Click to Enlarge.

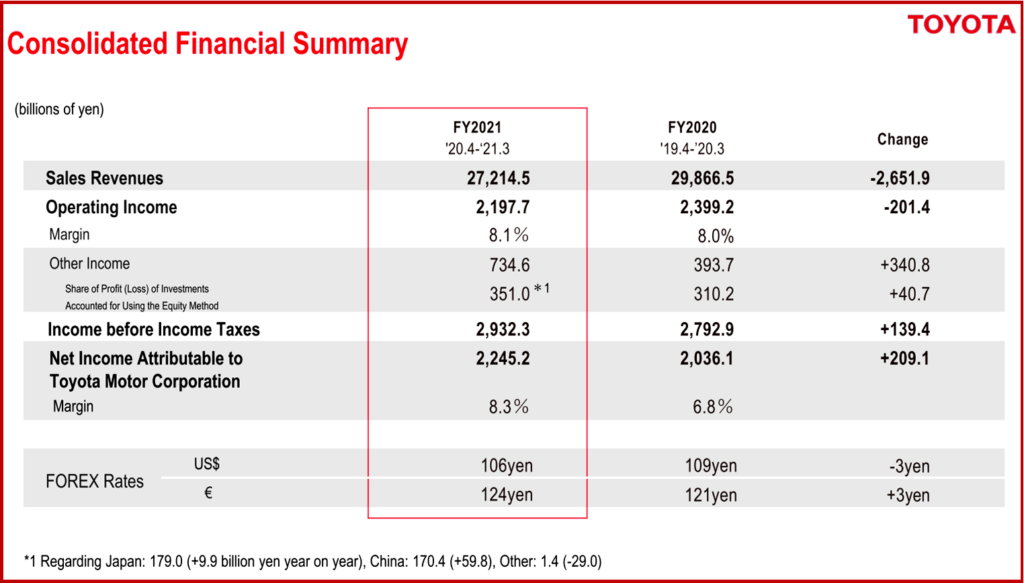

Toyota posted solid FY 2021 results this morning in Japan leaving other global automakers in the dust. The world’s top-selling automaker in 2020 at 9.5 million vehicles revealed consolidated financial results of: Sales revenue at 27 trillion 214.5 billion yen; Operating income of 2 trillion 197.7 billion yen; Pre-tax income of 2 trillion 932.3 billion yen and, Net income of 2 trillion 245.2 billion yen. Excluding the overall impact of foreign exchange rates, swap valuation gains and losses and other factors, operating income increased by 10-billion-yen year-on-year.

Although operating income significantly decreased in the first half of the fiscal year, it increased in the 2nd half. In Japan, Europe and other regions, operating income decreased mainly due to the decrease in sales volume. However, in North America and Asia, operating income increased year on year, thanks mainly to marketing efforts and cost reduction efforts. Toyota is also thus far unaffected by the semi-conductor shortage that is closing plants at competitors.

Factors which affected operating income compared year-on-year include:

- First, the effects of foreign exchange rates decreased operating income by 255 billion yen.

- Second, cost reduction efforts increased operating income by 150 billion yen.

- Third, the effects of marketing activities decreased operating income by 210 billion yen, largely due to the decrease in sales volume.

- Finally, a reduction in expenses increased operating income by 70 billion yen.

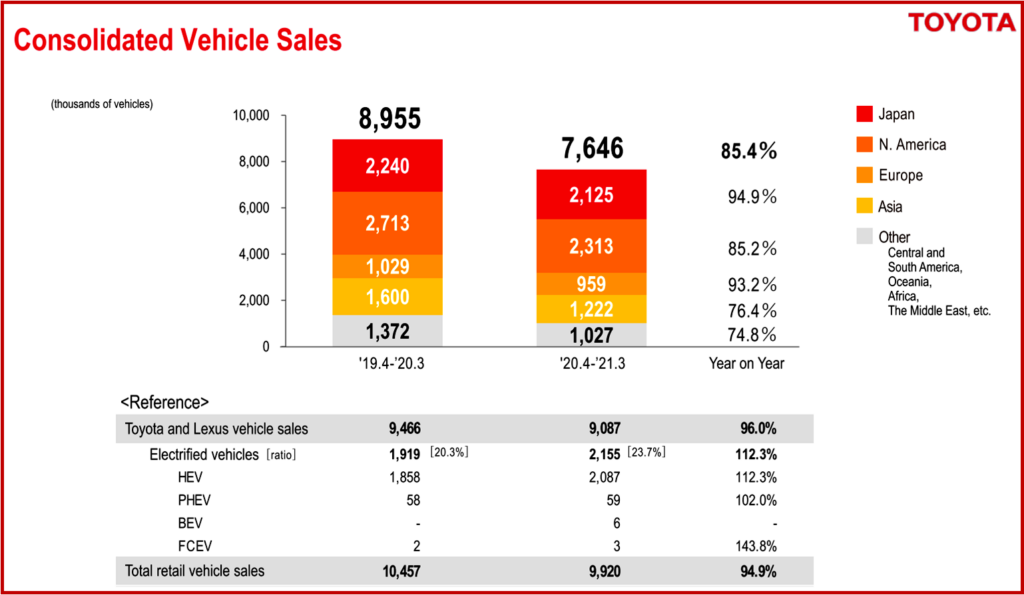

Because of the spread of COVID-19 in each region, sales volume declined significantly during the first half of the fiscal year, but in the 2nd half of the fiscal year, sales volume increased in many regions compared to the previous fiscal year.

Click to Enlarge.

In particular, sales of electrified vehicles of 2,155,000 units or 112.3% of the previous fiscal year presents a serious challenge to would be competitors who are late to a game that increasingly is the only game in town or will be given the trend of current regulations.

Toyota now plans to pay a year-end dividend of 135 yen per common share. Together with the interim dividend of 105 yen per common share, which included a special dividend of 5 yen, the annual dividend for the fiscal year will be 240 yen per common share, an increase of 20 yen per common share compared to the previous fiscal year, and the dividend pay-out ratio for the fiscal year will be 29.8%. “We will continue to aim to pay stable and sustainable dividends while maintaining and improving upon our consolidated dividend payout ratio benchmark of 30%,” Toyota said Kenta Kon CFO and clearly in AutoInformed’s view a candidate to succeed Akio Toyoda.

Toyota postponed share repurchase for the interim period of the fiscal year ended March 2021 due to the spread of COVID-19. Toyota now plans to buy back up to 250 billion yen’s worth. “We will continue to implement share repurchases in a flexible manner, taking into account various factors including investment in growth, dividend levels, liquidity, share price levels, and other factors,” said Kon.

“We will split our common shares at the ratio of 5 shares for each share with the record date of September 30, 2021. The purpose of the stock split is to reduce the minimum investment price, thereby creating an environment where it is easier to invest in our shares,” Kon said.

Toyota FY2022 Forecast

Consolidated vehicle sales for the fiscal year ending March 2022 are expected to be 8,700,000 units, which is 113.8% of sales of the previous fiscal year 2021. Vehicle sales are expected to increase in each region.

Toyota and Lexus brand vehicle sales are expected to be 9,600,000 units, or 105.6% of such sales during FY2021. electrified vehicles, are projected at 2,800,000 or 129.9% compared to FY2021. Toyota said the ratio of electrified vehicles will increase up to 29.2%.

Toyota has the world’s largest and rapidly expanding lineup of electrified vehicles, consisting of BEVs, HEVs, PHEVs, and FCEVs. Toyota has been working on electrification for nearly 25 years., Toyota’s technology is undisputedly world-class in AutoInformed’s opinion and strongly positioned to help different countries around the world reduce emissions and achieve Carbon Neutrality faster. This was all done before mandated rules by governments or the recent global movement and growing awareness of the need for Carbon Neutrality.

The forecast assumes exchange rates to be 105 yen per U.S. dollar and 125 yen per euro. Based on this, Toyota predicts:

- Net revenue of 30 trillion yen

- Operating income of 2 trillion 500 billion yen

- Pre-tax income of 3 trillion 110 billion yen and

- Net income of 2 trillion 300 billion yen

Toyota thinks that cost reduction efforts will decrease operating income by 135 billion yen, largely due to the significant negative impact of increased prices of materials, despite the planned improvement of around 300 billion yen on a gross basis. Toyota anticipates that marketing efforts will increase operating income by 850 billion yen, mainly due to an increase in sales volume. Also predicted is increase in expenses that will decrease operating income by 350 billion yen.

“This is because we are investing more resources than ever in carbon neutrality and digitalization. As a result, excluding the overall impact of foreign exchange rates, swap valuation gains and losses and other factors, operating income is expected to increase by 365 billion yen,” Kon said.

AutoInformed on Toyota

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Toyota FY2021- Net Profit Surges 10% on $20.6B in Revenue

Click to Enlarge.

Toyota posted solid FY 2021 results this morning in Japan leaving other global automakers in the dust. The world’s top-selling automaker in 2020 at 9.5 million vehicles revealed consolidated financial results of: Sales revenue at 27 trillion 214.5 billion yen; Operating income of 2 trillion 197.7 billion yen; Pre-tax income of 2 trillion 932.3 billion yen and, Net income of 2 trillion 245.2 billion yen. Excluding the overall impact of foreign exchange rates, swap valuation gains and losses and other factors, operating income increased by 10-billion-yen year-on-year.

Although operating income significantly decreased in the first half of the fiscal year, it increased in the 2nd half. In Japan, Europe and other regions, operating income decreased mainly due to the decrease in sales volume. However, in North America and Asia, operating income increased year on year, thanks mainly to marketing efforts and cost reduction efforts. Toyota is also thus far unaffected by the semi-conductor shortage that is closing plants at competitors.

Factors which affected operating income compared year-on-year include:

Because of the spread of COVID-19 in each region, sales volume declined significantly during the first half of the fiscal year, but in the 2nd half of the fiscal year, sales volume increased in many regions compared to the previous fiscal year.

Click to Enlarge.

In particular, sales of electrified vehicles of 2,155,000 units or 112.3% of the previous fiscal year presents a serious challenge to would be competitors who are late to a game that increasingly is the only game in town or will be given the trend of current regulations.

Toyota now plans to pay a year-end dividend of 135 yen per common share. Together with the interim dividend of 105 yen per common share, which included a special dividend of 5 yen, the annual dividend for the fiscal year will be 240 yen per common share, an increase of 20 yen per common share compared to the previous fiscal year, and the dividend pay-out ratio for the fiscal year will be 29.8%. “We will continue to aim to pay stable and sustainable dividends while maintaining and improving upon our consolidated dividend payout ratio benchmark of 30%,” Toyota said Kenta Kon CFO and clearly in AutoInformed’s view a candidate to succeed Akio Toyoda.

Toyota postponed share repurchase for the interim period of the fiscal year ended March 2021 due to the spread of COVID-19. Toyota now plans to buy back up to 250 billion yen’s worth. “We will continue to implement share repurchases in a flexible manner, taking into account various factors including investment in growth, dividend levels, liquidity, share price levels, and other factors,” said Kon.

“We will split our common shares at the ratio of 5 shares for each share with the record date of September 30, 2021. The purpose of the stock split is to reduce the minimum investment price, thereby creating an environment where it is easier to invest in our shares,” Kon said.

Toyota FY2022 Forecast

Consolidated vehicle sales for the fiscal year ending March 2022 are expected to be 8,700,000 units, which is 113.8% of sales of the previous fiscal year 2021. Vehicle sales are expected to increase in each region.

Toyota and Lexus brand vehicle sales are expected to be 9,600,000 units, or 105.6% of such sales during FY2021. electrified vehicles, are projected at 2,800,000 or 129.9% compared to FY2021. Toyota said the ratio of electrified vehicles will increase up to 29.2%.

Toyota has the world’s largest and rapidly expanding lineup of electrified vehicles, consisting of BEVs, HEVs, PHEVs, and FCEVs. Toyota has been working on electrification for nearly 25 years., Toyota’s technology is undisputedly world-class in AutoInformed’s opinion and strongly positioned to help different countries around the world reduce emissions and achieve Carbon Neutrality faster. This was all done before mandated rules by governments or the recent global movement and growing awareness of the need for Carbon Neutrality.

The forecast assumes exchange rates to be 105 yen per U.S. dollar and 125 yen per euro. Based on this, Toyota predicts:

Toyota thinks that cost reduction efforts will decrease operating income by 135 billion yen, largely due to the significant negative impact of increased prices of materials, despite the planned improvement of around 300 billion yen on a gross basis. Toyota anticipates that marketing efforts will increase operating income by 850 billion yen, mainly due to an increase in sales volume. Also predicted is increase in expenses that will decrease operating income by 350 billion yen.

“This is because we are investing more resources than ever in carbon neutrality and digitalization. As a result, excluding the overall impact of foreign exchange rates, swap valuation gains and losses and other factors, operating income is expected to increase by 365 billion yen,” Kon said.

AutoInformed on Toyota

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.