It was the beginning of March – not even April Fool’s Day yet, when President Trump heralded a 25% tariff on imported steel and a 10% tariff on imported aluminum from all U.S. trading partners. This latest boneheaded plan from the beleaguered, chaotic non-Administration seems designed to distract attention from the growing investigation with indictments and the growing number of links between Trump land and the Russians.

It’s real effect – as the special council will proceed apace with more Russian indictments – will be to hurt American jobs, thereby screwing the people he is allegedly making America Great again for.

The U.S exports about 2.5 million vehicles a year – ten final assembly plants of jobs, not including the related businesses from supply to transportation et cetera – and a trade war threatens these jobs – to say or tweet nothing about other sectors of the U.S. economy that will be peripheral damage.

Commerce said it would launch the steel and aluminum 232 in early 2017. Steel and aluminum consumers known an action was possible. They may have already adjusted purchasing to reduce risks.

The tariffs – better described as raising taxes on consumers – are based on an investigation by the U.S. Department of Commerce into the effects of steel and aluminum imports on U.S. national security under Section 232 of the Trade Expansion Act of 1962, as amended (19 U.S.C. § 1862). The announced tariffs exceed the 24.7% and 7.7% tariffs recommended by the Commerce Department as an outcome of its investigation.

The Commerce Department announced it would launch the steel and aluminum 232 in early 2017, so steel and aluminum consumers have known that a trade action was possible and may have already adjusted their purchasing footprint to reduce risks as much as possible.

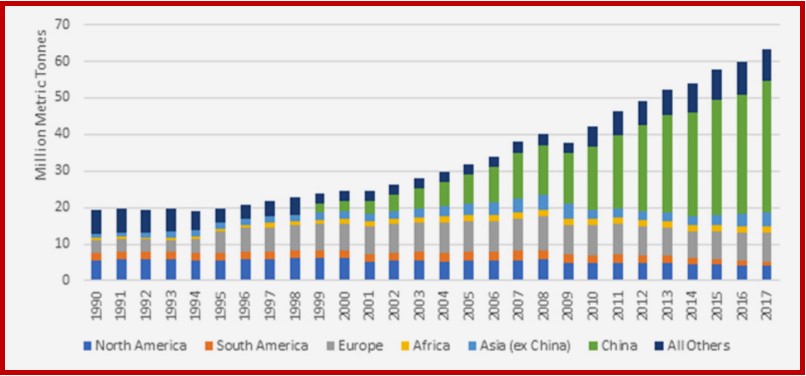

The Center for Automotive Research notes that global overcapacity is rampant in both aluminum and steel production, mainly driven by expanded steel and aluminum production capacity in China since 2000. Prices are down, and U.S. production has fallen roughly 20% in the post-2009 recovery.

Imports increased in the post-2009 recovery from the Republican induced Great Recession, with steel imports comprising roughly 45% of U.S. steel and steel mill product production in 2017, and aluminum imports comprising 160% of U.S. aluminum production that same year.

The mathematics are as simple as the arguments against proceeding with the tariffs as proclaimed by Trump. This trade action will help the steel and aluminum producing industries by boosting prices and will harm steel-consuming industries. However, there are 3.5 times as many production workers employed in motor vehicle, parts, and aerospace industries than those employed in primary metals production in the United States, and many other industries also use steel and aluminum as production inputs beyond these two sectors.

Center for Automotive Research

CAR – normally a conservative think tank in its approach – notes:

The impact on automotive and parts production will be significant, but the magnitude of the action is not yet known. Some key points to consider:

- The process allows for companies to petition to exclude certain types or grades of material that are not available in sufficient quantities from U.S. producers. The Commerce Department investigations suggested that the Commerce Department will readjust tariffs after granting any exclusions. If that happens, tariffs will go higher for the remaining types and grades of material than the 25% on steel and 10% on aluminum that the President announced.

- Even if companies buy their steel or aluminum from domestic sources, the metals producers may import some or all their inputs and will face higher prices for those materials such as scrap steel and aluminum.

- Automakers and suppliers purchase raw materials such as steel and aluminum under long-term contracts, and usually a price fluctuation over a specific period will trigger a renegotiation. However, tariffs do not fit under this type of trigger.

- Other countries will react to the U.S. trade action, and the retaliatory measures may include challenges at the World Trade Organization or tariffs on unrelated U.S. exports. This type of retaliation is, after all, the reason we have a 25% tariff on imported pickup trucks and cargo vans but call it the “chicken tax.”

- The new steel and aluminum tariffs will likely have a chilling effect on the ongoing NAFTA renegotiation. Canada and Mexico are both among the top five exporters of steel to the U.S. market, and Canada also ranks as the top exporter of unwrought, bar, and sheet aluminum to the U.S. market. The tariff actions apply to all countries, and therefore Canadian and Mexican industries will be affected.

- Automotive consumers would buy fewer vehicles if prices were to rise at a rate commensurate with materials cost share and the tariff impact. The U.S. automotive market is at currently at a plateau, down from a peak of 17.5 million units in 2016. New vehicle sales price inflation is currently lower than the inflation rate—the first time in five years and used vehicle prices are at a 10-year low.

- With consumer credit slowing, and auto loan defaults rising, manufacturers may not have much room to recoup the raw materials cost increases they will face because of this trade action. Automakers and suppliers will closely watch as the exclusions process plays out and U.S. trading partners react to these trade protections.

American’s knew what they were getting with Trump, one of his broken

record surrogates argued on TV today, because Trump had long beefed

about trade imbalances. Yes, they knew he was speaking on the issue.

But what they did not know is they would get someone so incompetent

as to make things worse instead of better.

Not only do we now know what we got, if we didn’t know what we were

getting before, we know what we need to get rid of.

Lock Him Up Trump popcorn boxes: https://www.utalk.us/?g=5:PB

Trump, YOU’RE Fired caps: https://www.utalk.us/?g=2:Y

Dump Trump bumper stickers: https://www.utalk.us/?g=1:SU

Trump the Fraud bumper stickers: https://www.utalk.us/?g=1:SF

Custom Trump Resistance bumper stickers:

http://www.peaceteam.net/custom_trump_sticker.php