Click to enlarge.

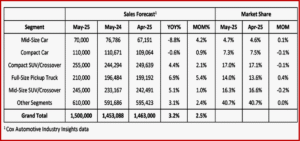

May 2025 U.S. new-vehicle sales, scheduled to be reported early next week, are expected to show a slower sales level from March and April’s tariff-inspired buying surge, according to the Cox Automotive forecast released today. The May seasonally adjusted annual rate (SAAR), or sales rate, is forecast by Cox Automotive* at ~16.0 million, up slightly from last May’s 15.8 million level. However, this represents a significant decline from March’s 17.8 million and April’s 17.3 million pace. Sales volume in May is expected to rise 3.2% from last year and 2.5% from last month. This month’s gains, however, are overstated because May has one more selling day than last year or last month.

“The vehicle market has been particularly strong since new tariff announcements in March, as many vehicle shoppers who were considering buying this year decided to pull ahead their purchase, before higher prices hit the market,” said Charlie Chesbrough, senior economist at Cox Automotive. “However, much of that pull-ahead demand has now been satiated, so consumer demand is expected to fall this month.”

Per Cox Automotive’s vAuto Live Market View, strong vehicle sales in March and April led to tighter inventory levels. New-vehicle inventory at the start of May totaled 2.49 million units on U.S. dealer lots, down 7.4% from the start of April and lower by 10.5% from a year ago. Days’ supply was 66 at the beginning of May, down six days from the previous measure at the start of April.

“Available inventory on dealer lots has declined significantly over recent weeks,” said Chesbrough. “Finding the right vehicle will be more challenging for shoppers. Additionally, prices will be high as existing inventory becomes less available and more valuable due to tariffs on incoming replacement supply. As more tariffed products replace existing inventory over the summer, prices are expected to be pushed higher, leading to slower sales in the coming months.”

The Q2 Cox Automotive Dealer Sentiment Index out last week said that dealers are increasingly wary of future market conditions. While many acknowledged the short-term lift in sales from tariff-driven urgency, the broader sentiment reflected anxiety about a cooling market and the long-term impact of trade policies. As expected, newly implemented tariffs by the Trump administration were a dominant theme in dealer responses, reinforcing the forecast of a cooling market in the months ahead.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. It uses first-party data fed by 2.3 billion online interactions a year. Cox Automotive says it tailors solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

Trump Tariff Chaos – May Auto Sales Crash

Click to enlarge.

May 2025 U.S. new-vehicle sales, scheduled to be reported early next week, are expected to show a slower sales level from March and April’s tariff-inspired buying surge, according to the Cox Automotive forecast released today. The May seasonally adjusted annual rate (SAAR), or sales rate, is forecast by Cox Automotive* at ~16.0 million, up slightly from last May’s 15.8 million level. However, this represents a significant decline from March’s 17.8 million and April’s 17.3 million pace. Sales volume in May is expected to rise 3.2% from last year and 2.5% from last month. This month’s gains, however, are overstated because May has one more selling day than last year or last month.

“The vehicle market has been particularly strong since new tariff announcements in March, as many vehicle shoppers who were considering buying this year decided to pull ahead their purchase, before higher prices hit the market,” said Charlie Chesbrough, senior economist at Cox Automotive. “However, much of that pull-ahead demand has now been satiated, so consumer demand is expected to fall this month.”

Per Cox Automotive’s vAuto Live Market View, strong vehicle sales in March and April led to tighter inventory levels. New-vehicle inventory at the start of May totaled 2.49 million units on U.S. dealer lots, down 7.4% from the start of April and lower by 10.5% from a year ago. Days’ supply was 66 at the beginning of May, down six days from the previous measure at the start of April.

“Available inventory on dealer lots has declined significantly over recent weeks,” said Chesbrough. “Finding the right vehicle will be more challenging for shoppers. Additionally, prices will be high as existing inventory becomes less available and more valuable due to tariffs on incoming replacement supply. As more tariffed products replace existing inventory over the summer, prices are expected to be pushed higher, leading to slower sales in the coming months.”

The Q2 Cox Automotive Dealer Sentiment Index out last week said that dealers are increasingly wary of future market conditions. While many acknowledged the short-term lift in sales from tariff-driven urgency, the broader sentiment reflected anxiety about a cooling market and the long-term impact of trade policies. As expected, newly implemented tariffs by the Trump administration were a dominant theme in dealer responses, reinforcing the forecast of a cooling market in the months ahead.

*Cox Automotive

Cox Automotive says it is the world’s largest automotive services and technology provider. It uses first-party data fed by 2.3 billion online interactions a year. Cox Automotive says it tailors solutions for car shoppers, auto manufacturers, dealers, lenders and fleets. The company has 29,000+ employees on five continents and a portfolio of industry-leading brands that include Autotrader®, Kelley Blue Book®, Manheim®, vAuto®, Dealertrack®, NextGear Capital™, CentralDispatch® and FleetNet America®. Cox Automotive is a subsidiary of Cox Enterprises Inc., a privately owned, Atlanta-based company with $22 billion in annual revenue. Visit coxautoinc.com or connect via @CoxAutomotive on X, CoxAutoInc on Facebook or Cox-Automotive-Inc on LinkedIn.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.