Late Friday the UAW once again blasted the bipartisan Inflation Reduction Act in its latest attempt to protect the jobs, health, and safety of its members. Using data from a new Good Jobs First* report, “Power Outrage: Will Heavily Subsidized Battery Factories Generate Substandard Jobs?” the union pointed out that “Under a provision of the Inflation Reduction Act, some factories making batteries for electric vehicles will each receive more than a billion dollars per year from the U.S. government, with no requirement to pay good wages to production workers. Thanks to the Advanced Manufacturing Production Credit, also called 45X for its section in the Internal Revenue Code, battery companies will receive tax credits that they can use, sell, or cash out.” Since this is a UAW contract year the outlook for Automakers remains stormy, with strikes clearly a threat. (AutoInformed on EV Politics – Biden versus the UAW)

“The so called 45X program alone will cost taxpayers more than $200 billion in the next decade, far more than the $31 billion estimated by Congress’s Joint Committee on Taxation. On top of 45X and other federal incentives, factories manufacturing electric vehicles and batteries have also been promised well over $13 billion in state and local economic development incentives in just the past 18 months,” the UAW said.

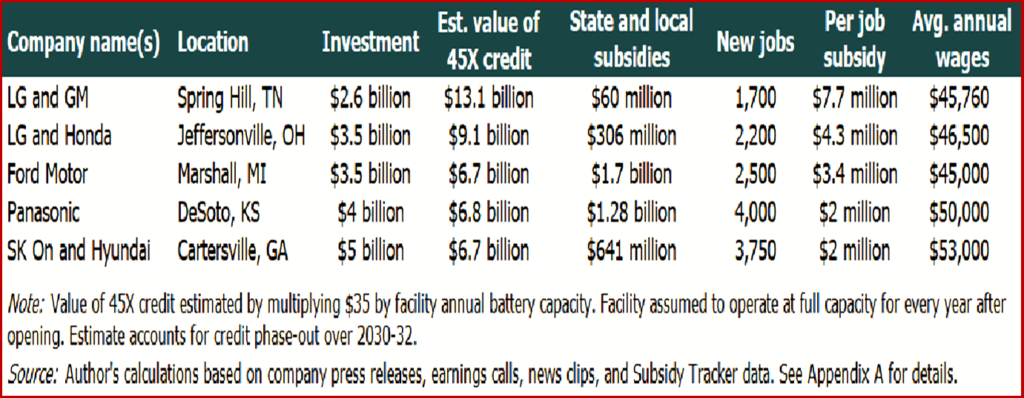

Click to enlarge the subsidies for corporations.

“What do local communities get from companies in exchange for public money? The Biden administration says the IRA will create “good-paying union jobs,” but the federal tax credit has no job quality requirements for permanent jobs and doesn’t mandate companies pay market-based wages or benefits.

“Good Jobs First did the math for five recently announced battery factories. Here’s what we learned:

- Total subsidies will range from $2 million to $7 million per job.

- Average annual wages, as announced, will be below the current national average for production workers in the automotive sector.

- The 45X credit alone is large enough to cover each facility’s initial capital investment cost and wage bill for the first several years of production.

“For example, Ford Motor’s new $3.5 billion battery plant in Marshall, Michigan, will be eligible for an estimated $6.7 billion in federal 45X tax credits. State and local governments have already awarded it an additional $1.7 billion in subsidies. The company has promised to create 2,500 new jobs that it says will pay an average annual wage of just $45,000 a year, while reaping subsidies of $3.4 million per job.

“As plans for these facilities are finalized, we recommend a set of policy actions to set the country’s emerging EV-battery industrial complex on the path to ‘high road’ employment,” the UAW said.

*Good Jobs First

Good Jobs First Is a Washington, DC-based non-profit advocacy group that traces the use of state and local economic development subsidies and reports “corporate misconduct.”

“We offer legislative reforms and organizing strategies that can and have made subsidies more accountable. Our 50-state “report card” studies have spurred further subsidy transparency and our comment campaign led to the landmark GASB Statement No. 77 on Tax Abatement Disclosures.

“We provide activist support to community groups, tax and budget watchdogs, legal rights and sunshine groups, corporate ethics advocates, worker centers, labor unions, environmentalists, and public officials working on campaigns and reforms.

“We assist journalists every day, helping them better understand and communicate economic development issues while bringing “sunshine” to specific deals and policies.” More on Good Jobs First click here.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

UAW Blasts Biden and Inflation Reduction Act

Late Friday the UAW once again blasted the bipartisan Inflation Reduction Act in its latest attempt to protect the jobs, health, and safety of its members. Using data from a new Good Jobs First* report, “Power Outrage: Will Heavily Subsidized Battery Factories Generate Substandard Jobs?” the union pointed out that “Under a provision of the Inflation Reduction Act, some factories making batteries for electric vehicles will each receive more than a billion dollars per year from the U.S. government, with no requirement to pay good wages to production workers. Thanks to the Advanced Manufacturing Production Credit, also called 45X for its section in the Internal Revenue Code, battery companies will receive tax credits that they can use, sell, or cash out.” Since this is a UAW contract year the outlook for Automakers remains stormy, with strikes clearly a threat. (AutoInformed on EV Politics – Biden versus the UAW)

“The so called 45X program alone will cost taxpayers more than $200 billion in the next decade, far more than the $31 billion estimated by Congress’s Joint Committee on Taxation. On top of 45X and other federal incentives, factories manufacturing electric vehicles and batteries have also been promised well over $13 billion in state and local economic development incentives in just the past 18 months,” the UAW said.

Click to enlarge the subsidies for corporations.

“What do local communities get from companies in exchange for public money? The Biden administration says the IRA will create “good-paying union jobs,” but the federal tax credit has no job quality requirements for permanent jobs and doesn’t mandate companies pay market-based wages or benefits.

“Good Jobs First did the math for five recently announced battery factories. Here’s what we learned:

“For example, Ford Motor’s new $3.5 billion battery plant in Marshall, Michigan, will be eligible for an estimated $6.7 billion in federal 45X tax credits. State and local governments have already awarded it an additional $1.7 billion in subsidies. The company has promised to create 2,500 new jobs that it says will pay an average annual wage of just $45,000 a year, while reaping subsidies of $3.4 million per job.

“As plans for these facilities are finalized, we recommend a set of policy actions to set the country’s emerging EV-battery industrial complex on the path to ‘high road’ employment,” the UAW said.

*Good Jobs First

Good Jobs First Is a Washington, DC-based non-profit advocacy group that traces the use of state and local economic development subsidies and reports “corporate misconduct.”

“We offer legislative reforms and organizing strategies that can and have made subsidies more accountable. Our 50-state “report card” studies have spurred further subsidy transparency and our comment campaign led to the landmark GASB Statement No. 77 on Tax Abatement Disclosures.

“We provide activist support to community groups, tax and budget watchdogs, legal rights and sunshine groups, corporate ethics advocates, worker centers, labor unions, environmentalists, and public officials working on campaigns and reforms.

“We assist journalists every day, helping them better understand and communicate economic development issues while bringing “sunshine” to specific deals and policies.” More on Good Jobs First click here.

AutoInformed on

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.