Click for more.

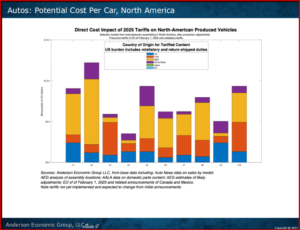

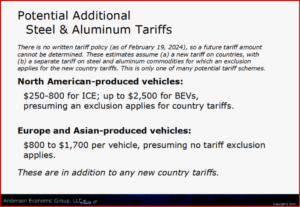

Despite all the legal and political controversies surrounding the Trump Administration’s trade and tariff policies, there is emerging clarity in one area with a high potential for damaging the auto industry and the U.S. economy. Anderson Economic Group identified the threat of tariffs as a “two-alarm fire for the auto industry” in November 2024. It recently estimated the costs per car of tariffs on Mexico and Canada at $4000 to $10,000, based on its analysis of ten different vehicles from multiple manufacturers.

“The Trade Expansion Act (TEA) has clear statutory authority. It’s been used before. It’ll probably be used again, whether now or next year, said Patrick Anderson,* Anderson Economic Group CEO today speaking to the Automotive Press Association.

“It’s commonly called section 232, but it’s traditionally section 232. We have been advising our clients back in December to expect given the President’s statements about this time that you would could see. The President asked for reports from the Commerce Secretary, in particular, about the impact of imports and whether this represented a problem for the United States.** In fact, the President on Inauguration Day signed Memorandum directing the Treasury and Commerce to review this set April deadline for the reports. (Perhaps April Fools’ Day is ironically appropriate here – AutoCrat)

Click to Enlarge.

“This mechanism is in play right now. So even though there might be these other things that are coming up, I would suggest keep your eye on TEA section 232 in these reports coming out in April, because, unquestionably, the president has authority to use that. – to adjust imports through tariffs,” said Anderson.

The revision of the USMCA as it is called in the United States. (Anderson noted that one of the interesting things about this particular trade agreement is we can call it the US. Canada. Agreement. Canada can call it the Canada, US, Mexico Agreement, and Mexico can call it the Mexico US, Canada Agreement.)

“The timeline for this is we started this negotiation on Inauguration Day. The last item here, if you look at the Memorandum of February 13th. From the president, he has asked again for reports and cited other reports, including TA Section 232 and in Section 2 of that he says that we should study tariffs and value added taxes … The identification of value added tax is a potential tariff like barrier that we should we in the United States should consider,” said Anderson.

“The threat of tariffs has yet to become specific, but the daily chaos from Washington seems to be negatively impacting consumer sentiment more than anything else. With lower auto loan rates now looking less likely in the future as well, we have a current environment where consumers are deciding it is better to buy sooner rather than later, all else being equal,” said Jonathan Smoke, Chief Economist at Cox Automotive in his market analysis earlier this week.

“The delays and uncertainty are doing no one any favors, and there is little automakers can do in the near term, as changing sourcing and/or production sites is not an easy task and costly as well. Ultimately, the North American market has long approached the automotive industry as an integrated and complex vehicle supply and assembly partnership. Every automaker is at risk in some way here and, more importantly, has a critical supply chain already facing inflation, labor unrest, and affordability challenges. Tariffs across North America won’t just impact the ‘big guys,’ because there are countless small businesses in all three countries that have worked together for decades to produce some of the market’s most affordable vehicles,” added Erin Keating, Executive Analyst at Cox.

*Michigan-based Anderson Economic Group LLC is one of the industry’s leading experts, and has estimated the costs of strikes, compared the fueling costs for EVs and ICE vehicles, and identified the stakes facing the U.S. auto industry as it faces steel and aluminum tariffs as well as potential 25% tariffs on all goods from Canada and Mexico.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Tariffs – Trump’s Next Economic Disaster Looming

Click for more.

Despite all the legal and political controversies surrounding the Trump Administration’s trade and tariff policies, there is emerging clarity in one area with a high potential for damaging the auto industry and the U.S. economy. Anderson Economic Group identified the threat of tariffs as a “two-alarm fire for the auto industry” in November 2024. It recently estimated the costs per car of tariffs on Mexico and Canada at $4000 to $10,000, based on its analysis of ten different vehicles from multiple manufacturers.

“The Trade Expansion Act (TEA) has clear statutory authority. It’s been used before. It’ll probably be used again, whether now or next year, said Patrick Anderson,* Anderson Economic Group CEO today speaking to the Automotive Press Association.

“It’s commonly called section 232, but it’s traditionally section 232. We have been advising our clients back in December to expect given the President’s statements about this time that you would could see. The President asked for reports from the Commerce Secretary, in particular, about the impact of imports and whether this represented a problem for the United States.** In fact, the President on Inauguration Day signed Memorandum directing the Treasury and Commerce to review this set April deadline for the reports. (Perhaps April Fools’ Day is ironically appropriate here – AutoCrat)

Click to Enlarge.

“This mechanism is in play right now. So even though there might be these other things that are coming up, I would suggest keep your eye on TEA section 232 in these reports coming out in April, because, unquestionably, the president has authority to use that. – to adjust imports through tariffs,” said Anderson.

The revision of the USMCA as it is called in the United States. (Anderson noted that one of the interesting things about this particular trade agreement is we can call it the US. Canada. Agreement. Canada can call it the Canada, US, Mexico Agreement, and Mexico can call it the Mexico US, Canada Agreement.)

“The timeline for this is we started this negotiation on Inauguration Day. The last item here, if you look at the Memorandum of February 13th. From the president, he has asked again for reports and cited other reports, including TA Section 232 and in Section 2 of that he says that we should study tariffs and value added taxes … The identification of value added tax is a potential tariff like barrier that we should we in the United States should consider,” said Anderson.

“The threat of tariffs has yet to become specific, but the daily chaos from Washington seems to be negatively impacting consumer sentiment more than anything else. With lower auto loan rates now looking less likely in the future as well, we have a current environment where consumers are deciding it is better to buy sooner rather than later, all else being equal,” said Jonathan Smoke, Chief Economist at Cox Automotive in his market analysis earlier this week.

“The delays and uncertainty are doing no one any favors, and there is little automakers can do in the near term, as changing sourcing and/or production sites is not an easy task and costly as well. Ultimately, the North American market has long approached the automotive industry as an integrated and complex vehicle supply and assembly partnership. Every automaker is at risk in some way here and, more importantly, has a critical supply chain already facing inflation, labor unrest, and affordability challenges. Tariffs across North America won’t just impact the ‘big guys,’ because there are countless small businesses in all three countries that have worked together for decades to produce some of the market’s most affordable vehicles,” added Erin Keating, Executive Analyst at Cox.

*Michigan-based Anderson Economic Group LLC is one of the industry’s leading experts, and has estimated the costs of strikes, compared the fueling costs for EVs and ICE vehicles, and identified the stakes facing the U.S. auto industry as it faces steel and aluminum tariffs as well as potential 25% tariffs on all goods from Canada and Mexico.

**AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.