The federal budget deficit was $867 billion for the first 10 months of fiscal year 2019, the Congressional Budget Office estimates. This, gulp,is $184 billion more than the deficit recorded during the same period last year. Revenues were $92 billion higher, and outlays were $276 billion higher than in the same period in fiscal year 2018. So much for Republican lip service that claimed deficits were bad. The annual interest payments on the debt are now $479 billion.

However, outlays in the first 10 months of last year were reduced by shifts in the timing of certain payments. If not for those shifts, the deficit for that period would have been $44 billion greater, and the increase in the deficit so far this year would have been $140 billion rather than $184 billion.

Total Receipts: Up +3% in the First 10 Months of Fiscal Year 2019

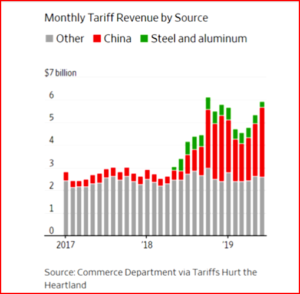

China now dominates monthly US tariff revenues. The tariffs are being passed on to U.S. customers of Chinese goods.

Receipts totaled $2,858 billion during the first 10 months of fiscal year 2019, CBO estimates—$92 billion or a mere +3% more during the same period last year. That increase was the result of changes in receipts from the following sources:

- Individual income and payroll taxes together rose by $78 billion(or 3%).

- Amounts withheld from workers’ paychecks rose by $51 billion (or 3%). That change largely reflects increases in wages and salaries that were partly offset by a decline in the share of income withheld for taxes. The Internal Revenue Service issued new withholding tables in January 2018 to reflect changes made by the 2017 tax act (Public Law 115-97). All employers were required to begin using the new tables by February 15, 2018. Those new withholding rates were in effect during the first 10 months of this fiscal year but for only five and a half months of the same period last year.

- Non-withheld payments of income and payroll taxes rose by $9 billion (or 1%).

- Income tax refunds were down by $22 billion (or 8%

- Corporate income taxes increased by $5 billion (or 3%). June was the first month in which receipts consisted mainly of estimated payments for tax year 2019.

- Revenues from other sources increased by $9 billion (or 4%), mostly as a result of increased collections of customs duties and excise taxes.

- Customs duties increased by $24 billion (or 74%), primarily because of new tariffs imposed by the Trump Administration during the past year.

- Excise taxes increased by $8 billion (or 12%), partly because of payments received in October for the tax on health insurance providers. In 2017, that tax was subject to a one-year moratorium that was lifted for 2018 but re-imposed for the current fiscal year.

- Revenue increases were partially offset by smaller remittances from the Federal Reserve to the Treasury. Remittances declined by $15 billion (or 25%), mainly because short-term interest rates have been higher, leading the central bank to pay depository institutions more interest on reserves.

- Estate and gift taxes decreased by $5 billion (or 28%), reflecting changes made by the 2017 tax act, which doubled the value of the estate tax exemption.

- Estimated Deficit in July 2019: $120 Billion

- The federal government realized a deficit of $120 billion in July 2019, CBO estimates—$43 billion more than the shortfall in July 2018.Outlays in July 2018 were affected by a shift to the previous month of certain federal payments that otherwise would have been due on the first weekend in July. If not for that shift, the deficit in July 2018 would have been $123 billion—$3 billion more than the deficit this July.

- CBO estimates that receipts in July 2019 totaled $249 billion—$24 billion (or 11%) more than those in the same month last year. An increase in individual income and payroll taxes of $19 billion (or 10%) accounts for most of that change, mainly because withheld taxes increased by $18 billion (or 10%). Part of that increase occurred because this July had one more business day.

- In addition, corporate income taxes were up by $3 billion (or 66%) and customs duties were up by $2 billion (or 47%).

Estimated Deficit in July 2019: $120 Billion

- The federal government realized a deficit of $120 billion in July 2019, CBO estimates—$43 billion more than the shortfall in July 2018.

- Outlays in July 2018 were affected by a shift to the previous month of certain federal payments that otherwise would have been due on the first weekend in July. If not for that shift, the deficit in July 2018 would have been $123 billion—$3 billion more than the deficit this July.

- CBO estimates that receipts in July 2019 totaled $249 billion—$24 billion (or 11%) more than those in the same month last year. An increase in individual income and payroll taxes of $19 billion (or 10%) accounts for most of that change, mainly because withheld taxes increased by $18 billion (or 10%). Part of that increase occurred because this July had one more business day. In addition, corporate income taxes were up by $3 billion (or 66%) and customs duties were up by $2 billion (or 47%).

Pingback: Biden’s Build Back Better Act Decreases Budget Deficit! | AutoInformed

Pingback: May US Budget Deficit, Gulp, $424 Billion | AutoInformed