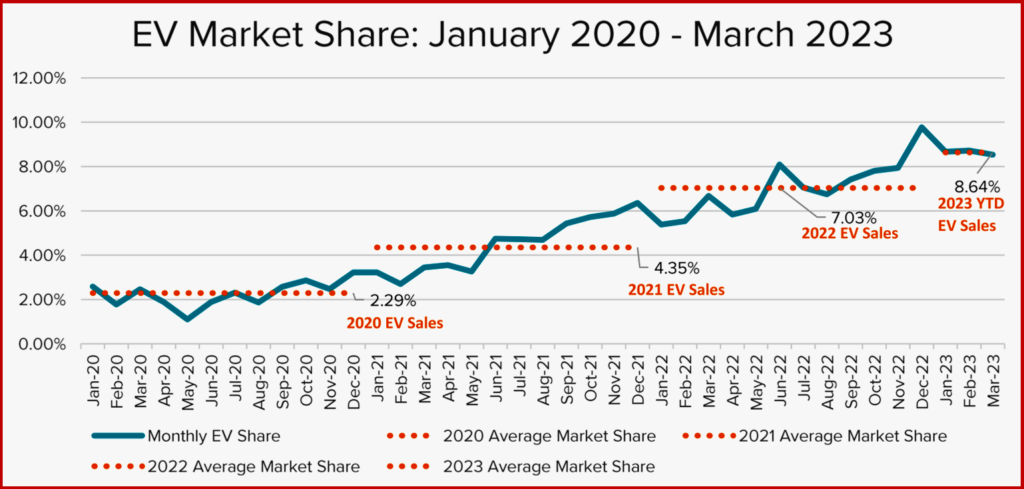

The Alliance for Automotive Innovation today released its analysis of the US electric vehicle (EV) market for Q1 2023. More than 305,000 EVs sold in U.S. During Q1, an increase of 56% compared to Q1 2022. This means that EVs represent 8.6% of new light-duty vehicle sales in Q1 2023, up slightly from 8.5% in Q4 2022 and 5.9% in Q1 2022. While this is relatively good news, supply constraints still hinder growth. This might not be as bad as it sounds for consumers since Q1 2023 public charging data show that the installation of US public chargers is not keeping up with current and – above all – projected EV sales.

Consider: At a total of 133,982 publicly available charging outlets in U.S. for 3.34 million EVs on the road, the ratio is 25 EVs per charger. However, with 305,047 EVs registered in Q1 2023, but only 7802 new chargers were added – the ratio is 39 EVs for every new public port. The number of Level 2, DC Fast public EV chargers increased 31%% year-over-year (from 101,946 in Q1 2022 to 133,925 in Q1 2023).

Click for more information.

Passenger cars once dominated the EV market. However, automakers continue to introduce new models in other profitable traditional segments. Utility vehicles continue to grow, and while electric pickup trucks are a relatively new entry to the market (sales debut in September 2021), more models are coming. As a result, non-car segments are continuing to make gains, and Q1 of 2023, light truck (UVs, minivans, and pickups) sales comprised 73% of the EV market – a 5 percentage point increase over the last quarter and 11 ppts more than Q1 2022. Quarterly sales of BEV and PHEV UVs have grown from~19% of EVs at the start of 2020 to 68% in Q1 of 2023.

Click for more information.

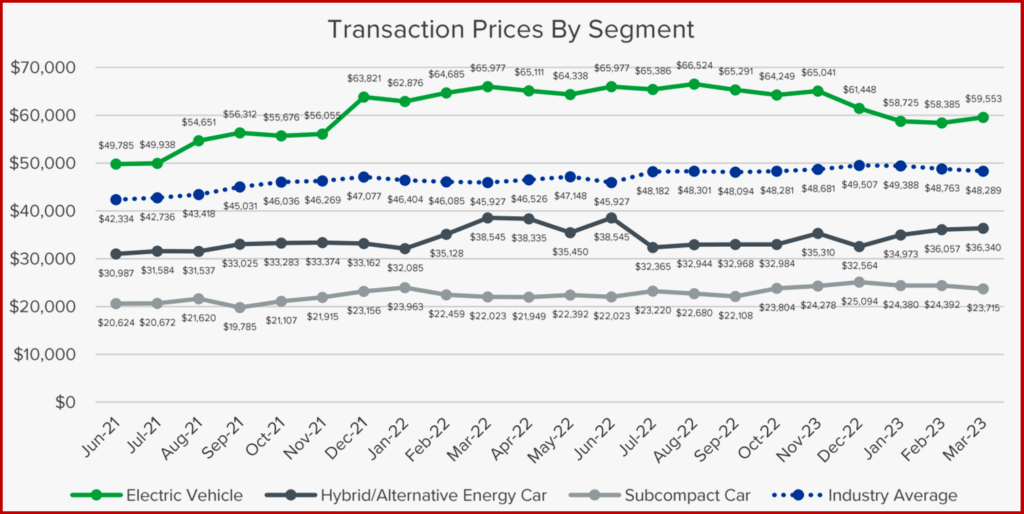

The cost of the average EV in the first quarter of 2023 was ~$58,800 while the average cost of all new light-duty vehicles in that time period was about $48,800. Year-over-year, EV prices declined more than $5600 from the first quarter of 2022 while the average cost of all new light vehicles rose just under $2700.

There are more than 284 million light-duty vehicles in operation (VIO) in the United States, EVs represent just 1.17% of all light vehicles in the country (~ 3.3 million EVs). EVs represented more than 1% of total VIO for the first time at the end of 2022. The EV VIO of 1.17% is an increase of 0.3 ppts since the first quarter of 2022 and nearly double the EV VIO from first quarter in 2021 (0.60%)

China and Other Issues

Automakers and battery partners have committed $115 billion thus far in electrification and domestic battery cell manufacturing and announced plans to build nearly two dozen battery factories in the US during the next few years. While capacity to manufacture battery cells is increasing, Benchmark Minerals forecasts a lack of upstream (mining) and midstream (processing and cathode/anode production) capacity to supply new battery facilities with necessary materials.

- China (designated as a foreign entity of concern) is predicted to remain the largest producing country for cathode active materials through at least 2040. China has at least 90% of the world’s anode production capacity and will continue at that rate through 2030, despite global efforts to diversify the supply chain.

- The US imports 100% of its graphite, the mineral used for battery anodes. Almost one-third comes from China. China also converts ore than 90% of the world’s graphite into anode material.

- China currently controls more than 71% of the world’s nickel sulphate manufacturing.

List of vehicles qualifying for a US government New Clean Vehicles tax credit of up to $7500 tax rebate is HERE.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn.

He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe.

Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap.

AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks.

Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.

US EV Market Growing – Problems Growing Too

The Alliance for Automotive Innovation today released its analysis of the US electric vehicle (EV) market for Q1 2023. More than 305,000 EVs sold in U.S. During Q1, an increase of 56% compared to Q1 2022. This means that EVs represent 8.6% of new light-duty vehicle sales in Q1 2023, up slightly from 8.5% in Q4 2022 and 5.9% in Q1 2022. While this is relatively good news, supply constraints still hinder growth. This might not be as bad as it sounds for consumers since Q1 2023 public charging data show that the installation of US public chargers is not keeping up with current and – above all – projected EV sales.

Consider: At a total of 133,982 publicly available charging outlets in U.S. for 3.34 million EVs on the road, the ratio is 25 EVs per charger. However, with 305,047 EVs registered in Q1 2023, but only 7802 new chargers were added – the ratio is 39 EVs for every new public port. The number of Level 2, DC Fast public EV chargers increased 31%% year-over-year (from 101,946 in Q1 2022 to 133,925 in Q1 2023).

Click for more information.

Passenger cars once dominated the EV market. However, automakers continue to introduce new models in other profitable traditional segments. Utility vehicles continue to grow, and while electric pickup trucks are a relatively new entry to the market (sales debut in September 2021), more models are coming. As a result, non-car segments are continuing to make gains, and Q1 of 2023, light truck (UVs, minivans, and pickups) sales comprised 73% of the EV market – a 5 percentage point increase over the last quarter and 11 ppts more than Q1 2022. Quarterly sales of BEV and PHEV UVs have grown from~19% of EVs at the start of 2020 to 68% in Q1 of 2023.

Click for more information.

The cost of the average EV in the first quarter of 2023 was ~$58,800 while the average cost of all new light-duty vehicles in that time period was about $48,800. Year-over-year, EV prices declined more than $5600 from the first quarter of 2022 while the average cost of all new light vehicles rose just under $2700.

There are more than 284 million light-duty vehicles in operation (VIO) in the United States, EVs represent just 1.17% of all light vehicles in the country (~ 3.3 million EVs). EVs represented more than 1% of total VIO for the first time at the end of 2022. The EV VIO of 1.17% is an increase of 0.3 ppts since the first quarter of 2022 and nearly double the EV VIO from first quarter in 2021 (0.60%)

China and Other Issues

Automakers and battery partners have committed $115 billion thus far in electrification and domestic battery cell manufacturing and announced plans to build nearly two dozen battery factories in the US during the next few years. While capacity to manufacture battery cells is increasing, Benchmark Minerals forecasts a lack of upstream (mining) and midstream (processing and cathode/anode production) capacity to supply new battery facilities with necessary materials.

List of vehicles qualifying for a US government New Clean Vehicles tax credit of up to $7500 tax rebate is HERE.

About Ken Zino

Ken Zino, editor and publisher of AutoInformed, is a versatile auto industry participant with global experience spanning decades in print and broadcast journalism, as well as social media. He has automobile testing, marketing, public relations and communications experience. He is past president of The International Motor Press Assn, the Detroit Press Club, founding member and first President of the Automotive Press Assn. He is a member of APA, IMPA and the Midwest Automotive Press Assn. He also brings an historical perspective while citing their contemporary relevance of the work of legendary auto writers such as Ken Purdy, Jim Dunne or Jerry Flint, or writers such as Red Smith, Mark Twain, Thomas Jefferson – all to bring perspective to a chaotic automotive universe. Above all, decades after he first drove a car, Zino still revels in the sound of the exhaust as the throttle is blipped during a downshift and the driver’s rush that occurs when the entry, apex and exit points of a turn are smoothly and swiftly crossed. It’s the beginning of a perfect lap. AutoInformed has an editorial philosophy that loves transportation machines of all kinds while promoting critical thinking about the future use of cars and trucks. Zino builds AutoInformed from his background in automotive journalism starting at Hearst Publishing in New York City on Motor and MotorTech Magazines and car testing where he reviewed hundreds of vehicles in his decade-long stint as the Detroit Bureau Chief of Road & Track magazine. Zino has also worked in Europe, and Asia – now the largest automotive market in the world with China at its center.