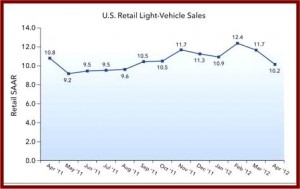

New-vehicle retail sales in April are projected to decrease by 600,000 units on a seasonally adjusted annualized rate (SAAR) to 10.2 million units when compared to April of 2011. Nevertheless, volume is expected to increase by 8% (selling day adjusted at 24 versus 27), which is the same as the year-over-year auto sales increase of 8% in the first quarter. A higher fleet mix continues into April, though, with fleet volume expected to represent 21% of all light vehicle sales.

The real question is what happens in May, after three straight months of SAAR declines – will it plummet like last May or continue what is a slow recovery in auto sales? Most automakers remain cautious about this year, with retail sales projected to be less than 11.5 or 12 million units.

In April, auto industry growth has been in less profitable non-luxury vehicle segments. The luxury segment share of industry retail sales in April to date is 10.8%, down from 12.1% in April 2011.

“While April is typically a challenging month to draw comparisons with because the Easter holiday some years falls in April and other years in March, the signs of sustained growth are evident,” claims John Humphrey, senior vice president of global automotive operations at J.D. Power and Associates.

Humphrey says the decline in luxury share of retail sales is one of the reasons why lease penetration is down in April, as the luxury market typically has a higher lease penetration than the non-luxury market. Through the first 15 selling days in April, lease penetration overall is 17.7%, the lowest level since December 2009 and down from 20.2% in April 2011.

The issue here is money. Even rich people are apparently now concerned about the large depreciation rates of their luxury vehicles, which drives up the cost of ownership as trade-in values or lease residuals droop. The improved content and features in recent non-luxury vehicles offer a better value for consumers returning to the marketplace, especially if their needs are not ego driven. The problem for automakers is compounded by market forces, which are prompting free maintenance and longer warranties on non-luxury cars, once the sole province of expensive vehicles.

Based on the first quarter 2012 selling pace – 14.5 million units total and 11.7 million units retail – LMC Automotive, which owns Power, is raising its light-vehicle sales forecast for the full year. The current forecast is now at 14.3 million total light vehicles, up 200,000 vehicles, and 11.5 million retail light vehicles, up from 11.4 million units. An increase in fleet sales to 20% of total sales for the year is expected to outpace the increase in retail volume for 2012.