said. Its brands include Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys.

McEwen Copper

McEwen Copper Inc. holds 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA. Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.2 billion pounds at a grade of 0.48% Cu (Indicated category) and an additional 19.3 billion pounds at a grade of 0.33% Cu (Inferred category).

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.