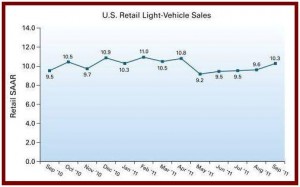

New-vehicle retail sales for September in the U.S. continue to slowly improve, with the selling rate expected to be stronger than in August. September new-vehicle retail sales are projected to come in at 842,400 units, which means a seasonally adjusted annualized rate (SAAR) of 10.3 million units. In September of 2010 the retail selling rate was 9.5 million new cars and light trucks.

This is the first time the retail selling rate would be above 10 million units since the 10.8 million-unit rate in April, if the J.D. Power and Associates projection holds up. Nonetheless, sales are far, far below the 16-17 million unit SAARs of last decade as a jobless recovery continues with record levels of long-term unemployment.

“Coming off a solid Labor Day sale, retail sales exhibited unexpected strength in the second week of September, as the recovering inventory levels have helped to bring buyers back into the market,” said Jeff Schuster, executive director of global forecasting at J.D. Power and Associates.

“However, incentive levels remain flat compared with August and the economy remains a concern, so the sales pace in the second half of the month is expected to give back some of the gains,” said Schuster

Total light-vehicle sales in September are expected to come in at 1,038,700 units, which is 9% higher than in September 2010. Fleet sales are expected to be down 1% compared with last September, but will still be 19% of total sales.

Sales Outlook

Given the relative strength of September, J.D. Power is maintaining its revised forecast for light-vehicle sales in 2011 and 2012. Total light-vehicle sales for 2011 are expected to come in at 12.6 million units, a 9% increase from 2010. Retail light-vehicle sales are forecast at 10.2 million units for 2011, an increase of 11% from 2010.

For 2012, the outlook for total light-vehicle sales remains at 14.1 million units and retail light-vehicle sales are at 11.5 million units.

“The uncertain global environment, specifically the debt troubles in Europe, continue to be the major source of downside risk in the U.S. economy and automotive markets,” said John Humphrey, senior vice president of automotive operations at J.D. Power and Associates. “Until a level of stability is reached globally and consumer confidence is returned, the U.S. automotive selling pace is not expected to return to pre-recession levels.”

North American Production

Through August 2011, light-vehicle production in North America has increased to 8.5 million units, up 8% from the same period in 2010. The Detroit 3 have increased production by 16% year-to-date, while the Japanese manufacturers have lost 8%—due to the parts shortages from the earthquake in Japan earthquake and tsunami in March. European automakers are up 38% for the same period, as a result of added production of the BMW X3 and Volkswagen Passat in North America, as well as strong demand for the new Volkswagen Jetta.

Vehicle inventory maintained a 49-day supply at the beginning of September, unchanged from August. Car inventory remained at the same 40-day level as it was in the previous month, while truck supply edged down by one day to 57 days. With stronger production levels and imported shipments returning, inventory is improving—although several manufacturers continue to have limited availability: Hyundai/Kia with a 21 days’ supply (19 days in August), Honda with a 32 days’ supply (previously 28 days), and BMW at 33 days’ supply (previously 30 days).

The 2011 North American production outlook remains on track for 12.9 million units, an increase of 9% from 2010. Fourth-quarter 2011 production output is expected to reach 3.3 million vehicles, which is an increase of 11% from the same quarter in 2010.

“Continued inventory stock replenishment and Japanese OEM recovery is responsible for the large year-over-year increase relative to the lower level of recovery in vehicle demand,” said Schuster. “As inventory normalizes into 2012, growth in production levels is expected to slow to a pace more consistent with sales.”

|

U.S. Sales |

September 2011 |

August 2011 |

September 2010 |

| New retail |

842,400 |

870,365 |

758,425 |

| Total vehicle |

1,038,700 |

1,069,843 |

956,639 |

| Retail SAAR |

10.3 million |

9.6 million |

9.5 million |

| Total SAAR |

12.9 million |

12.1 million |

11.7 million |

| J.D. Power and Associates – September 2011 sales are forecast | |||