Click for more data.

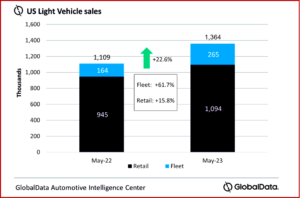

Sales of light vehicles in the US increased by 22.6% at 1.36 million when compared year-over-year (YoY) in May, according to the latest numbers from the GlobalData* consultancy. However, the YoY result is distorted by abnormally weak year-ago sales, when a lack of inventory was severely hindering the industry.

“After a particularly robust result in April, it would not have been surprising if May sales were a little disappointing, but instead, we interpret May’s outcome as another encouraging one for the industry,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

May’s results continued a recent trend of sales at a similar level. Average transaction prices remain near-record highs, although the YoY increases are “becoming modest, with April’s $46,266 only 2.5% above one year- ago.” Discounting varies significantly depending on the vehicle.

“With one fewer selling day than April and two fewer than March, volumes were within 10k units of either month. The fact that the daily selling rate was the highest in two years is another indicator that conditions remain healthy despite lingering concerns over a potential recession and higher interest rates. Consumers also appeared, for the most part, to shrug off any fears of a default if lawmakers did not agree to raise the debt ceiling, a position which turned out to be justified with Congress now having reached a deal,” said Oakley.

For the 10th straight month, General Motors was the leading automaker. Toyota Group came in second again, trailing GM by 39,000 vehicles. “This was 3k units smaller than the gap in April, but Toyota Group appears to have turned a corner, with its own sales growing by 6.4% YoY.

The Toyota brand outsold Ford by 3000 units at the top of the rankings, the first time this has occurred since November 2022. Chevrolet was a further 10,000 units behind Ford. The Ford F-150 was once again the bestselling model in the market, with a 10,000-unit lead over the Toyota RAV4. “In April, the RAV4 had slipped down to fifth in the rankings, albeit the margins between second and fifth are thin,” said Global Data.

“The current strength of the US market is indisputable, benefiting from both an improved inventory environment and a return of incentives to offset the high transaction prices and elevated interest rates. While we are still concerned that the recovery could lose momentum as pent-up demand is satisfied, there is growing optimism that the US market will continue to outperform expectations through the summer months. One additional wildcard on the radar is the UAW contract negotiations this Fall and the probability of a strike that could negatively impact the recovery in the 4th quarter, while the market may also tip into recession,” said Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData.

Global Data Observations

- With May 2022 having been such a low point for the industry, many manufacturers saw double-digit YoY percentage gains in May 2023.

- We estimate Tesla to have seen a 72.8% YoY increase, while Mazda’s sales were up by 117.2% YoY, and Honda Group enjoyed a 58.2% YoY uplift.

- In market share terms, GM accounted for 16.6% of May sales, down marginally from April’s result, but up by 0.3 pp YoY. Toyota Group’s share was down by 2.1 pp YoY, to 13.8%, but last year’s share was unusually high as its competitors struggled more intensely with inventory shortages.

- Compact Non-Premium SUV continued to be the bestselling segment in May, with an 18.5% market share, up by 2.1 pp, YoY, although this was down by 0.7 pp from April’s result.

- Midsize Non-Premium SUV once again came in second, on 16.4%, down by 1.0 pp YoY.

- Large Pickups, the third largest segment, had a similar share to recent months, on 13.8%, though this was down by almost 0.5 pp, YoY.

- For the third consecutive month, Cars likely outsold Pickups, although the difference was marginal. We estimate Cars to have come out ahead by only around 500 units.

- With May continuing the robust level of US Light Vehicle sales, YTD sales in May are up 11% from the same period last year. The selling rate is averaging 15.4 million units through May 2023, up from 13.9 million through May 2022.

- While the stronger than expected performance in May could signal a marked increase in the outlook for 2023, we have decided to keep the forecast at 15.3 million units, though it has been increased by 50,000 units since last month. Uncertainty in the second half of the year given the recession risk is tempering our view for now.

- The forecast for 2024 remains at 16.0 million units.

- Light Vehicle inventory ended April at 1.8 million units, up 55% YoY. Days’ supply rose to 35 days, while the sales pace increased, a good overall sign for better inventory health. May is expected to fall slightly by 50,000 units of inventory, but on a YoY basis, overall volume should be up between 55-60%. Days’ supply is projected to be 32-34 for the month.

Global Sales Forecast

Global Light Vehicle sales in April at 6.8 million units increased 23.7% from March as the market continues to improve through increased production and less supply disruption. “Of the major markets, China led the growth, up 81% from April 2022. Europe (+19.0%), India (+10.6%) and North America (+9.3%) also posted strong results. The selling rate improved to 85.4 million units, up nearly 2 million units from March. Sales have been tracked in line with expectations, so we are not making any material changes to the topline forecast for 2023. Volume is expected to reach 86.1 million units, up 6.2% from 2022. While risk is balanced overall, there remains some upside potential in 2023 if major markets avoid a recession or consumers show further resilience,” said GlobalData.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US Auto Sales Soar in May

Click for more data.

Sales of light vehicles in the US increased by 22.6% at 1.36 million when compared year-over-year (YoY) in May, according to the latest numbers from the GlobalData* consultancy. However, the YoY result is distorted by abnormally weak year-ago sales, when a lack of inventory was severely hindering the industry.

“After a particularly robust result in April, it would not have been surprising if May sales were a little disappointing, but instead, we interpret May’s outcome as another encouraging one for the industry,” said David Oakley, Manager, Americas Sales Forecasts, GlobalData.

May’s results continued a recent trend of sales at a similar level. Average transaction prices remain near-record highs, although the YoY increases are “becoming modest, with April’s $46,266 only 2.5% above one year- ago.” Discounting varies significantly depending on the vehicle.

“With one fewer selling day than April and two fewer than March, volumes were within 10k units of either month. The fact that the daily selling rate was the highest in two years is another indicator that conditions remain healthy despite lingering concerns over a potential recession and higher interest rates. Consumers also appeared, for the most part, to shrug off any fears of a default if lawmakers did not agree to raise the debt ceiling, a position which turned out to be justified with Congress now having reached a deal,” said Oakley.

For the 10th straight month, General Motors was the leading automaker. Toyota Group came in second again, trailing GM by 39,000 vehicles. “This was 3k units smaller than the gap in April, but Toyota Group appears to have turned a corner, with its own sales growing by 6.4% YoY.

The Toyota brand outsold Ford by 3000 units at the top of the rankings, the first time this has occurred since November 2022. Chevrolet was a further 10,000 units behind Ford. The Ford F-150 was once again the bestselling model in the market, with a 10,000-unit lead over the Toyota RAV4. “In April, the RAV4 had slipped down to fifth in the rankings, albeit the margins between second and fifth are thin,” said Global Data.

“The current strength of the US market is indisputable, benefiting from both an improved inventory environment and a return of incentives to offset the high transaction prices and elevated interest rates. While we are still concerned that the recovery could lose momentum as pent-up demand is satisfied, there is growing optimism that the US market will continue to outperform expectations through the summer months. One additional wildcard on the radar is the UAW contract negotiations this Fall and the probability of a strike that could negatively impact the recovery in the 4th quarter, while the market may also tip into recession,” said Jeff Schuster, Automotive Group Head and Executive Vice President, GlobalData.

Global Data Observations

Global Sales Forecast

Global Light Vehicle sales in April at 6.8 million units increased 23.7% from March as the market continues to improve through increased production and less supply disruption. “Of the major markets, China led the growth, up 81% from April 2022. Europe (+19.0%), India (+10.6%) and North America (+9.3%) also posted strong results. The selling rate improved to 85.4 million units, up nearly 2 million units from March. Sales have been tracked in line with expectations, so we are not making any material changes to the topline forecast for 2023. Volume is expected to reach 86.1 million units, up 6.2% from 2022. While risk is balanced overall, there remains some upside potential in 2023 if major markets avoid a recession or consumers show further resilience,” said GlobalData.

*GlobalData

GlobalData says that “4000 of the world’s largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData’s unique data, expert analysis and innovative solutions, all in one platform. GlobalData’s mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.”

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.