Click for more.

US Light Vehicle (LV) sales fell by 0.4% YoY in July, to 1.30 million. When sales contracted in June largely as the result of the CDK cyberattack,* it was expected by industry soothsayers that the market would experience a significant rebound in July. It didn’t happen. According to preliminary estimates released today by the respected GlobalData** consultancy, Light Vehicle (LV) sales fell by 0.4% YoY.

“According to initial estimates, retail sales totaled 1,148,000 units in July, while fleet sales finished at 152,000 units, accounting for 11.7% of total volumes. The low fleet total was likely due to a greater focus on serving retail customers whose purchases were delayed by the CDK cyberattack in June,” GlobalData said.

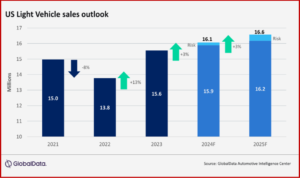

In July, it is estimated that US inventory levels contracted by 4% month-on-month as production aligned with demand. The days’ supply is also expected to have decreased from 56 days in June to 50-52 days in July. Concurrently, demand appears to be stabilizing at the current level. Looking forward, there is believed to be sufficient industry-wide inventory to meet demand. Consequently, some production balancing at the brand and segment level is likely during the remainder of the year and into 2025, unless strong demand growth resumes, GlobalData said. This appears to be unlikely given that the Federal Reserve despite clear indications that the economy is approaching a recession is doing nothing to cut interest rates in AutoInformed’s view.

GlobalData Observations

- There was little change in the relative performance of the largest-volume OEMs in July, as compared to the preceding months. GM led the market on 212,000 units, around ~30,000 ahead of Toyota Group, with Ford Group in third place on 167,000. At a brand level, however, Ford topped the rankings on 159,000 units, ~ 6,000 ahead of Toyota. This was the first time that Ford had outsold Toyota since February. Chevrolet was the third best-selling brand at 134,000.

- The Toyota RAV4 has become accustomed to being either number one or two in the sales rankings in recent months, but the Compact SUV finished third in July – the first time since June 2023 that the model has not been at least second. The FordF-150 is thought to have been the nation’s best- selling Light Vehicle in July, on 39,000 just ahead of the Tesla Model Y, estimated at 38,200, while the RAV4 was at 35,600.

- The hot streak that Compact Non-Premium SUVs have enjoyed recently continued to cool. The segment accounted for 19.9% of the total market, its lowest share since August 2023.

- The Mid-size Non-Premium SUV segment also performed relatively poorly in July at 14.8% of the market, its lowest share since December 2019.

- Large Pickups accounted for 13.9% of total sales, “a good return by recent standards,” but slightly down on the segment’s 14.1% share in June.

“While the Federal Reserve is indicating upcoming rate cuts and the overall economy is heading towards a soft landing, the concept of a rolling recession and vulnerabilities in certain sectors could materialize. Lower transaction prices and availability of affordable vehicles are crucial in reigniting growth in LV sales. The forecast remains optimistic, although it has slightly tempered over the next 18 months, “said Jeff Schuster, Vice President Research and Analysis, Automotive at GlobalData.

“Only the small-car and CUV segment posted year-over-year market share gains, while all other major segments posted declines. This shift helps illustrate the demand for more affordable models. While new-vehicle inventory has increased steadily throughout the year, much of the mix on dealer lots now is skewed toward more expensive models. The lack of more affordable choices is likely limiting sales overall. We expect final inventory for July to be flat or down slightly by the time final data are tallied,” said Patrick Manzi, chief economist of the National Automobile Dealers Association.

*CDK, a global company, is employed by ~15,000 automotive dealers and larger dealership groups with so-called dealership management systems ( aka DMS) in the United States. CDK’s products include targeted marketing, as well as systems for sales, financing, insuring, parts supply, repair, as well the maintenance and registration of vehicles. Some estimates have dealership losses at more than $1 billion. Let the lawsuits begin,” – AutoCrat.

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Soothsayer Shortfall – US Light Vehicle Sales Flat in July

Click for more.

US Light Vehicle (LV) sales fell by 0.4% YoY in July, to 1.30 million. When sales contracted in June largely as the result of the CDK cyberattack,* it was expected by industry soothsayers that the market would experience a significant rebound in July. It didn’t happen. According to preliminary estimates released today by the respected GlobalData** consultancy, Light Vehicle (LV) sales fell by 0.4% YoY.

“According to initial estimates, retail sales totaled 1,148,000 units in July, while fleet sales finished at 152,000 units, accounting for 11.7% of total volumes. The low fleet total was likely due to a greater focus on serving retail customers whose purchases were delayed by the CDK cyberattack in June,” GlobalData said.

In July, it is estimated that US inventory levels contracted by 4% month-on-month as production aligned with demand. The days’ supply is also expected to have decreased from 56 days in June to 50-52 days in July. Concurrently, demand appears to be stabilizing at the current level. Looking forward, there is believed to be sufficient industry-wide inventory to meet demand. Consequently, some production balancing at the brand and segment level is likely during the remainder of the year and into 2025, unless strong demand growth resumes, GlobalData said. This appears to be unlikely given that the Federal Reserve despite clear indications that the economy is approaching a recession is doing nothing to cut interest rates in AutoInformed’s view.

GlobalData Observations

“While the Federal Reserve is indicating upcoming rate cuts and the overall economy is heading towards a soft landing, the concept of a rolling recession and vulnerabilities in certain sectors could materialize. Lower transaction prices and availability of affordable vehicles are crucial in reigniting growth in LV sales. The forecast remains optimistic, although it has slightly tempered over the next 18 months, “said Jeff Schuster, Vice President Research and Analysis, Automotive at GlobalData.

“Only the small-car and CUV segment posted year-over-year market share gains, while all other major segments posted declines. This shift helps illustrate the demand for more affordable models. While new-vehicle inventory has increased steadily throughout the year, much of the mix on dealer lots now is skewed toward more expensive models. The lack of more affordable choices is likely limiting sales overall. We expect final inventory for July to be flat or down slightly by the time final data are tallied,” said Patrick Manzi, chief economist of the National Automobile Dealers Association.

*CDK, a global company, is employed by ~15,000 automotive dealers and larger dealership groups with so-called dealership management systems ( aka DMS) in the United States. CDK’s products include targeted marketing, as well as systems for sales, financing, insuring, parts supply, repair, as well the maintenance and registration of vehicles. Some estimates have dealership losses at more than $1 billion. Let the lawsuits begin,” – AutoCrat.

**GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.” J.D. Power is also part of GlobalData. Inquiries at: customersuccess.automotive@globaldata.com.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.